Zurich was the big sales winner in the advised life insurance market in 2018.

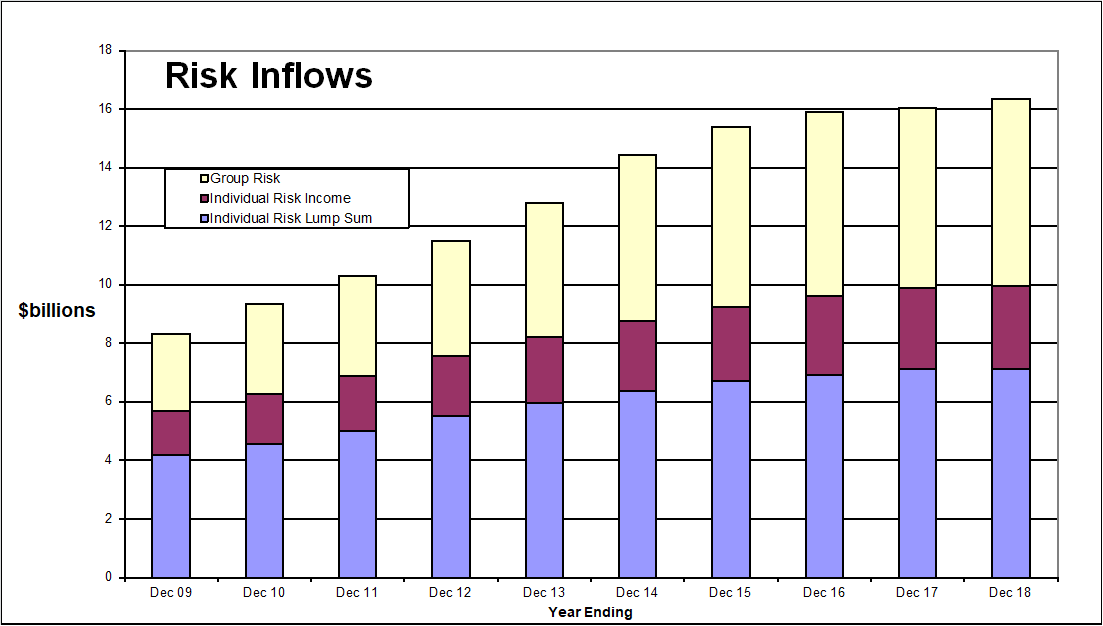

Data released by Strategic Insight for the year ended December 2018 reveals a further softening of life insurance inflows and sales, where overall risk inflows climbed by 2.0 percent during the year and risk sales were up by a similar margin, thanks only to increases in the group risk sector. These numbers, however, reflect growth at a much slower pace, according to Strategic Insight, than the double digit growth experienced over the last two decades.

Drilling down into the individual risk lump sum and individual risk income insurance markets, however, Zurich was a clear winner.

Individual Risk Lump Sum Market

Strategic Insight reports overall inflows for individual risk lump sum business only grew by 0.3 percent in 2018, while risk lump sum sales were down by 6.7%.

Zurich, however, experienced a 22.9 percent increase in sales last year, while others doing well included other specialist risk insurers including AIA Australia (up 5.3%) and ClearView Life (up 1.9%). All other firms experienced a decline in lump sum risk new business sales.

Individual Risk Income Protection Market

Similar to its performance in the lump sum market, Zurich has been credited with a jump of 22.1 percent for individual income protection new business sales, closely followed by CommInsure (up 18.5%) and OnePath (up 8.6%), while all other insurers lost ground.

In terms of overall market share of individual new business sales, AMP led the way in 2018, where its 14.7 percent share of individual lump sum new business sales took it to top position, followed by MLC Life Insurance (13.7%), OnePath (13.3%) and TAL Group (12.3%).

In the individual risk income protection market, TAL Group accounted for 15.8 percent of new business sales, followed by OnePath (14.3%), AMP (13.1%) and MLC Life Insurance (10.9%).

People distrust statistics because politicians use them to mislead and dissemble. This report should be identifying the REDUCTION in GENUINE NEW BUSINESS as a result of LIF commission reductions and CLAWBACK. Everything else is rubbish- overall risk premiums will of course be up because ALL insurers engaged in pre LIF increases, and all the usual reasons such as CPI increases, aged based increases and just plain everyday GOUGING by insurers.

APRA are reportedly concerned at the reduction in genuine NEW BUSINESS, written with any insurer since LIF started. Supposedly its down 25% and rising. That is a direct threat to the capital adequacy and solvency requirements, particularly for those insurers exposed to industry fund GROUP.

The industry, at least publicly, is ignoring the elephant in the room

But theres more. If Labor are elected, the current capacity for “supported” employes to claim a Tax Deduction for risk in super will be reversed, some 3 years after its introduction.

What’s not in the Labor platform, but will be on industry fund agendas, is to STOP ROLLOVERS out of a super fund to pay for insurance premiums in a new “fund “. Watch this space !

So those advisers who are “shoring up ” clients who may not be reliable in premium payment terms by using Rollovers, and one or two insurers whose new risk business is 70% in super and funded by Rollovers, are heading for a fall.

But only if we survive FASEA

THEN THAT HATED 2 YEAR CLAWBACK WILL REALLY REDUCE BUSINESS as originally predicted.

Comments are closed.