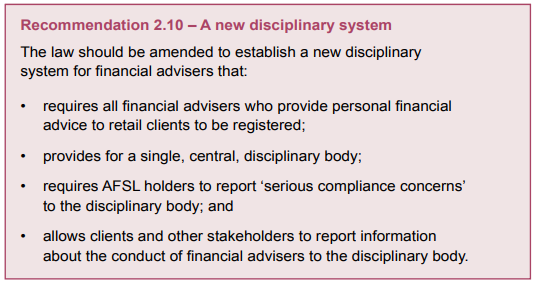

The Government has moved a step closer to implementing another of the Banking Royal Commission recommendations by releasing draft legislation this week which will establish a new disciplinary system for financial advisers.

According to a release by Minister for Superannuation, Financial Services and the Digital Economy, Senator Jane Hume, the draft legislation, which responds to Banking Royal Commission Recommendation 2:10 is intended to “…strengthen oversight of financial advisers while simplifying the regulatory framework governing the provision of financial advice, helping to reduce complexity and cost for advisers.”

The Minister adds this move is part of the Government’s ongoing commitment to ensure Australians have access to affordable and high quality advice (see also: FASEA to be Dismantled).

The draft legislation expands the role of ASIC’s Financial Services and Credit Panel (FSCP), which will exercise the functions of the single disciplinary body for financial advisers. The draft legislation includes clauses that seek to:

- Create new penalties and sanctions to apply to financial advisers found to have breached their obligations

- Introduce a new annual registration system for financial advisers

In a move intended to remove duplicated regulatory oversight, the draft legislation removes the requirement for tax (financial) advisers to be registered with the Tax Practitioners Board, and ensures relevant tax experts are appointed to the FSCP to hear disciplinary matters that involve tax-related advice.

According to Senator Hume’s statement, the reforms contained in this draft legislation will “…simplify the regulatory framework governing the provision of financial advice by streamlining the number of bodies involved in the oversight of financial advisers, while at the same time strengthening that oversight to ensure that advisers engaged in misconduct are appropriately disciplined under one system.”

Click here to access an exposure draft of the legislation and explanatory material from the Treasury website.

Submissions in response to the draft legislation close on Friday 14 May 2021 and can be sent to SDBconsultation@treasury.gov.au.