The number of Australian-owned major life insurance companies will fall to three at the conclusion of the current round of acquisitions, with their collective market share totalling around 20 per cent by March 2019.

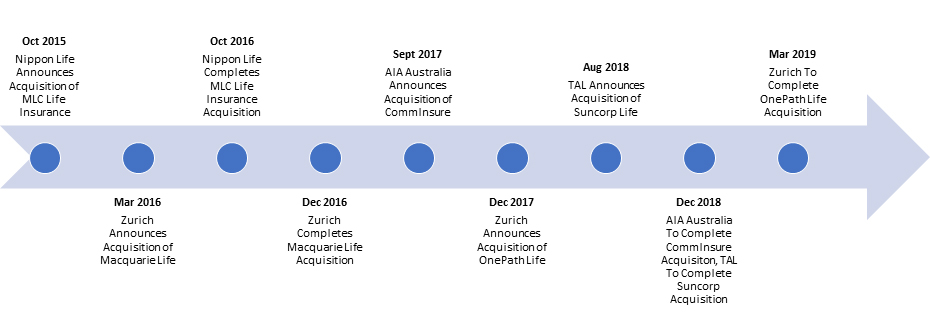

At the start of the current round, which began in October 2015 with the announcement of Nippon Life’s majority acquisition of MLC Life Insurance, there were eight Australian-owned life insurers in a market of 12 major life insurers offering products into the retail advised space.

A year later, this number had fallen to six as NAB completed the majority sale of MLC Life Insurance to Nippon Life, and Macquarie Life’s ownership transitioned to Zurich. By the end of 2018 this number will fall to four as the acquisition of CommInsure by AIA Australia and Suncorp by TAL will be completed, before the number drops to three following the completion of ANZ’s sale of OnePath to Zurich in March 2019 (Table 1).

This spate of transactions will also reduce the level of market share of Total Risk Inflows held by Australian-owned life insurers by half, falling from 43.7 per cent to 20.6 per cent, based on March 2018 risk inflow data from Strategic Insight (Table 2).

The transactions will also cement overseas-owned life insurers in the top three positions for market share, led by AIA Australia with 23.2 per cent, TAL with 22.7 per cent and Zurich with 14.3 per cent of Total Risk Inflows, based on March 2018 data (Table 3).

Table 1: Timeline of Acquisitions

Table 2: Market Share of Australian Insurers

| Life Insurers | Total Inflows Market Share (%) at March 2018* | Life Insurers | Total Inflows Market Share (%) Projected at March 2019* |

| Overseas Insurers | |||

| TAL | 17.7 | TAL (inc. Suncorp) | 22.7 |

| AIA Australia | 15.2 | AIA Australia (inc. CommInsure) | 23.2 |

| MLC Life Insurance | 12.0 | MLC Life Insurance | 12.0 |

| Zurich | 4.2 | Zurich (inc. Suncorp) | 14.3 |

| MetLife Insurance | 4.2 | MetLife Insurance | 4.2 |

| Total | 53.3 | Total | 76.4 |

| Australian Insurers | |||

| AMP | 11.6 | AMP | 11.6 |

| OnePath Australia | 10.1 | – | |

| CommInsure | 8.0 | – | |

| BT / Westpac | 7.7 | BT / Westpac | 7.7 |

| Suncorp | 5.0 | – | |

| ClearView | 1.3 | ClearView | 1.3 |

| Total | 43.7 | Total | 20.6 |

*Based on Total Risk Inflows Market Share at March 2018. Source: Strategic Insight

Table 3: Total Market Share By Life Insurer

| Life Insurers | Total Inflows Market Share (%) Projected as at March 2019* |

| AIA Australia | 23.2 |

| TAL | 22.7 |

| Zurich | 14.3 |

| MLC Life Insurance | 12.0 |

| AMP | 11.6 |

| BT / Westpac | 7.7 |

| MetLife Insurance | 4.2 |

| ClearView | 1.3 |

*Based on Total Risk Inflows Market Share at March 2018. Source: Strategic Insight

Interesting statistics. When I first entered the life industry in 1978 there were about 32 carriers. These included Norwich, Sun Alliance, Prudential, Legal & General, BMA and Aetna Life & Casualty. All of them have long since vanished from our shores. Has that been for the betterment of our industry? I can’t see it.

The problem with this is simply lack of competition which gives these insurers full control of the market particularly its pricing

We know the cartel type arrangement banks work where they take it in turns to be the first to move when rates drop ( very slowly mind you) and the same when rates increase ( far faster) although rates have been stable for some years you see that behaviour when they do

Will we see similar behaviour from the insurers I would not be holding my breath for any relief from the premium gouging that has gone in prior to the sales just to make the book look better

I guess there is no surprise here, the banks have successfully destroyed a great industry and are now deserting the sinking ship they put the holes in. Too bad for the consumers that the future is probably direct insurance.

@paulkate72:disqus

Actually mate there were 57 life companies in Australia right up to the 1990’s marketing over 300 products,….., so you were close.

Apart from the pricing model that will dominate current insurers, can anyone tell me if there is any product differentiation in the market place ?

You hope someone will come along and be clever enough to target market a product line that we can all be assured will be based on “policy benefits” that no one else offers,, rather than the same cheap “no frills” vanilla contract now available from the current crop.

All it requires is some imagination, understand the business you’re in, know who you want and know who you don’t want. You don’t have to be all things to all people, … but “dare to be different”.

I can guarantee you will get the kind of support from the adviser market that you’re looking for and be profitable.

57 you say, Alleycat. Hmm, well, as other advisers have stated here it isn’t likely to benefit the end-user. Things are definitely changing but I’m not going to see the end result in 10 years. Cheers.

@ Paulkate72,

Let me give you some heart.

My background in the life insurance industry is extensive even though I migrated to the dark side, and became a CFP.

There is a new life company about to launch into the market in October.

I am one of a small number of advisers who have been consulted and held talks with the CEO and their Chief Underwriter.

In my representations, he has fundamentally agreed with almost everything I’ve said to him.

The hope is, that they have engaged a “marketing actuary” which is part of the exposure I’ve had in my background.

A marketing actuary is a rare commodity these days, which is why fundamentally, there is no product differentiation other than price, which is gradually narrowing.

Great heads-up, Alleycat – obrigado!

Let’s get more perspective and less emotion into this discussion. There are currently 29 life insurers registered with APRA, and just as in the 70’s there were very many (of many: maybe 57 but it depended which year!) which were either wholesale, group only, reinsurers, boutiques, attached to general insurers etc etc., today we also have many which are not ‘mainstream’. Not much has changed in that respect. I would challenge any old-timer to say that even in the 70’s with 50+ insurers registered, they dealt with more than a maximum 4 or 5 insurers, as an unofficial APL, pre-APL days, so nothing has changed there either.

And when it comes to overseas ownership, the list of now-disappeared names quoted below were all owned by either UK or US parents. As were many which are not listed below.

This is an irrelevance when it comes to the day-to-day dealings for and by clients and advisers. It possibly makes good headlines. That’s all.

No emotion from me either way, Sue. Simply an observation which holds water in that the fewer players that there are in the market can result in monopolies. That isn’t ideal.

There may be 29 entities Sue but 7 of those are reinsurers and a few of the remaining 22 licences are or will be held by the same parent, e.g. AMP + NMLA, Zurich + Macquarie, Westpac + St George, AIA + CMLA, so there is some illusion of competition, but not perhaps as opaque as general insurance.

Dear Sue,

Since you and I know each other from a previous life, the bulk of those advisers were tied agents that dealt with AMP, National Mutual/AXA, Colonial Mutual, all Australian mutual societies with a spattering of independent advisers that dealt with Mercantile Mutual (Australian owned ) until bought out by Dutch owned ING bank and then on -sold to ANZ bank before heading over the cliff to Zurich.

Norwich Union, Aetna, Prudential, Occidental,Tyndal/ Sun Royal Alliance/Asteron and the like, all overseas owned that were really small players here against the Australian Mutuals.

You of all ,people know that insurance has always been sold based upon emotion.

The two over-riding themes for buying insurance are based on “what if” or “just in case”.

When that choice and lack of product differentiation prevails, then for the really true adviser, as you know, the basis of advise on one contract over another should be based on the policy contract benefits.

You would argue that any contract is better that none, and I agree but……

My argument is that, what is the client buying, if the contract has inferior policy terms and will only pay out should the client be hit by a meteorite on a Friday in July between the hours of 11pm and midnight.

If everyone left in the market place offers the same contract terms, then there are a wave of emotions for advisers to deal with, if that’s all there is.

Comments are closed.