After delivering ‘health checks’ and benchmarking the performance of advice practices since 2000, the team at Business Health has released a summary of the key learnings they have observed over the last 21 years. In the first of what will be a three-part series, this great summary article focuses on key takeaways associated with the structure and activities of an advice business…

Observation 1

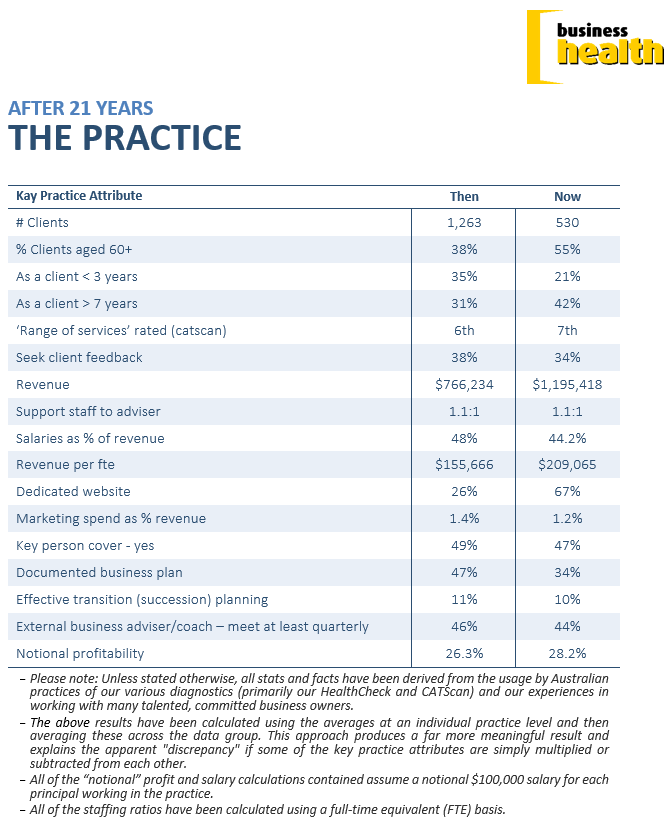

While client numbers have significantly reduced over the years, the notional profitability of practices has remained static. It seems to us that practices today have effectively trod water in their search for an acceptable ROI – with the savings provided by technology, reduced client numbers and a more disciplined approach to charging (fee levels and structures) being more than offset by increasing operating costs, regulatory requirements and time pressures.

Observation 2

The need for scale has gradually and surely emerged over time as a key factor. Practices with annual revenue of $500K for example, are averaging a notional profitability level of just 10%. And while this may have been acceptable in years past, we don’t believe it is tenable going into 2021+. Add to this the comments of several respected industry commentators earlier this year, that a revenue level of closer to $1M will be required and it’s easy to see the enormity of the ‘scale challenge’.

Observation 3

The % of practices seeking external input/advice through a coach, advisory board or respected B/PDM has remained frustratingly low over the years – disproportionate to the value of the practice itself. When we consider the challenges of the 21st century, we can’t help but ask why haven’t more business owners sought advice, guidance and external input into their business?

Our frustration has only risen over the years when, we can see through our bi-annual Future Ready analyses, that those practices who engage with a coach etc on a regular basis, are achieving a higher level of profitability when compared to those who don’t.

Observation 4

As shown in the table, financial planning practices have not been very adept at putting in place plans for their own business. In much the same way as the plumber with a leaking tap at home, financial planners don’t plan very well for their own business.

While this trend has remained a major disappointment for us over the years, it has reached ‘alarm bell’ status in our view – the marketplace is simply too challenging to navigate without clearly thought out, documented and actionable business plans.

Observation 5

It’s perhaps the ultimate irony that we’ve seen no real progress in the area of succession or transition planning over the years. The % of practices with an effective plan in place, has continued to lag behind the owner’s advancing years – so much so that we believe that we’ve reached a critical point.

The fact that succession planning can be difficult, challenging and even daunting does not excuse owners from proactively taking control of their transition planning. If they don’t plan, they will remain vulnerable to the vagaries of the market and exposed to the real possibility of an increasing number of practices coming onto the market, a shortage of potential buyers and (surprise, surprise) reduced valuations.

Observation 6

The accumulator demographic which has comprised the major portion of the client base for most practices has obviously aged and has seemingly not been supplemented by a younger base. Clients aged 60+ now make up 55% of the clientele – significantly higher than the 38% stat of 2001. They have stayed and they have greyed. And they don’t have the same needs as they once did.

Tips for practice owners

- Treat the practice as the very valuable asset it truly is. And pay it the respect it now demands by putting on the ‘business owner’ hat and answering the big questions currently in play:

- What is my desired end game?

- Can I be flexible and open to new ideas, concepts and approaches to business?

- Measure the key lead and lag indicators, benchmark against best practice with a focus on ‘profitability’ and not revenue.

- Is my level of profitability (remembering the industry average is around 28%) sustainable into the future? Does it represent a fair and reasonable return for the investment I’m making – not just in terms of money, but also in terms of time, people and community?

- Are there any key people (or client) dependency issues which you need to get on top of – before it’s too late?

- Determine your plans for the next 1 and 3 years, commit them to writing, stress test them to ensure they’re realistic and achievable and – JUST DO IT!

- Plan for your succession/transition before you have to. Document your plan, identify potential successor/s and satisfy yourself that funding will be available. And if your plan is to sell or merge, make sure your business is in the best possible shape it can be before you take it to the market.

- Enlist external input:

- Appoint a business coach – someone you respect, will listen to and who can help you implement your plans. Pre-requisite – a documented plan for your business.

- Consider joining a peer group to listen to, as well as share and collaborate.

- Keep abreast of the latest industry happenings, trends and developments

- As an AR you are effectively outsourcing some of your requirements to a third party, being your licensee. Are you satisfied that you are receiving value for the fees you’re paying? A question that should be revisited regularly.

- Satisfy yourself that your service offer continues to meet the changing needs of your client base. Outsourcing, strategic alliances and ramping up your internal capabilities are all options for consideration.

- Get to know your clients’ children, before they fire you when mum or dad passes. Research has continually shown that this will the most likely outcome, unless the adviser gets on the front foot before it’s too late. The key to the inheritance door, could well be – education.

- How’s your sales and marketing capability? For many of the reasons alluded to in the above, attracting new clients will be important for most practices over the course of this decade. Will your website, social media presence, CVP and all round profile stand up to the scrutiny of a new prospect, who is used to transacting with tech savvy organisations like Uber, Instagram, Trip Advisor and WhatsApp? Does your CRM hold all of the information needed to allow you to develop and maintain meaningful client relationships? Do you know the names of the other professionals your “A” clients utilise – lawyer, broker and accountant for example.

- As the business of financial planning has become more complex over the years, employing more staff and grappling with seemingly everchanging regulation we’ve noted the role of ‘Practice Manager’ gain in prominence. Perhaps not surprising with practices of $1M+ revenue on average employing 10 staff, while $3M+ revenue practices employ 18.5 people (including advisers). The role is already delivering tangible benefits to the business in terms of managing people, systems, reporting and that most valuable of resources, time. We suspect that, over the next few years, their influence and impact will continue to grow.

Business Health is an independent organisation specialising in customised advice and solutions to the financial services industry…

So basically more revenue and less work. Did I miss anything?

Comments are closed.