Specialist actuarial services firm, Retender, has released a paper which considers the sometimes opposing forces of regulatory reform and competition within Australia’s insurance and superannuation sectors.

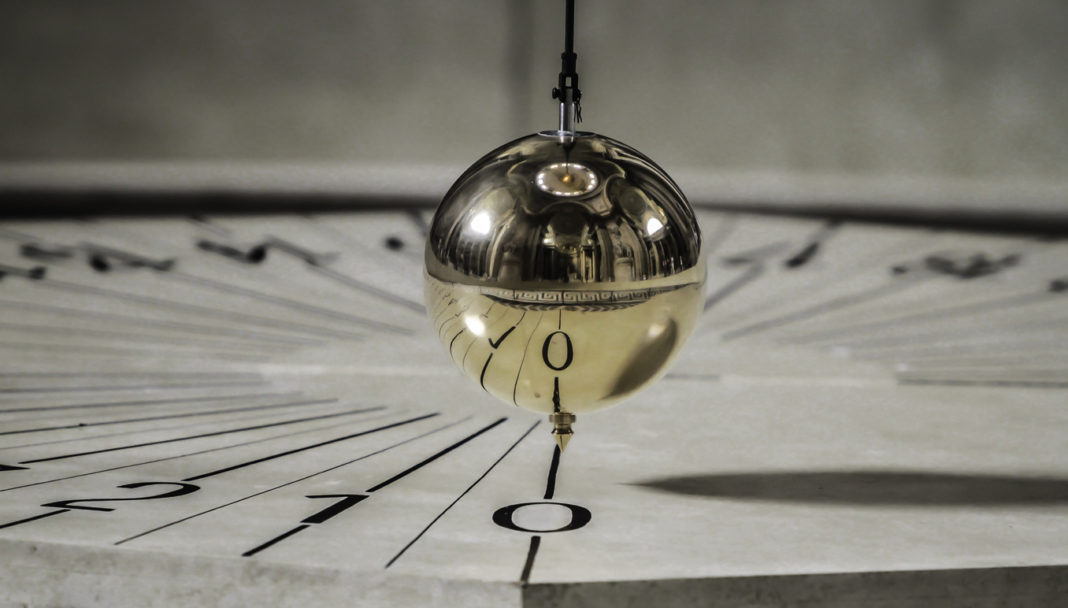

In concluding that the pendulum may have swung too far in the direction of regulatory reform in recent times, the paper reflects on circumstances past, present and future in offering a simple solution – a first step – in how the law-makers can address the conflict between stability and competition for the benefit of all stakeholders…

The paper, called When the Music is Playing, You Have to Keep Dancing, commences by referencing conventional thinking that there is usually an invisible hand at play that brings markets into equilibrium:

…there are certain situations where the market cannot be relied on

This thinking was behind the concept of laissez-faire, the favoured policy in the lead up to the 2007-2008 financial crisis whereby governments should interfere as little as possible in the workings of the free market and rely on the market to self-correct. What’s clear in hindsight, and a lesson that repeats itself over time, is that there are certain situations where the market cannot be relied on, where the laws of competition and rational choices don’t behave the way that simplified economic or actuarial models predict.

Drawing on the analogy of music and dancing, the paper argues that when the music stops, things can become complicated, but as long as the music is playing, there’s a need to keep dancing. This is the picture that is painted in describing how insurers and reinsurers, despite having to continually set aside billions of dollars in reserves which impacted returns year after year, continued to write loss-making products until APRA’s IP intervention emerged as a circuit-breaker.

In doing so, however, the paper asks whether the pendulum of government policy has swung too far in the direction of regulatory intervention.

The solution to the conflict between stability and competition

The paper asserts the unintended consequence of having the competition pendulum swing too far to the side of regulatory intervention is the cost which is ultimately imposed on consumers when both supply and competition is reduced.

The paper calls for a solution to what it considers the imbalance between free market forces and regulatory reform currently impacting both the life insurance and superannuation sectors:

This paper calls for an annual report for government that measures the levels of competition

This paper calls for an annual report for government that measures the levels of competition in these two industries, as a way to transparently reflect how the objectives of prudential stability and competition are being balanced in practice

Why were they dancing?

Drilling deeper into cause and effect – and what sometimes might be considered illogical behaviour or decisions, the paper endeavours to articulate a rationale that has seen the life insurance companies continuing to write loss making insurance business – to keep on dancing – while all the profitability and sustainability warning signs were obvious. The answer rests, at least in part, with the implications associated with first-mover status:

…the one who did nothing would end up stealing the other’s customers

To give a simplified example, consider two organisations faced with the following choices in respect of a loss-making product:

- If they both took action and repriced the loss-making product, they would both stand to increase their profits by $5m;

- If one took action and the other didn’t, the one who did nothing would end up stealing the other’s customers (gaining market share and ability to reprice) giving the former$10m and the latter $0; and

- If both didn’t take action, both would carry on losing $5m each on those products.

Correctly pointing out that each competitor needs to make its own independent decisions to avoid collusion, the paper says uncertainty as to what their competitors will do to address such profitability and sustainability issues can lead to irrationality in decision-making, despite the eventual result of those decisions, such as further discounting of first-year IP premiums, being a worse market outcome for everyone.

Called the prisoner’s dilemma, the paper argues this first-mover problem goes some way towards helping explain why, in the end, no individual insurer acted.

Consolidation, market share and size

The make-up of the Australian life insurance and superannuation sectors also comes under the microscope in the paper.

Focussing on the life insurance sector, the paper notes a rule of thumb is that an oligopoly exists when the top five firms account for more than 60% of total market sales. It says that in the life insurance space (once BT’s insurance arm has been absorbed by TAL) the top five insurers will account for more than 85% of the market share.

…too much consolidation may ultimately impact product choice and flexibility

It argues, though, that too much consolidation may ultimately impact product choice and flexibility for consumers:

The reviewable nature of Australian life insurance means that the limited practical ability to change providers can lock certain consumers into having no choice but to either accept the increases in price or reduce their cover levels to balance affordability. If consumers become captive in this way, and do not have the power to exercise choice themselves because of the nature of life insurance risk, then it is all the more important that competition is nurtured and flourishes at an institutional level to drive optimal consumer outcomes.

The following extract of a table included in the paper summarises the life insurance market consolidation over the last two decades:

Balancing the pendulum

The paper says that if the insurance market itself cannot be relied on to self-correct its sustainability issues, there may only be two government intervention options available to address what it refers to as the hot potato, namely APRA and the ACCC – but that neither of which would act, because of their respective agendas, to balance the pendulum:

Ideally owning the challenge is APRA but there is a conflict between prudential stability and competition. Its purpose statement is to ‘balance the objectives of financial safety and efficiency, competition, contestability and competitive neutrality and, in balancing these objectives, is to promote financial system stability in Australia.’ Competition is secondary to prudential stability, not the other way around. So, APRA do not own the government role for ensuring competition.

The ACCC is the other body but whose involvement in this particular space appears to be primarily related to sizeable merger assessments rather than through ongoing engagement with industry. Their role states that ‘We focus on taking action that most promotes the proper functioning of Australian markets, protects competition, improves consumer welfare and stops conduct that is anti-competitive or harmful to consumers.’ Here, prudential stability is ignored which would potentially pendulum the problem too far away from balance.

The beginning of the answer

To balance these two differing sets of guiding principles, Retender advocates what it says is a simple proposal to take a first step towards a better outcome for consumers.

Arguing that ‘what gets measured gets done’, Retender proposes that government request an annual report, ideally from APRA, that sets out how competition is being considered in the insurance and superannuation industries on an annual basis.

In making this call, Retender references a precedent for such reporting that is undertaken by the Prudential Regulation Authority in the UK, in which a number of areas are considered, including the extent to which different-size firms exist within the sector and the benefits to competition of having a scaled range of institutions successfully operating within it:

This thinking is critical to ensuring that innovation can take place, where a one size fits all approach which can only be implemented for the scale players isn’t allowed to become standard.

The Retender paper concludes that an annual report for government will take that first step to transparently reflect how the objectives of prudential stability and competition are being balanced in practice to seek the best outcomes for consumers.

Click here to access the full Retender paper: When the Music is Playing, You Have to Keep Dancing.

The author of this paper is Retender Managing Director, Ilan Leas.

Ilan has written a variety of articles and presented at a number of conferences (including ASFA, FSC, AIST and the Actuaries Institute) on members reasonable expectations, the group risk market, longevity, reinsurance and the future of life insurance.

Where Government entities and Regulators appear to have, or could be interpreted as having an overlap in their purpose and required tasks, this always leads to confusion.

If they all fall back on Regulatory requirements and interpretation of those requirements, we all end up on a merry go round to a no solution destination.

There is very much a disconnect between Regulatory ambition and REAL WORLD impacts on decisions being made on behalf of consumers.

If we look at the Life Insurance Industry, it has been an unmitigated disaster, where purported Government goals of affordable advice and premiums, has in actual fact, had the opposite effect, with 9,000 Advisers having exited the Industry and now less than 2,000 risk specialists in Australia, due to the maze of unworkable restrictions of trade that must not have been included as a priority in discussions prior to the new regime being enacted.

It is not good enough for theorists to dominate discussions and directions on the future of an Industry and ignore the very people who will be impacted.

Who are these people who have been negatively impacted?

The answer is, all Australians, except for the vested interest and Lobby groups who convinced the Government and Business to pay them multi Billions of dollars to restructure and as it turned out, destroy thousands of hard working, honest Advisers and practices, then deny millions of Australians the opportunity to attain Advice, security and peace of mind.

What was obviously not built into the thousands of calculations, was the continual warnings from Advisers that they have had enough and will leave the Industry unless the Government backed off with unworkable and unwieldly requirements.

So what we have today, is a simple choice and I agree that annual reporting is a good idea, though a better idea would be to start listening to Advice practitioners with decades of experience and ask them a simple question.

“what will it take for you to stay in the Industry and grow it again so every participant can benefit?

“When the music is playing, you have to keep dancing” should read “Don’t be the person that doesn’t realise the party is over and hangs around after everyone has left while the host just wants to go to bed.”

Comments are closed.