Latest quarterly data released by Plan For Life confirms the continuation of recent trends reflecting static overall premium inflows and falling new business sales.

For the twelve months to the end of June 2019, the research firm reports growth in premium risk inflows “…almost ground to a halt over the past year, only increasing by a relatively marginal 0.8%.”

PFL reported MetLife, ClearView and AIA Australia experienced the largest overall premium inflows in the twelve months to June 2019, while both CommInsure and AMP inflows were significantly lower.

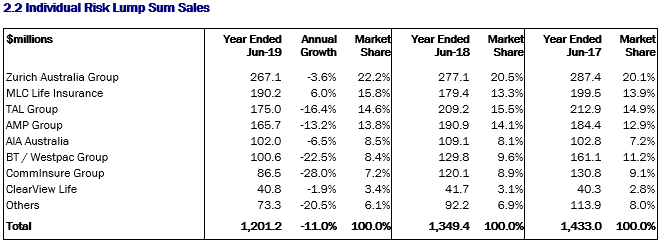

Within the individual lump sum risk market, while overall premium inflows remained static (down 1.7%), new business sales were reported to have fallen by 11% year on year.

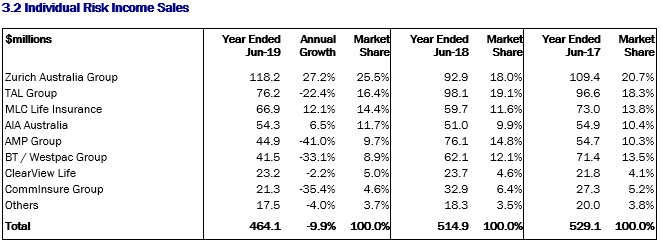

There was a similar result for individual income protection insurance products, where total premium inflows were also static (up 0.9%), but new business sales dropped by almost 10% in the year to June 2019.

Zurich ended its run of lump sum new business sales out-performance in this quarterly update (see: Inflows Flat, Sales Down – But Zurich Still Up), where MLC Life Insurance was the stand-out this time (up 6%). However, Zurich maintained its stellar run in new IP sales (up 27%), followed by MLC Life Insurance (up 12%).

The following tables, taken from PFL’s market overview report for the year ended June 2019 demonstrate the retail market sales leadership of Zurich, post its acquisition of the OnePath risk portfolio from ANZ Wealth:

There is a reason ordinary punters hate statistics and it is because politicians abuse and misinterpret them to advantage. This stuff from PFL may be misleading simply because different insurers mean different things by the term “new business”

There is an easy method to measure the impact of LIF on RISK NEW BUSINESS – just add up the number of retrenched underwriters and New Business staff

Comments are closed.