New research has revealed that emerging job opportunities and greater work flexibility created by the relentless advance of technology comes at a cost to workers’ employment and income security.

New research has revealed that emerging job opportunities and greater work flexibility created by the relentless advance of technology comes at a cost to workers’ employment and income security.

A global study released by the Zurich Group, called Perceptions on Protection, indicates the increase in work flexibility for Australians and workers in 14 other countries is seeing workers prone to more gaps when it comes to job and income security. At the same time, the report concludes that mechanisms that have previously provided safety nets and financial protection have failed to evolve at the same rate, leaving employers, insurers and governments with significant challenges if they are to adapt to the new world.

The headline findings of the research, conducted across 17,000 respondents, include:

- The extent to which inadequate retirement savings is a global concern

- The vulnerability of women to the changing nature of work due to their lower mobility and flexibility

Within the Australian component of the study, research found:

- Australians are among the least concerned that they will lose their jobs to technology

- Australians are among the most likely to become a freelance or self-employed worker in the near future

- Australians are relatively better savers

- Australian blue collar workers are more likely to have life insurance protection in place

Commenting on the release of the survey findings, Tim Bailey, CEO of Zurich’s Australian Life & Investments business, noted people of all ages are clearly worried about how to maintain their living standards when they retire. He added that the results also provide a timely reminder of the role of life insurance in optimising retirement savings – a point he says is often lost during the ongoing discussions about group life and member best interests:

“The policy basis for life insurance being such an important part of the superannuation system is the role it plays in mitigating any interruption to a person’s income stream – and ability to save – because of illness or injury”, said Mr. Bailey.

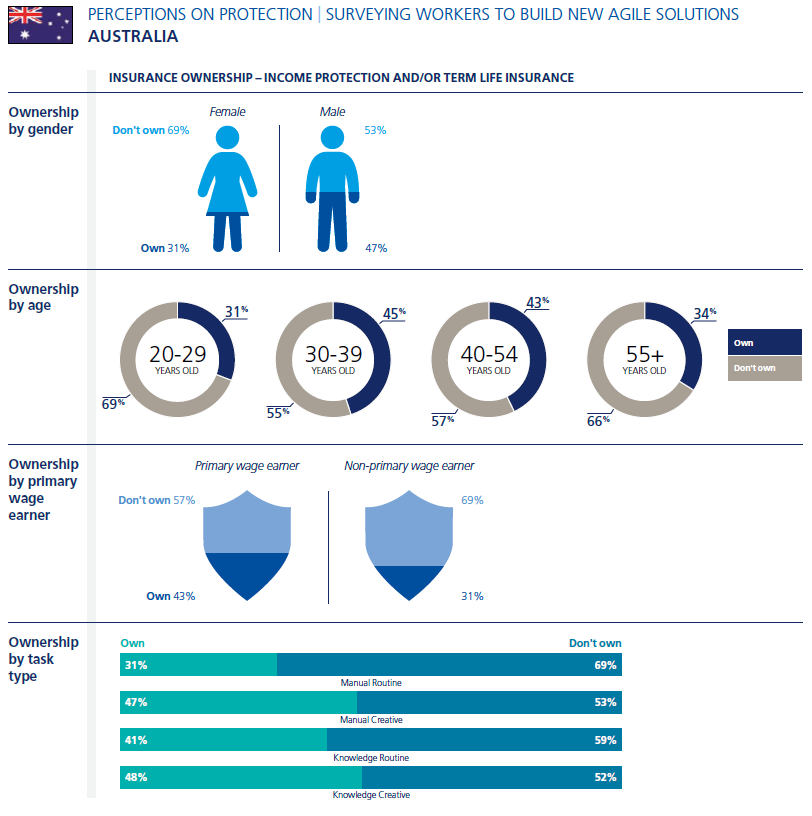

Advisers can click here and follow the links to access the full global study, which includes the following summary graphic which reflecting Australian insurance ownership across income protection and/or term life insurance: