More than one million life insurance policies had the potential to switch providers in the past financial year but a recommendation from an adviser was the key driver in only six per cent of switches, according to research released by Roy Morgan.

The research firm found that in the 12 months to June 2018, 1,008,000 life insurance policies had the potential to switch to another life insurer with the leading reason for making a switch being the cost of the policy premium.

According to Roy Morgan, 242,000 policies switched providers and a further 766,000 policies were renewed with the same insurer despite another insurer being considered before making the decision to renew.

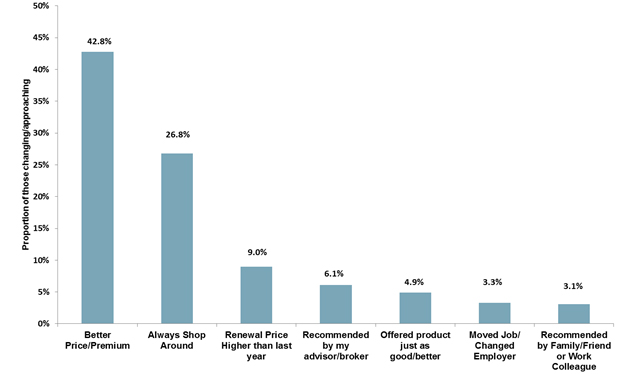

The combined figures represent 10.8 per cent of the total life insurance market and Roy Morgan found that price issues were the leading reason in more than 50 per cent of switching decisions with

- ‘better price/premium’ the key reason in 42.8 per cent of switches

- ‘renewal price higher than last year’ the key reason in 9 per cent of switching decisions

- ‘always shop around’ was a key factor in 28.8 per cent of decisions

Comparatively, professional advice featured in only 6.1 per cent of decisions but was twice as high as advice from family, friends or work colleagues (3.1 per cent).

…professional advice featured in only 6.1 per cent of decisions…

The research also found that people aged between 35 and 64 had the largest potential to switch making up nearly 78 per cent of those who could change providers.

The 35 to 49 age group had the largest segment of potential switches with 425,000 or 42.2% of the total, and the 50 to 64 age group had 360,000 or 35.7%, with a combined total of 77.9 per cent of the switching potential.

This distribution of potential switchers was linked to the proportion of policies they held in the overall market, according to Roy Morgan Industry Communications Director, Norman Morris, who added the first group above was likely to be coping with young families and other cost pressures, including mortgages, and may not always be interested in taking out life insurance.

“This research has shown that there is obviously considerable potential in this market for insurance companies to either gain or lose customers. This is due to the fact that in the last 12 months, one million policies were either switched to another company or were under consideration to do so,” Morris said.

The data was drawn from Roy Morgan’s Single Source survey of 50,000 Australians, including interviews with 10,000 people who held life insurance policies, who switched their life insurance or approached another company about doing so in the 12 months to June 2018.

Research like this, confirms what we have been saying for years.

Sometimes I think we overthink.

People do not need an economics degree to realise that when their Life or Disability premium increases by 10 to 20 percent and that they are struggling with their bills, it is a quick decision for them to want to reduce their outgoings.

Unfortunately, many times, those decisions are made in haste and can have a negative impact on the type of cover they end up with, though Life and Disability Insurance is an intangible, grudge purchase at the best of times, so it is a natural reaction to want to tell the Life Company if that is how you treat your loyal customers, then I will show you the same loyalty and leave.

The whole LIF fiasco was based on a lie and this research continues to clarify that.

too bad if an adviser changes the policy at the clients request to save money he is labelled a “churner” and according to the Govt, LIF, FASEA and all the other witch hunters, that makes you a greedy, self serving criminal…..!

Comments are closed.