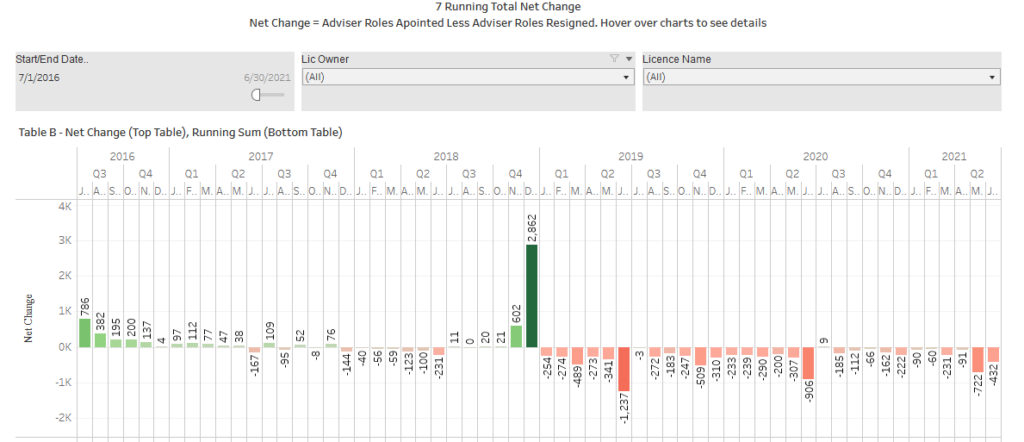

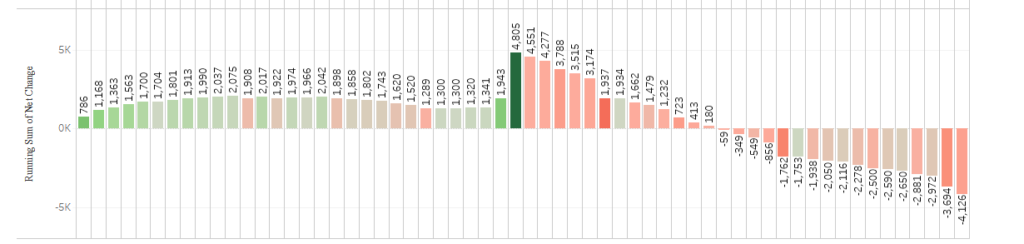

Weekly financial adviser movement, coinciding with the end of the financial year, saw a net loss of 549 adviser roles from the ASIC Financial Adviser Register, according to Wealth Data.

The firm’s weekly report on financial adviser movement to July 1, 2021 saw adviser roles moving from a total of 19,894 to 19,345, however the number of actual advisers dropped from 19,631 to 19,082.

But Wealth Data’s Colin Williams urged caution around the numbers.

He wrote in his weekly report that this week was “much anticipated as it coincided with the end of the financial year which is traditionally the most volatile in terms of adviser movement.”

He stressed that the data released on July 1 by ASIC closed off overnight on June 30 “and is unlikely to have captured all the movement” noting that licensees have up to 30 days to report adviser movement and that the last few days had been busy for many licensees.

“Add in the lockdowns around the country which can be disruptive, we have probably not seen the full June 30th impact. Having said all that, the numbers do highlight what was anticipated with a major reduction in the number of advisers.”

Other key highlights for the week that Williams pointed to included:

- Losses for the week were dominated by large groups with National Tax & Accountants Association (NTAA) which runs SMSF Adviser Network losing (-91), a gap to IOOF at (-45) followed by Easton Group (-32), AMP (-30) and Synchron (-27)

- A total of 137 licensee owners had net losses for a total (-581) advisers

- 24 licensees owners had growth for a total of 32 roles

- 19 Licensees closed (zero advisers) for a total of (-51) adviser losses

Williams also highlights that for the financial year, a total of (-2,364) roles have been lost or (-10.89 percent).

…this is traditionally a time of year that many advisers decide to call it quits…

Asked about the large decrease coinciding with the end of the financial year, Williams told Riskinfo that this is traditionally a time of year that many advisers decide to call it quits. “Most resignations require a bit of planning and we often see June 30 as a good time to move on.”

But he said that this year is a bit different, with the FASEA exam hanging over many advisers “and that would have caused a few to call it a day early as opposed to working through to the end of this year.”

Williams says that a big issue that has emerged is the increased levies from ASIC – “as I understand things, the ASIC fees have increased and the number of advisers have decreased, this means the fee per adviser has gone up dramatically (see: AFA Slams ASIC Fund Levy Increase.)

“This fee is paid by licensees but I guess it needs to be recouped in one form or another from the advisers.”

He added that what he has seen happening for most of this year is that those advisers who provide advice on a ‘part time’ basis, such as accountants who provide a limited form of SMSF advice, “have come to the conclusion that the cost of providing advice along with the time taken to pass exams etc, has made providing advice too costly so now is as good a time to finish up.”

Williams noted that he is expecting a bit of a bounce back from some advisers who left the more traditional advice groups as they bow out of one licensee to go to another “and/or start up their own self licensee which has become very popular. Again, closing out in one financial year and starting in a new year makes sense.”

He noted that with the data cut off at June 30, any bounce back will start coming through from this week. “I think any bounce would be a ‘dead cat bounce’. The FASEA exam issue will now only get more concentrated as the year progresses and I expect more advisers to move out of advice with a big drop off at the end of the year, despite some recent changes allowing some advisers to resit the exam next year.”

And here’s something else to chew on while you’re absorbing these numbers folks. Three people allegedly also committed suicide in the last week as a result of this situation the Government, FASEA and ASIC have created for advisers.

Furthermore, ASIC with all its care and support of this industry chose to slam my Licensee with a huge random adviser ‘advice document’ audit TWO WEEKS BEFORE THE END OF THE FINANCIAL! Instead of helping my clients and studying for the FASEA Exam, I’ve spent days and days compiling this information for this wretched organisation.

That’s how much ASIC cares about advisers and consumers who were probably relying on their advisers to help them complete their insurance cover applications before the EOFY so they could get their tax deductions but instead, were forced to drop everything to satisfy ASIC’s off the cuff demands. ASIC is nothing but an incredibly mean-spirited, bitter and cruel regulator who have no regard for the members within its scope.

Comments are closed.