Latest APRA claims data continues to reinforce the value of financial advisers with individual advised business showing higher payment rates than individual non-advised across death, TPD and DII claims.

APRA has released its latest Life Insurance Claims and Disputes Statistics publication, covering a rolling 12-month period from 1 January 2020 to 31 December 2020 which found that individual advised death cover was admitted at 96 percent compared with 90 percent for non-advised claims (see: Claims by Advisers More Likely to Succeed).

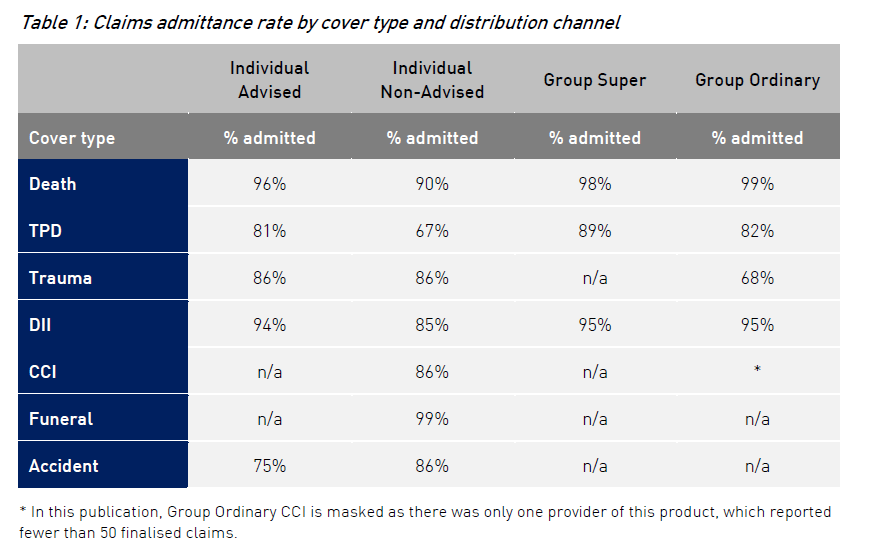

A table showing the admittance rate by cover type and distribution channel for the 12 months also shows TPD claims were paid at 81 percent for individual advised claims, while non-advised was at 67 percent.

However trauma claims were paid at 86 percent for both individual advised and non-advised while DII individual advised claims were admitted at 94 percent compared with 85 percent for non-advised.

APRA’s executive summary in its full report states that generally, individual advised business showed higher admittance rates than individual non-advised for the same cover type which it says could be due “…to the policyholder having clearer expectations up front of what is covered by the product, or… the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.”

APRA’s executive summary in its full report states that generally, individual advised business showed higher admittance rates than individual non-advised for the same cover type which it says could be due “…to the policyholder having clearer expectations up front of what is covered by the product, or… the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.”

Claims Paid Ratio

In looking at the claims paid ratio (the dollar amount of claims paid out in the reporting period as a percentage of the annual premiums receivable in the same period) for the 12 months to December 2020 the report points to individual advised death claims at 42 percent (36 percent for non-advised).

TPD and Trauma claims were at 56 percent and 54 percent respectively for individual advised claims compared with 43 percent and 36 percent under the individual non-advised category.

The claims ratio paid for DII stood at 77 percent for individual advised claims and 120 percent for non-advised.

APRA’s summary notes that DII business has the highest claims paid ratio for all distribution channels. “While a ratio of over 100 percent suggests good value for policyholders, this is not sustainable and will threaten the ongoing availability of IDII for the Australia community in the future.”

APRA’s summary notes that DII business has the highest claims paid ratio for all distribution channels. “While a ratio of over 100 percent suggests good value for policyholders, this is not sustainable and will threaten the ongoing availability of IDII for the Australia community in the future.”

It adds that with the release of the final sustainability measures and the introduction of the individual DII capital charge “…APRA is working with the industry to move the product to a sustainable state and thereby deliver better outcomes for policyholders.”

APRA describes the data as the product of a world-leading joint project with ASIC aimed at making it easier to compare life insurers’ performance in handling claims and disputes. This is the fifth publication using the full data set since it was launched in March 2019.

Click here for the full report.

ASIC’s MoneySmart Life insurance claims comparison tool has been updated with the latest data.

That last table is uglier than a lovechild between Peter Dutton and Pauline Hanson.

Comments are closed.