The critical importance of documenting reasons for the amount of life insurance recommended to clients has been driven home to advisers during the AFA’s 2020 Roadshow series.

This message was delivered by AFA GM Policy & Professionalism, Phil Anderson, within the context of lingering concerns he says the AFA still holds around the interpretation of adviser conflicts of interest within Standard Three of the proposed FASEA Advisers Code of Ethics.

Notwithstanding additional guidance released by FASEA just before Christmas (see: …Green Light for Risk Commissions) – Anderson has been sharing the Association’s concern around one of the guidance notes for Standard Three.

According to Anderson, his concern about what may drive future conflict of interest relates not to adviser commission levels or choice of product (now capped at 60 percent upfront) but rather with the level of life insurance recommended to the client. He cautioned advisers about what he described as a ‘legalistic’ phrase which states:

A disinterested or unbiased person, in possession of all the facts, would reasonably conclude that the remuneration would not lead the adviser to prefer the interests of someone (including their own) over the client’s best interest.

…it is critical that you adequately document why you’ve selected the level of cover you’ve recommended

Anderson was unequivocal in advocating to advisers that they are able to demonstrate – every time – that the amount of insurance they recommend for their clients is appropriate to their circumstances and serves their best interests: “Therefore it is critical that you adequately document why you’ve selected the level of cover you’ve [recommended] …and that you can demonstrate why that’s in the best interests of the client,” he said.

The message around potential future conflict of interest under the FASEA Code of Ethics was one of a host of current topics considered by both Anderson and AFA CEO, Phil Kewin, as they provided an update on the AFA’s positions on and activities around the many changes and other issues impacting the financial services sector in general and the financial advice sector in particular.

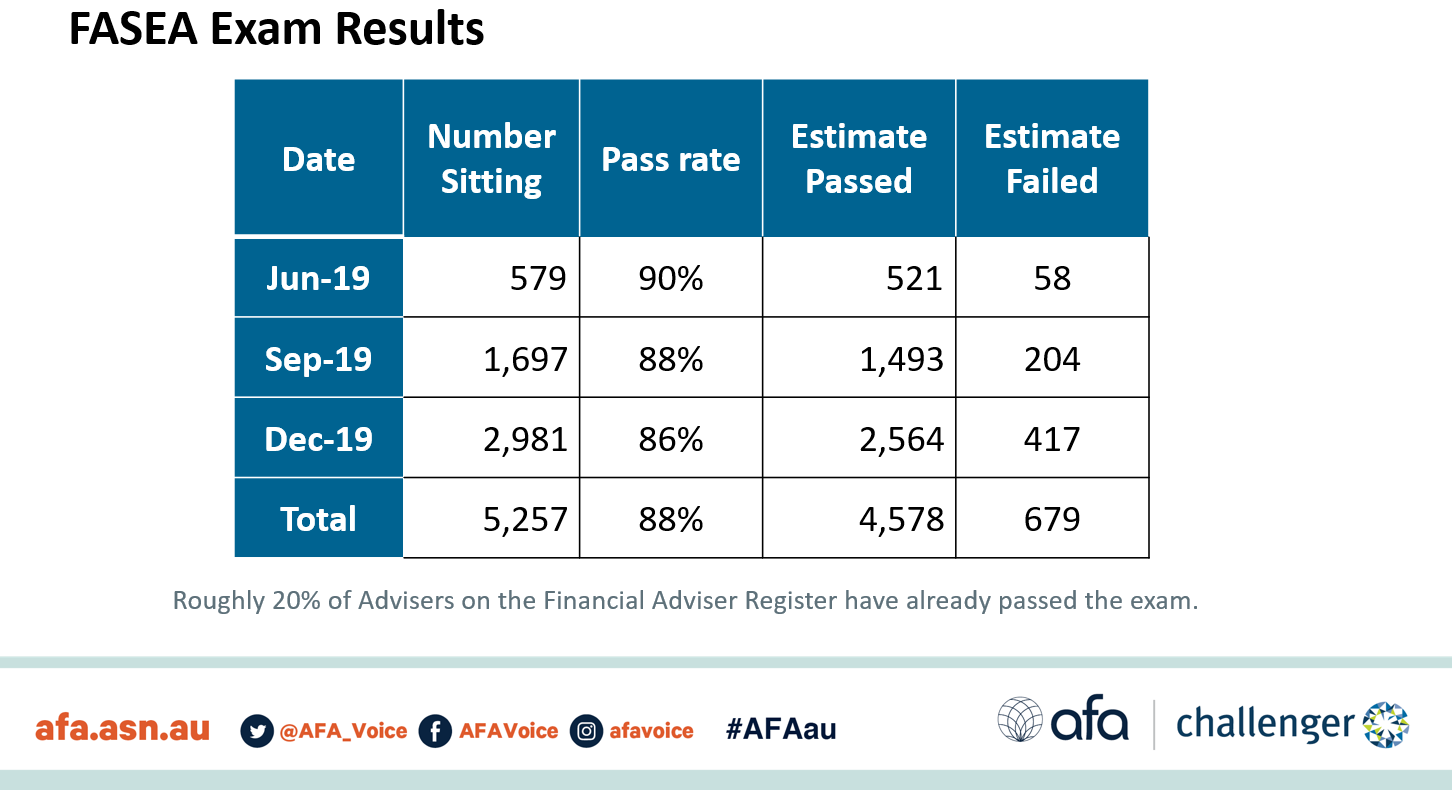

One of the ‘good news’ areas covered by Anderson related to the FASEA Adviser Exam results to date, which have delivered an average pass rate of 88 percent of those sitting the first three exam series, and who represent around 20 percent of the overall adviser community. Roadshow attendees were provided with this summary:

There is a lingering ideology that Commission for Life Insurance is tainted and that the very concept of taking Commission, must to a degree, show that there is some form of conflict and if the premium should in any way be a tad higher than some hidden bench mark, then BID must be in doubt.

To all those idealistic theorists who have been proven wrong every time they pop up with their false propaganda, though have still managed to cause untold damage to all Australians with their lies and mis-truths, may I suggest that before you once again show your ignorance, try something different and write about real world perspectives and implications of regulatory imposts which have had little or nil benefit to Australia.

Funny thing. During many of my annual audits the compliance person raised concerns I could have [possibly] recommended more cover. I would dutifully explain once more how I arrived at my lump sum recommendation of [say] $1.25million and not $1.50million [which I considered excessive]. So based on my past audit track record I very much doubt ‘Standard Three’ would ever come back to bite me on the behind. My Licensee has sent me daily FASEA Code updates explaining each standard and related issues. At the same time, the current MD is emailing vids of his days in Vietnam organising yet another extravagant [and totally unnecessary] overseas convention this year…something I believe ASIC red flags every time he puts something about it on Facebook. It’s become a very weird [fianncial/insurance] world.

I haven’t recommended a specific sum assured for over 10 years out of concern that any recommendation can be picked apart with perfect hindsight. I present a range of options based on initial client education, discussions and instructions and then have the client tell me specifically how much of each type of cover they wish to purchase, based on overall affordability and their priorities. Clients love the control and it protects me against those who want to tell advisers at some point inthe future that they’ve ‘done the wrong thing’. Without a working crystal ball it is impossible to accurately assess insurance requirements.

Comments are closed.