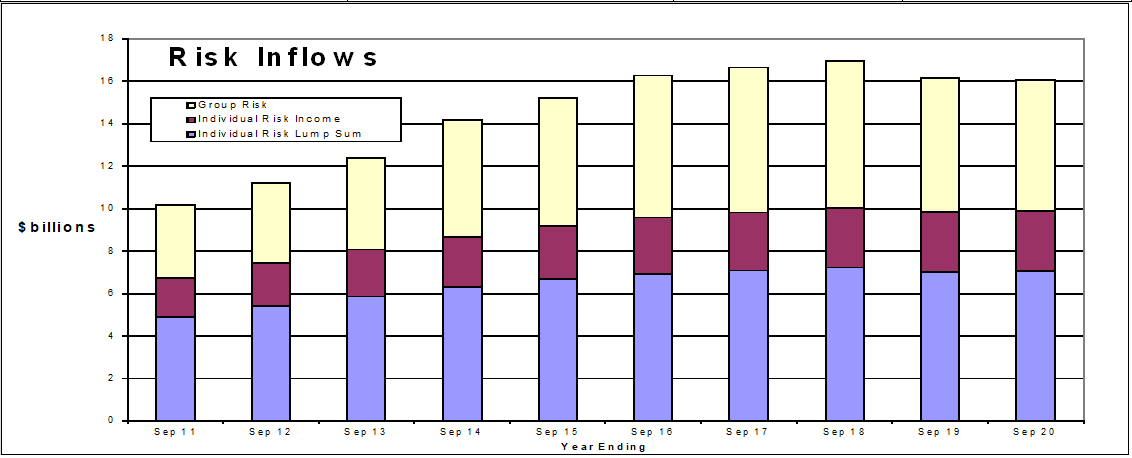

Overall risk premium inflows have steadied in the 12 months to September 2020 but individual risk sales have continued their downward trend, according to latest data released by Plan For Life.

In encouraging news, the research house’s market overview for Life Insurance Risk Premium Inflows & Sales for the Year Ended September 2020 reports risk inflows remained virtually static year-on-year – down 0.4 percent, following a drop of more than six percent in the year ending June 2020.

In further good news, Plan For Life data shows total premium sales jumped by almost one quarter – up 28.9 percent for the year ended September 2020, but this spike was attributed to a sharp jump in the more volatile group risk sector.

The news is not as good for individual risk new business sales

The news is not as good for individual risk new business sales, where both lump sum and income protection insurance sales continued to contract.

In the year to September 2020, individual risk lump sum new business declined by 7.4 percent, following a steeper drop of 9.2 percent in the year to June 2020.

Similarly, individual income protection new business fell by 7.2 percent in the year to September 2020, following a decrease of 8.1 percent in the year to June 2020.

what do they expect, we get paid almost nothing now… have a 2 year clawback period…..compliance to submit a policy takes a good week to prepare and then underwriting takes up to another 3 months to go into force. something will need to give or this trend will only get worse.

Most New Business is written by Advisers, who due to unworkable restrictions of trade, a revenue commission model that is now unprofitable, the annual file reviews still a maze of contradiction, in conjunction with the current Life Insurance Framework and FASEA fiasco being unchanged, there is only one direction New Business will continue to head and that is down.

Life Insurance today, is an Industry of indecision and hand wringing with little leadership.

The solution is easy, quick to set up and all it will take is for Life Company CEO’s and the Government to start listening and ACTING upon the correct strategy NOW.

It is irrelevant to state there has been some stability in New Business, when everyone knows that specialist risk advisers are just biding their time and will exit the Industry, some by the first January 2022 and the majority by the 31st December 2025 when the Education requirements must be met.

Most Financial Planners are turning their backs on Life Insurance, as it is now way too hard for them.

For the Life Insurance Industry to recover, there needs to be a doubling then tripling of risk advisers.

Today, the reverse is happening. We have shouted from the rooftops the reasons why and have given the solutions, yet still no-one acknowledges our experience.

What we watching is the totally preventable destruction of the retail advice Life Insurance sector.

At what point will the Government wake up to it?

Bide your time or at least prepare for another career if that is viable and you are not near retirement.

If you are anywhere near able to retire, then just do it! It’s a marvellous time.

Comments are closed.