Key findings in data compiled by the Life Code Compliance Committee for the year to 30 June 2020 reveal the superannuation risk market is contracting, while complaints around claims are on the rise.

The committee’s report attributes an industry-wide 20% contraction in the number of insurance policies to the cancellation of covers within the superannuation sector, which it says is due to the implementation of the Protecting Your Super and Putting Members’ Interests First laws, which came into effect following recommendations stemming from the Financial Services Royal Commission. It reports the implementation of these laws led to a 23% reduction in group superannuation cover during the reporting period.

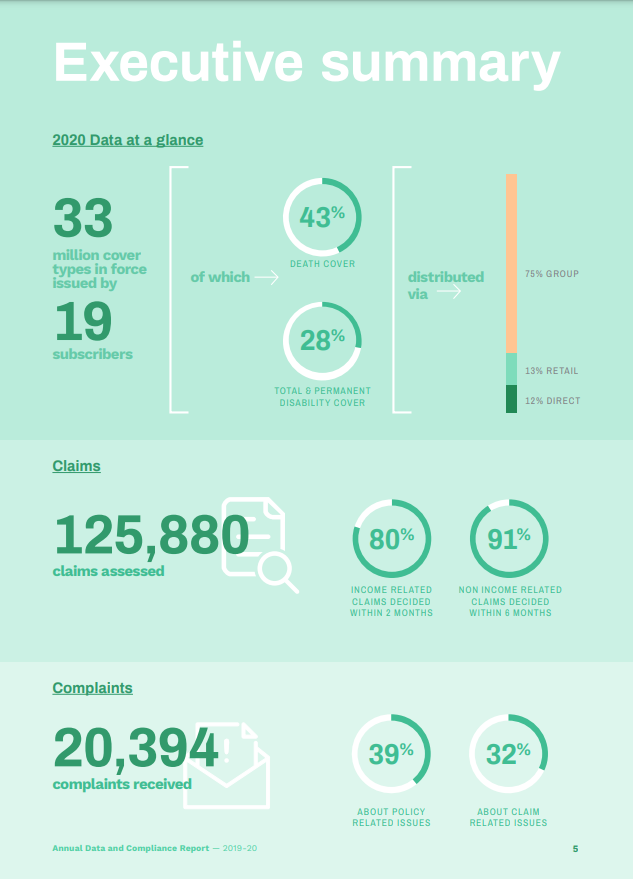

Claims

The committee noted elsewhere that it was pleased most claims decisions across the sector were made inside timeframes set out within the Life Insurance Code of Practice, where:

- 80% of income-related claims decisions were made within two months

- 91% of non-income related claims decisions were made within six months

While it was encouraged that most subscribing life companies were able to clearly identify the reasons when unexpected circumstances applied to a claim, the committee also noted the number of claims related complaints jumped by 40% during the year.

…the sharpest surge related to complaints about the amount of time insurers took to assess customers’ claims

It says the sharpest surge related to complaints about the amount of time insurers took to assess customers’ claims, where there was also a 25% rise in complaints about claims decisions.

Offering a reason for this increase, the committee noted feedback from insurers “…indicates that the COVID-19 pandemic had some impact on their ability to assess claims in a timely manner during the last quarter of the reporting period, leading to an increase in customer complaints.”

It added that life company staff transitioning to remote working arrangements, and the closure of some offshore claims processing and call centres also contributed to delays and impacted response times.

Human Error Breaches

Elsewhere in the report’s key findings the committee noted that, according to the product manufacturers, 93% of isolated breaches of the Code of Practice were caused by people, where human error accounted for 34% of all ‘people-related’ breaches, while staff failing to follow established processes was the cause of another 32% of those breaches.

The report summarises feedback from insurers, which outlines four reasons for the rise in people-related breaches:

- Resourcing issues

- Challenges ensuring that staff have the necessary skills and capability

- Improvements to breach reporting

- The operational challenges of staff working remotely during the last quarter of the reporting period because of the Covid-19 pandemic

Click here to access the Life Code Compliance Committee’s Annual Industry Data and Compliance Report for the year to 30 June 2020.