- No (73%)

- Yes (18%)

- Not sure (9%)

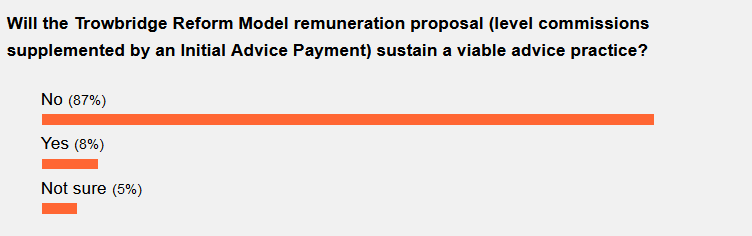

Two thirds of advisers think the revised risk commission model proposed by actuary John Trowbridge would not sustain a viable advice practice.

This is the main message stemming from our latest poll, which asked advisers to make their own assessment of Trowbridge’s call for the Government to re-think the remuneration model for risk advice which it implemented through its Life Insurance Framework reform legislation (see: Call for Re-Think on Risk Commissions).

As we go to press, almost exactly two thirds of those voting (66%) have rejected the 2020 Trowbridge model proposal, however, 23% believe the $2,000 IAP accompanied by a flat 20% commission and no clawbacks will work. Around one in ten (11%) are unsure.

This poll has delivered a similar result to the same question we asked you in 2015 about the original Trowbridge reform model, where a significantly higher proportion gave the proposal a thumbs-down:

With thanks to the many advisers who took the time to add their comments on this issue, a summary of the recurring key themes, observations and messages arising from this debate include:

- Less Australians are receiving access to critical life insurance advice

- For life insurance to be accessed properly by consumers it needs to be accompanied by advice

- The 60/20 commission model, two-year clawback period operating under the Life Insurance Framework reforms is unsustainable for advisers and limits their ability to advise mums and dads clients

- The industry should be allowed to return to an 80/20 commission model with a one-year clawback period, in order for retail risk advice businesses to remain viable and in order for the mums and dads market to have access to life insurance advice

…The proposed Trowbridge model is not viable as it is a one-dimensional approach to a multi-faceted problem

- The updated Trowbridge proposal discriminates against advisers who work with larger risk insurance clients with more complex insurance needs

- With implied reference to LIF, FASEA reforms: “Why is the industry so broken after these so called improvements?”

- This is a free market economy

- The proposed Trowbridge model is not viable as it is a one-dimensional approach to a multi-faceted problem

- “Either the compliance burden needs to be reduced or commission rates to be increased or a mix of both”

- In the real world, remuneration for risk advice must change with the complexity and size of the case

- “This entire mess was created based on a false premise” (ie the ongoing dispute over the veracity or interpretation of the data which supported the recommendations made in ASIC’s Report 413 in October 2014)

Representing the almost one in four who think the new Trowbridge commission model is sustainable, one adviser noted the model might create sufficient incentive for risk advisers to stay in the industry or even to return.

Finally, another very strong message or theme which has remained ever-present in recent years is the frustration felt by many advisers that their voice is not being heard and that the regulatory and political decision-makers aren’t listening to, or consulting enough, with the adviser community.

Our poll remains open for another week and we welcome your further thoughts on this critical issue, especially within the context of the ASIC review of the impact of the LIF reforms, which is scheduled for completion in 2022…

The majority of advisers have now twice rejected Trowbridge’s suggestions as unworkable. Furthermore, the second last paragraph of the article is an accurate reflection of the situation – advisers voices are just not being heard. What will it take to make the regulators and the decision makers realise that they have ignored talking to the right people? The destruction of the retail life insurance industry?

Take what you can get. As they say a bird in the hand is better that two in the bush! Regulators have no idea how we work or the value we add. They just think people would just ring their super funds to get what ever they need in insurance or worse still some online company you hear about on the day time shows.

Comments are closed.