The Government’s Better Advice Bill, now introduced into Parliament, includes a new registration system for financial advisers which, according to the FPA, means registration is the personal responsibility of each financial adviser and is not connected with their employment or authorisation under an AFSL.

A statement from Senator Jane Hume, the Minister for Superannuation, Financial Services and the Digital Economy, says the Government is introducing further reforms to strengthen the financial advice sector and implement recommendation 2.10 of the Royal Commission into the Banking, Superannuation and Financial Services Industry.

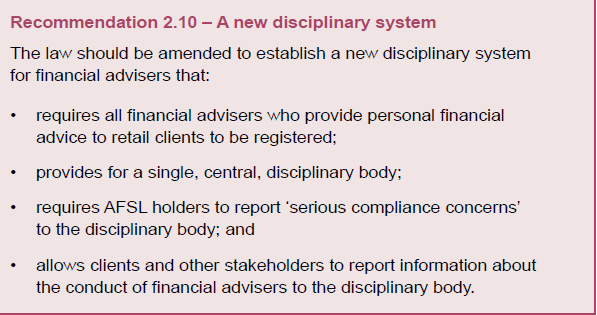

That Recommendation proposed the establishment of a single disciplinary body for financial advisers and that all financial advisers who provide personal financial advice to retail clients be registered.

The Minister’s statement says that the Financial Sector Reform (Hayne Royal Commission Response – Better Advice) Bill 2021 will:

- Expand the role of the Financial Services and Credit Panel within ASIC to operate as the single disciplinary body for financial advisers to ensure that less serious misconduct does not go unaddressed

- Create additional penalties and sanctions for financial advisers who have breached their obligations under the Corporations Act, reflecting that the current set of sanctions are limited to banning a financial adviser

- Introduce a new registration system for financial advisers to improve the accountability and transparency of the financial services sector

- Transfer functions from FASEA to the Minister responsible for administering the Corporations Act and to ASIC to streamline the regulation of financial advisers

The statement adds that in line with an announcement made in December 2020, FASEA will be wound up and its standard‑making functions moved to be the responsibility of the Treasurer, supported by Treasury. ASIC will be responsible for administration of the adviser exam.

Cut-off Date to Pass FASEA Exam

The Bill will also give the Minister the power to extend the cut‑off date for certain existing financial advisers to pass the exam. Hume say the Government will use the power to extend the cut‑off date to 30 September 2022 for advisers who have attempted the exam twice prior to 1 January 2022 (also see: Limited Extension to FASEA Exam Requirements Announced).

“These reforms will further streamline the number of bodies involved in the oversight of financial advisers, delivering improvements to the regulatory framework for the sector and enhanced access to affordable and quality financial advice for Australians,” the statement concludes.

Individual Personal Registration

Meanwhile, the FPA has welcomed the Government supporting an individual personal registration system for financial advisers.

“The Single Disciplinary Body for Financial Planners is an important reform for the profession. Creating a model that requires financial planners to individually register annually with the disciplinary body from 2023 is an important part of the journey to individual professional accountability,” says FPA CEO Dante De Gori, in a statement.

“The FPA strongly supports a model in which registration is the personal responsibility of each financial planner and is not connected with their employment or authorisation under an AFSL. This was a key recommendation in its submission in May to the Treasury’s consultation on Single Disciplinary Body for Financial Advisers,” the statement notes.

The association adds that the current model, which will come into effect from 1 January 2022, makes the registration of a financial planner the responsibility of their AFSL in year one until the financial adviser register is transferred from ASIC to the ATO in 2023.

The AFA Pleased with Exam Extension

Phil Anderson, the AFA’s Acting CEO and General Manager Policy and Professionalism, told Riskinfo that the association was pleased that there will be an extension for those advisers who are struggling with the exam.

He says the association had recently requested the Government to consider a six month grace period for those advisers who had not passed the exam by the end of this year, so that they had time to sell their business or otherwise exit without the need for a fire sale.

“This extension will allow those advisers to focus upon passing the exam this year, without being too focussed on what the consequences are if they are unable to pass.”

He adds the AFA is aware that it will only apply to a limited number of advisers and those who have not yet attempted the exam are unlikely to benefit. “Unless they have applied for the June exam, they will not be able to complete the two attempts before the end of this year.”

Anderson also noted the association was comfortable with the outcome with adviser registration with ASIC, “…where this will be done by the licensee on a once off basis to start with, before moving to an annual requirement for individual advisers at some point, maybe four years down the track.”

I wonder why the AFA is silent on individual registration. Do they have a problem with it and, if yes, what is the problem?

When it comes to new requirements, I fear there will be intended and unintended consequences.

The current maze of Legislation, Regulatory requirements and Legal interpretation that enables Lawyers to charge eye watering fees to disseminate the grey areas, whereby if you ask 10 of them to come up with a solution, there will be 10 different answers, does not bode well for Individual Advisers who are caught in a vice of full responsibility for a set of rules no-one understands.

However, everyone in Legal Land has an opinion and charges outrageous fees for Advice that can be overuled, which leaves Advisers in no mans land, with their Assets at risk, in a system where it seems the lunatics are running the Asylum, charging fees with NIL guarantees, yet still insisting that the Adviser abides by illegible Legalese and an inability to defend themselves due to the web of impossible wordings designed to trap everyone, except the Lawyers who always win, no matter the outcome.

This is a Merry go round that never ends and the gravy train for Lawyers will continue at all our expense with NIL positive outcome for Australia and all Australians, unless there is a simple set of rules that everyone understands and can abide by.

Anyone would think that they are trying to get rid of the adviser distribution chanel. By making the rules suitably vague they can then easily charge the advisers with a breach that is impossible to defend.

On the same theme is the public relations assault against advisers. When an adviser is banned by ASIC its headline news. I can’t remember ever seeing a blaring headline when an accountant/lawyer/RE agent/doctor is banned from their industry for a serious breach. This is easy to prove and should be useful for a class action in the future

Comments are closed.