The latest data reaffirming that advised life insurance clients fare better in the claims process than unadvised claimants, attracted strong reader interest this week…

Latest data reaffirms that advised life insurance clients fare better in the claims process than unadvised claimants.

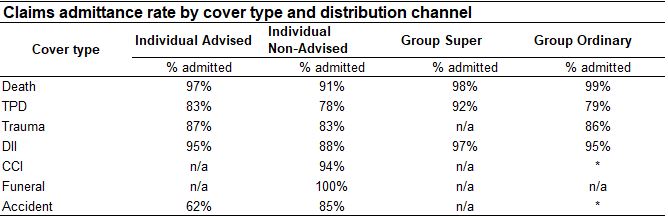

APRA’s Life Insurance Claims and Disputes Statistics for the year to 31 December 2023 again shows that the claims admittance rate for individual advised death, TPD, trauma and DII cover were higher than for individual non-advised claims (also see: Successful Claims More Likely for Advised Clients).

In the year to December 2023, according to APRA’s data, the claims admittance rate by cover type and distribution channel reveals 97% of individual advised claims for death cover were admitted, while only 91% of individual non-advised claims were admitted.

For TPD cover, individual advised claims admittance sat at 83% compared with 78% for individual non-advised.

The table also shows that for trauma cover the rates were at 87% and 83% while DII insurance had 95% of individual advised claims admitted against 88% for individual non-advised.

In an industry highlights section of the report APRA states that for year ended June 2018 to December 2023 the “…admittance rates across all distribution channels have remained relatively stable over time.”

It notes admittance rates vary by cover types but have also remained relatively stable over time.

(APRA’s publication presents the key industry and entity-level claims and disputes outcomes for 17 Australian life insurers writing direct business.)