AIA Australia has launched a new trauma insurance proposition within its flagship AIA Priority Protection range.

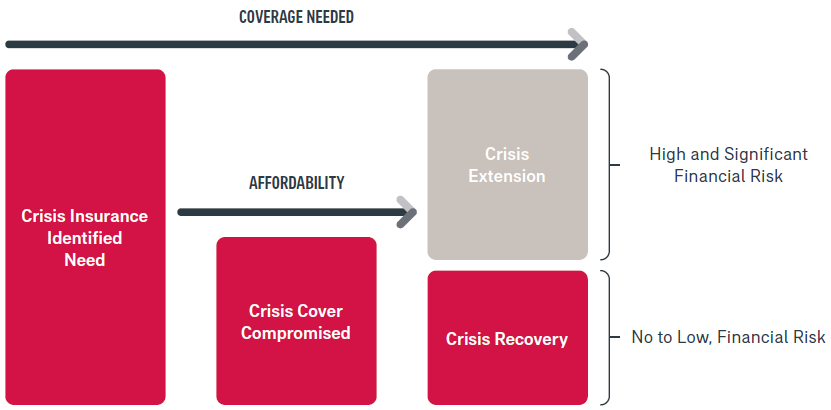

Named Crisis Extension, the new offer is an optional rider benefit for clients taking out AIA Crisis Recovery Insurance, where the client can select an extra and separate level of trauma insurance cover in addition to the amount of cover they select under AIA’s Crisis Recovery benefit.

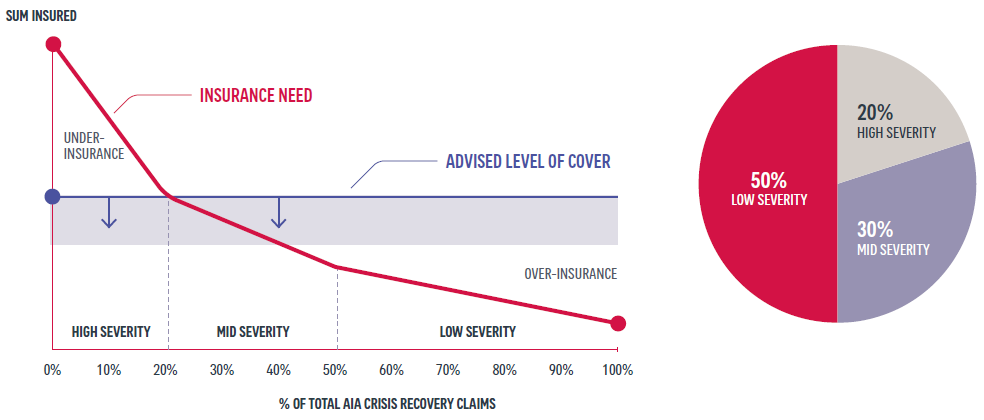

Part of the rationale supporting the implementation of this initiative, according to AIA Australia, relates to the sliding scale of severity which attaches to the claims the insurer pays out, and where the financial impact of the event can often correspond with its severity.

Referencing, to an extent, the original purpose of trauma (or critical illness) insurance – of softening the financial burden that accompanies these events – clients can select a level of cover which will be paid on the confirmed diagnosis of a range of events, and can nominate an additional amount of cover under Crisis Extension that will be paid out if the client’s condition worsens or becomes more serious.

According to the insurer, the new optional benefit, which it does not characeterise as a severity-based proposition, offers customers access to a greater level of protection over a longer period, at a lower total cost.

Coverage

Events and conditions covered under the Crisis Extension option are charaterised by the insurer as medical conditions that have progressed or deteriorated from the initial diagnosis, or are more serious conditions. However it says some Crisis Extension events may also be claimable under the insurer’s existing Crisis Recovery benefit. If the claimant meets both definitions, then both benefits would be payable.

In other circumstances, however, the insurer outlines scenarios in which claimants may first meet the definition of a crisis event under Crisis Recovery and receive a benefit. If the claimant’s condition progresses or deteriorates, it says they may later meet the definition of the Crisis Extension event and receive the additional Crisis Extension benefit.

Flexibility

…these are like levers that can be pulled in either direction

According to consumer support material released by AIA Australia, its Crisis Extension benefit option is treated independently, meaning clients are able to separately select the sum insured amount they wish to apply to both their Crisis Recovery and Crisis Extension benefits. It says these are like levers that can be pulled in either direction, intending to deliver greater flexibility for the client.

It adds this means clients can choose to add as much or as little toward their Crisis Extension sum insured, where this flexibility allows the client to access more cover for the most serious events, at lower premium rates.

Pricing

As an indicator, AIA says clients taking out a Crisis Extension benefit option can access more cover for longer, at a discount of around 25 percent compared to where the combined amount of benefit has been insured entirely under the Crisis Recovery benefit.

In a release accompanying the launch of this new benefit option, AIA Australia’s Chief Life Insurance Officer, Ben Walsh, notes “We hope that this flexibility will allow financial advisers and their clients to vary the mix between Crisis Recovery and Crisis Extension to ensure the protection and cost suits each person’s specific needs.

New PDS

The insurer has released adviser support materials which detail the nature of the new option in more detail, together other product enhancements, all of which are documented in a new PDS dated 10 October 2020.