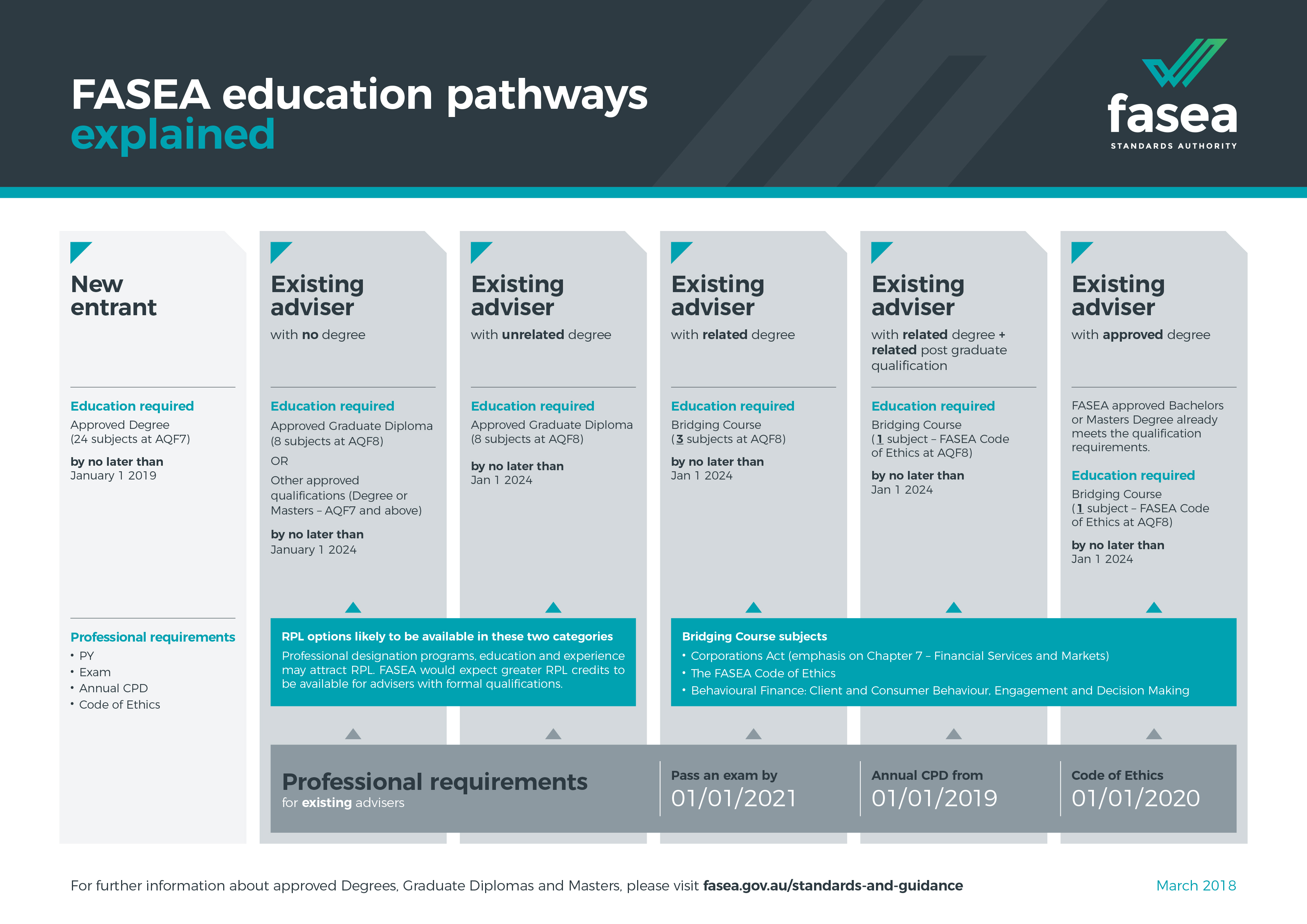

Financial advisers holding relevant degrees will be required to do only three bridging courses to be compliant with new education standards under new proposed guidelines released by the Financial Adviser Standards and Ethics Authority (FASEA).

The guidelines, which have been released for industry consultation, state that an adviser with a FASEA approved Bachelors or Masters Degree already meet the qualification requirements and will be required to do a single bridging course on ethics at graduate certificate level by 1 January 2024.

The same will apply to advisers with a related degree (accounting, financial planning or advice, business, commerce, law or economics) and a related post graduate qualification while advisers who hold a related degree only will be required to complete three bridging courses covering elements of the Corporations Act, ethics and behavioural finance at graduate certificate level by 1 January 2024.

Announcing the changes, FASEA stated the three units would equate to less than one year of study if taken part-time and “…all advisers with these types of degrees will be eligible for the relevant bridging course option, regardless of when they obtained their degree”.

“…an adviser with a FASEA approved Bachelors or Masters Degree already meet the qualification requirements…”

The proposed guidance also reiterated previous statements (see: Existing Advisers Will Require Study: FASEA) that advisers with unrelated degrees would be required to complete eight units of an approved graduate diploma by 1 January 2024 and advisers without a degree would be required to complete graduate diploma, degree or masters course by the same date (see table below).

FASEA stated professional designations fell outside the current training framework “…and did not equate to a qualification on their own” but any education undertaken to achieve the designation could be taken into account as part of potential recognition of prior learning (RPL) exemptions for qualifications.

Previous training and education courses would also be considered for RPL exemptions but FASEA warned “RPL is a matter of individual policy for the Higher Education provider and TEQSA [the Government Education Agency] reviews the RPL that a provider offers”, adding “FASEA reserves the right to not be bound by RPL awarded outside of TEQSA guidelines”.

FASEA stated relevant bridging courses would be available by the commencement of the 2019 academic year and “This will allow a full five years to complete any necessary courses before the 2024 deadline”.

The draft guidance is available on the Standards Authority’s website: www.fasea.gov.au. Consultation will close on 29 June 2018.

i have 31 years experience, with a 100 percent success rate with claims and not one customer complaint in 31 years.

I do not have a degree and it appears, my experience matters little.

My Business only does Life Insurance advising to the Business and Employee markets, yet the 3 advisers in my practice are being forced to take on ridiculous additional studies that have NIL bearing on what we do.

Experianced advisers that are in a similar position as ours, will not do this additional study, they will simply exit the Industry.

That is hardly “Best Interest” for the clients.

I certainly agree same position Jeremy 40 years and a great client base who trust our business expicently

Hopefully some common sense may still yet come from these ongoing discussions

It is a stupid situation.

If I had to choose between a Masters Degree recipient with 2 years experience and people like yourself I have no doubt whom I would value more. The fact that the rule makers disregard actual experience is baffling and just shows that they don’t have enough themselves.

I give advice on a number of areas, so I understand the higher education standard for someone in my position, but I’m mindful of the risk-only advisers. This still doesn’t help their cause. I feel as though there should be a special consideration for them, in that they’re restricted from providing advice in any other area without satisfying the proposed critera (that keeps FASEA happy), so they can continue doing exactly what they’re doing without needing to be educated on many unrelated areas of advice.

Perhaps FASEA should consider a ‘risk specialist’ course or something?

It is a money making scam and does not make those advisers, like myself a better adviser. I have 15 yrs experience, have dfP 1-8 and my own business and will only get an exemption for 2 of the Fasea 8 subjects. I have been slugged $1500 for the two exemptions and am told that i will have to pay $2,095 (That is at a discounted rate) per subject. So times that by 6 this is a huge cost on top of the study. The industry is set to lose a lot of great well qualified and experienced advisers and someone is profiting at the same time.

Comments are closed.