The Beddoes Institute’s Dr Rebecca Sheils takes advisers on a journey through her firm’s extensive research findings that have identified seven critical ‘domains of knowledge’ that will become essential ingredients within the make-up of any advice business seeking to survive and thrive in 2020 and beyond…

It’s not an understatement to say that the advice industry has been in a constant state of change for years. External forces that range from societal, economic, political and technological have all contributed to the evolution of the advice industry.

Add to this the repercussions and reshaping of the industry in the aftermath of the Financial Services Royal Commission, combined with general distrust and cynicism in market sentiment and one thing becomes clear: there has never been a more apt time than now to re-think and re-define what advisers should learn and put into practice.

At Beddoes Institute our team has undertaken research across advisers, regulators, academics, consumers, licensees and professional association members with the aim of identifying the skills advisers need to thrive in the new financial services landscape.

Our extensive research reveals that a broad range of knowledge domains and competencies, in conjunction with the recognition of adviser attributes that are more reflective of the conversations between advisers and their clients, is required to help the advice sector develop further.

Another primary finding of our research is the confirmation of an industry-wide belief in the need to invest in education that extends beyond traditional technical knowledge in order to adapt to the shape-shifting forces of financial advice. In analysing feedback and input from over 500 experts, 1,600 written submissions and over 60 qualitative interviews our research team has been able to identify the primary skills required for an adviser to be considered proficient, trustworthy and effective at developing strong adviser-client relationships.

These findings form what we refer to as ‘The Financial Advice Competency Framework’. This concept comprises:

- 36 specific competencies

- Seven domains of knowledge that house these competencies

- Five domains that apply to financial advisers active in the management of clients

- Two domains that specifically apply to advisers who manage staff and the delivery of advice within practices

- The timeframe involved in the development of these skills

What are the competencies advisers need to thrive into the future?

The Financial Advice Competency Framework can be considered a contemporary reflection of today’s adviser and client relationship.

Our team at Beddoes Institute worked extensively with industry participants to identify the primary skills required for an adviser to be considered efficient, authentic, credible and apt at developing strong adviser-client relationships, which resulted in the formation of seven domains of knowledge outlined below:

Each domain consists of several core competencies, which cumulatively form an overall picture of the soft and hard skills advisers require to thrive moving forward in the new financial advice landscape.

What are the seven domains of knowledge?

1: Technical Services

The ability of an adviser to provide technical financial advice services remains core to the successful performance of advisers. This domain represents the need for advisers to have an extensive understanding of these six areas:

- The financial advice process

- Insurance

- Cash flow management

- Investment

- Retirement and estate planning

- Taxation

2: Professionalism

Also considered fundamental to the provision of financial advice services is professionalism. This includes areas such as:

- Professional and ethical conduct

- Regulation and compliance

- Professional development

- Training and expertise

3: Client Focus

This domain represents the importance of maintaining client centrality in the advice process, as well as the ability to provide individualised, proactive, responsive and reliable client service. It consists of five core competencies:

- Recognition of client needs

- Effective client management

- Well-informed contemporary advice

- Customised service

- Client education

4: Self-Development

The Self Development domain embodies the need for advisers to understand the impact of personal qualities on the client and their professional relationships. Five key elements constitute this domain including:

- Sound judgement

- Deep understanding of client personal values

- Adviser adaptability

- Being organised and systematic

- Possessing an appreciation of the role resilience plays in maintaining performance and quality under difficult circumstances or uncertainty

5: Connecting with People

The focus of this domain includes communication and interpersonal skills that contribute to the development of a personal connection and strong relationship with the client. It includes:

- Trust

- Effective communication

- Interpersonal skills

- Coaching and psychology

The final two domains are considered essential to the sustainability of businesses but not to all advisers, only those who chose to work in a managerial capacity:

6: Business Operations

This domain includes:

- Understanding the role of information and communication technology

- Development of talent

- Clear goal setting and robust performance measures

- The ability to evaluate operations of a practice, its client management systems and its marketing

7: Strategy and Leadership

This final domain relates to the ability to perform in a leadership role:

- Knowing how a practice reputation is developed

- Understanding the business model and its effect on factors such as efficiency, strategy and business management

- General business planning

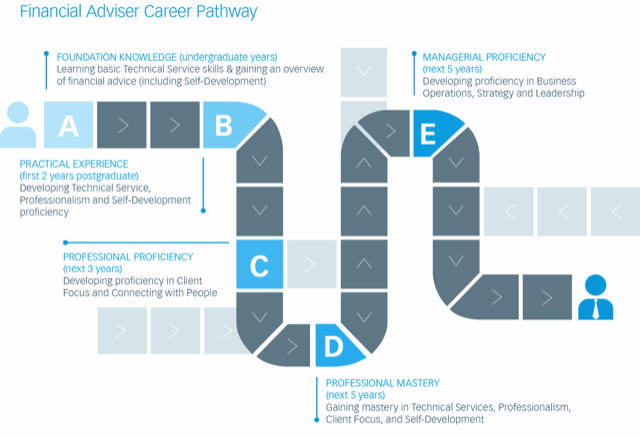

How long does it take to develop these skills?

Our research shows that during the first five years of practice, an adviser’s growth and development occurs rapidly and concurrently on many fronts at the same time. Our findings indicate that the domains of technical services and professionalism are developed first. Then the adviser goes on to acquire levels of capability described within the client focus, self-development and connecting with people.

Importantly, as advisers begin to practice, and the acquisition of client-facing competencies such as interpersonal skills become highly relevant, their need to further develop competencies in Technical Service and Professionalism doesn’t diminish but needs to continue apace.

This research demonstrates that skills are not learnt one after another. Rather, advisers increase in proficiency as they move from developing competencies to becoming proficient and finally acquiring mastery of many competencies simultaneously. So, at any point in time advisers can be viewed as possessing many competencies, with differing levels of proficiency that change over time.

The Role of Experienced Advisers

The research conducted by the Beddoes team highlights the value that experienced advisers bring to both clients and new advisers. Experienced advisers, if harnessed in ongoing mentoring and coaching roles, may be able to provide the longer-term professional development necessary for the acquisition of competencies in the Client Focus, Self-Development, and Connecting with People domains by younger advisers – and this is before the managerial experience is shared.

However, given the fact that an average of 15 advisers are leaving the industry every day for various reasons ranging from retirement through to the new professional standards, there is a chance that this could produce an industry-wide “memory gap” resulting from a lack of experienced practitioners available to mentor and coach. If this is the case, then who will transfer their knowledge to the next generation of advisers?

Let the Beddoes Institute help you better your business

To support your business and help you become truly client-centric, Beddoes Institute is offering you the opportunity to receive FULL FREE access to the Client Experience Survey. In addition to receiving your own Adviser Trust Score calculated from the trust framework outlined in this paper, this market-leading tool will enable you to find out what your clients really think about you, and it will also show you how you perform compared to Beddoes’ high-performing adviser and practice benchmarks and provide clear guidance on how to strengthen trust with your clients.

Plus you’ll have the opportunity to qualify for Beddoes’ Most Trusted Advisers (MTA) Network. Launched in 2014, the MTA network is a consumer-focused brand that represents the best of the advice industry to peers and consumers.

Simply complete Beddoes Adviser Experience Benchmarking Study to:

- Tell insurers how they can better support you and your clients;

- Have your voice heard on how industry changes have impacted your business;

- Receive FULL FREE access to Beddoes’ Client Experience Survey; and

- Take your first step towards becoming part of Beddoes’ Most Trusted Advisers (MTA) Network.

Click here to learn more about Beddoes’ eFFECTIV Coach platform. An evidence-based coaching and compliance tool for practices and licensees, which makes monitoring adviser coaching and development easy during the new professional year.

This article is based on research conducted by the Beddoes Institute, culminating in its development of The Financial Advice Competency Framework

Web: beddoesinstitute.com.au

Email: info@beddoesinstitute.com.au

Ph: +61 3 5974 8198