APRA’s latest Life Insurance Claims and Disputes Statistics publication appears to reinforce that advised clients are more likely to be paid for death, TPD and DII claims.

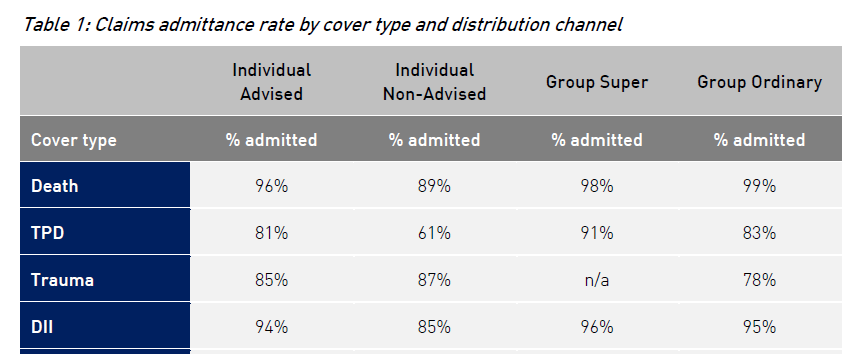

APRA’s data on the admittance rate by cover type and channel for the 12 months to June 2020 shows that individual advised cover for death was paid 96 percent of the time compared with 89 percent for individual non-advised.

It also reports advised TPD claims were 81 percent paid compared with 61 percent of non-advised claims and DII claims that were advised recorded 94 percent compared with 85 percent for non-advised.

However of the trauma admittance, non-advised claims were two percent higher than advised claims at 87 percent.

A statement from APRA says the data is the product of a “world-leading” joint project between the authority and ASIC, aimed at making it easier to compare life insurers’ performance in handling claims and disputes. This is the fifth publication using the full data set since it was launched in March 2019.

It says the publication presents the key industry and entity-level claims and disputes outcomes for 20 Australian life insurers writing direct business, excluding reinsurance.

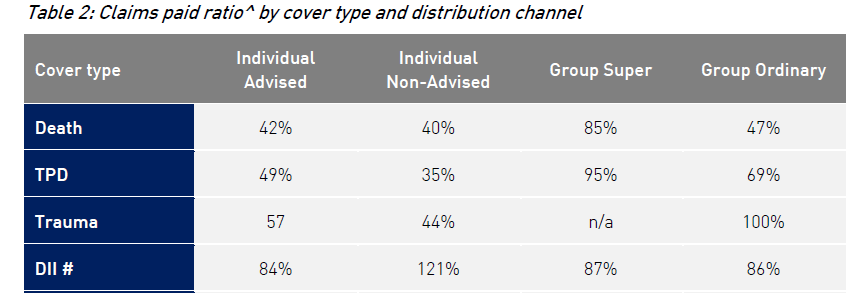

The statement also highlights the claims paid ratio by cover type and channel for the 12 months to June 2020. The regulator notes the advised claims for death (42 percent), TPD (49 percent) and trauma (57 percent) were higher than non advised which came in at 40 percent (death), 35 percent (TPD) and 44 percent (trauma) respectively.

DII cover saw non-advised claims at 121 percent and advised at 84 percent.

In its executive summary to the full report APRA notes that generally, individual advised business shows higher admittance rates than individual non-advised for the same cover type.

It says this could be due to the policyholder having clearer expectations up front of what is covered by the product, or the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.

APRA says this second point is related to a previous comment in the summary discussing cover types and distribution channels where only a small number of claims were reflected.

Click here for the full report.

ASIC’s MoneySmart Life Insurance Claims Comparison Tool has been updated with the latest data. It compares insurers across cover types and distribution channels on four metrics – the percentage of claims accepted; the length of time taken to pay claims; the number of dispute and the policy cancellation rates.