- Open APL (41%)

- More than 6 (18%)

- 6 (13%)

- 4 (9%)

- 5 (9%)

- 3 (7%)

- 1 (2%)

- 2 (1%)

Our latest poll seeks your views on the minimum required number of insurers on Approved Product Lists.

Just prior to Christmas, the Financial Services Council released an updated standard for life insurance APLs (see: FSC to Require at Least Three Insurers on APLs).

In its finalised standards the Council noted it supports principles of competitive access and choice for all advisers and their clients to available life insurance products. It also stressed that its members will be required to offer a strong off-APL process so advisers can meet their best interest duty obligations.

Is the choice of three insurers and a strong off-APL process sufficient? Is it more than enough? Is it not enough?

We note a proportion of advisers and some licensees have always supported an ‘open APL architecture’, but this probably does not include most of the licensee firms owned by institutions.

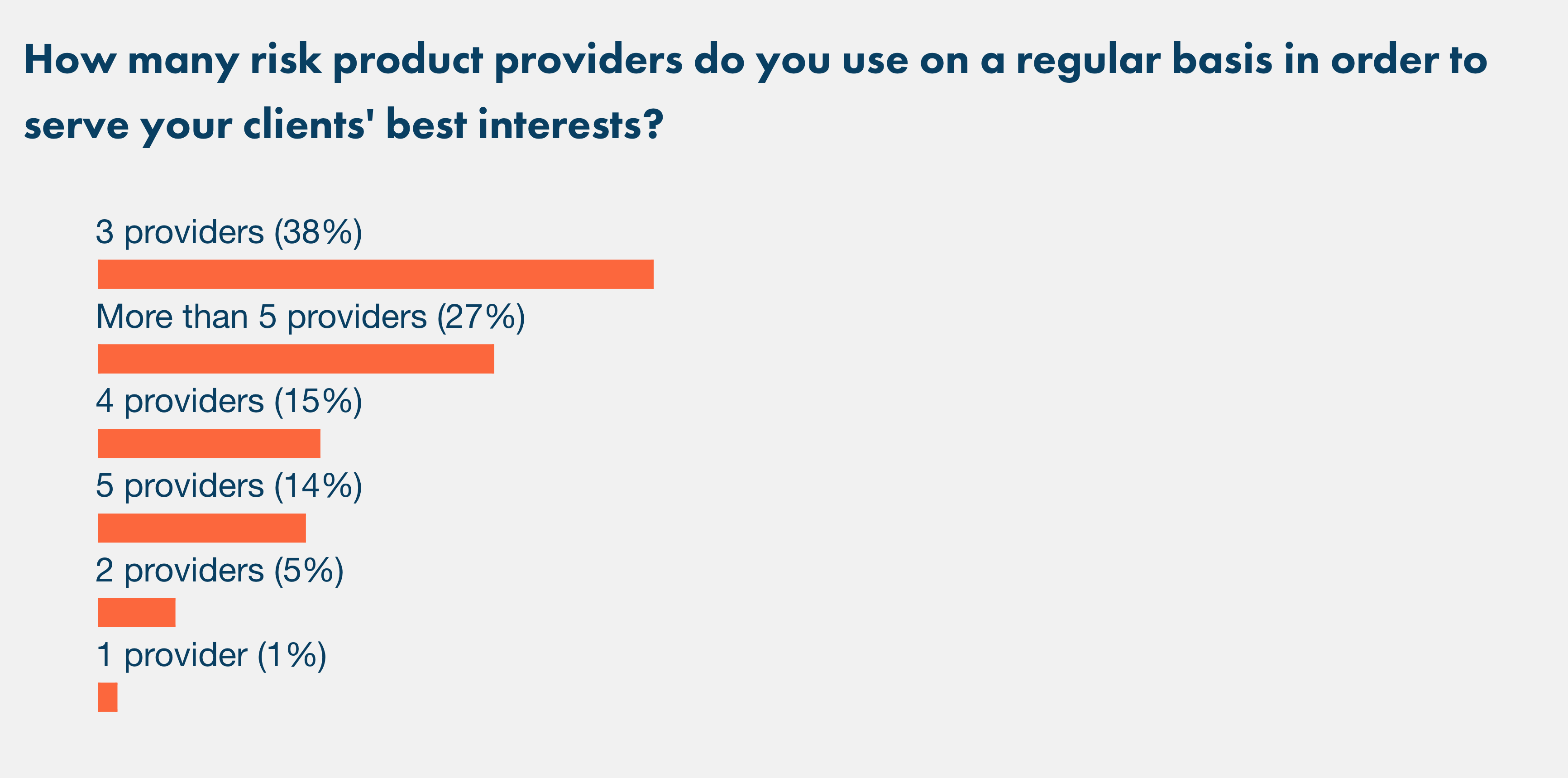

We also note a recent poll in which we asked advisers how many different insurers they used on a regular basis. This was the result:

While our new poll asks a very different question, we still reflect on whether this recent poll suggests advisers may differ in their opinion about the minimum required number of insurers on APLs.

As usual, the issues associated with question are many and varied, so we invite you to take up the conversation from here and we’ll report back to you next week…