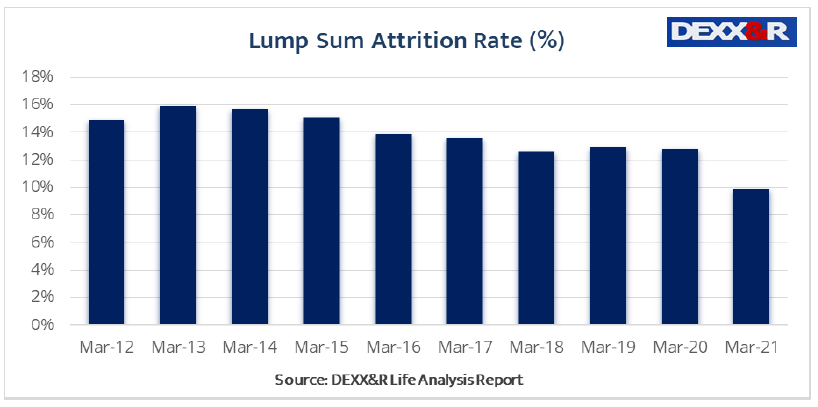

Individual discontinuance rates continue their march south, with latest data from DEXX&R reporting both individual lump sum and disability continuances have fallen below 10% – but this trend equally applies to IP new business.

The research firm’s Life Analysis Report for the year ending March 2021 documents individual lump sum discontinuances at 9.9% (down from 10.1% in the year to December 2020), while individual disability income discontinuances have fallen to a low of 8.8%, down from what was already a 10-year low of 9.1% in the year to December 2020 (see: Risk New Business Sales Recover).

This further reduction in individual discontinuance rates reinforces DEXX&R’s message that this low level of discontinuances indicates that clients are retaining their existing policies at a higher rate than has been the case over the past ten years – especially for individual IP contracts.

Individual risk new business

Meanwhile, individual lump sum new business sales – while higher in the March 2021 quarter compared with the same quarter a year ago – were still down by a little over 1% for the year ending March 2021. DEXX&R says this is the third consecutive yearly decline in individual lump sum new business since March 2018.

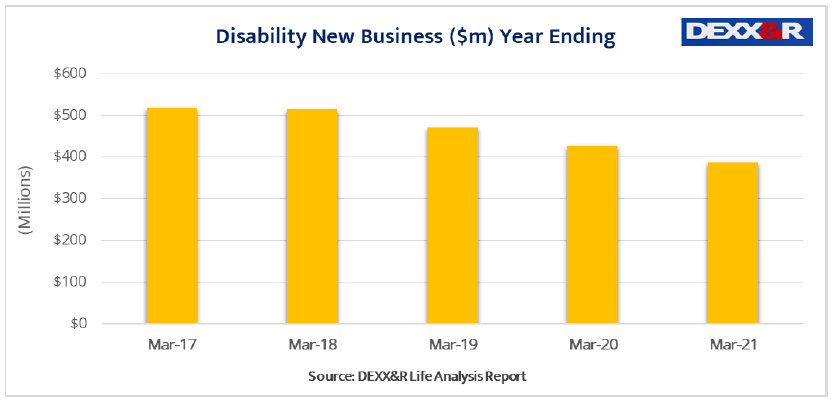

While individual lump sum new business has remained relatively static in the year to March 2021, the same cannot be said for new individual IP business, which saw a decrease of 9.4% in the year ending March 2021. DEXX&R notes this significant decline in individual income protection new business sales represents a 10-year low.

It attributes the IP sales decline to the impact of the Covid-19 pandemic, and also to disruption in advice channels and APRA’s mandated product intervention measures, which came into effect at the end of March 2020.

So how about the number of lives insured? In-force premiums? How much of that new business is churn?

no such thing as churn….client best interest…. But you would know this if you are actually an adviser

What is worrying is that you didn’t dispute that a very large portion of new business is “clients best interest” (which also means getting upfront commissions – again – what a delightful coincidence).

The industry is the worst game of pass the parcel ever.

doesnt even make sense ….. what is your argument? Should we work for free should we? there is a need for insurance specialists even if you dont believe we add any value. My clients refer a lot of friends and family so we must be doing something right. If they had to deal with insurers on their own, they would be chewed up and spat out. good luck getting a straight answer

People once navigated around the country using a UBD Street Directory. It was a pretty good business model for UBD and while a street directory is not completely useless, it has been usurped by a superior offering – Google Maps. I’m sure people would manage insurance companies just fine given the right offering.

But my point is that the current business model is killing the industry. The entire supply chain is working against each other – advisers moving business for “BID”, adviser reliance on rating agencies that punish insurers for not offering some obscure benefit, insurers against advisers with LIF, insurers raising rates because they are coerced in to offering unprofitable products to gain marketshare. Each stakeholder is just trying to keep their head above water but in doing so each stakeholder is dragging the others under water. It’s not sustainable and everyone is going to end up drowning.

But at the end of the day risk advisers, ratings agencies and the like are similar to pilot fish – fish that eat the parasites off the skin of the big fish. There is a symbiotic relationship between the pilot fish and the big fish but without the big fish the pilot fish would die. Similarly, without insurers, advisers have no products to sell and ratings agencies have no products to rate.

Solve the profitability problem and you restore the ecosystem to a healthy state. Perhaps slowing the rate of “BID”/churn or not relying on ratings agencies for product selection (which will lead to product simplification) will help. But perhaps it is like the Great Barrier Reef or the ice caps on this planet: it is already too late and the entire system is destined to collapse.

What we have is a perfect storm, where all the contributing factors are aligning to enable a temporary reduction to declining discontinuances, though this will not last, based on the current Business framework which has become unprofitable for everyone.

Advisers have worked tirelessly over the last 18 months to convince clients to keep their covers, or at least what they can afford, due to the never ending premium increases.

However, the cost to provide these services and to abide by the maze of the current LIF and FASEA requirements, is becoming too prohibitive for Advisers today and most Advisers are being forced to scope out risk advice, as clients will not pay for what it costs to abide by the wall of Best Interest Duty and client apathy, which has been the case from day one.

The Life Insurance Industry will be further impacted as more Risk specialists continue to exit the Industry and all the Financial Planners who will continue to NOT provide risk advice due to the current cost and complexity.

Comments are closed.