Nearly 900 financial advisers have qualified for the 30 September 2022 extension to pass the financial adviser exam.

This statistic was highlighted by the AFA in its latest policy update for members which points to questions asked of ASIC by Queensland Nationals Senator Susan McDonald following the February 2022 Senate Estimates hearing.

ASIC’s answers included the fact that 882 financial advisers have qualified for the exam extension, which is for those advisers who had attempted the exam at least twice before the end of 2021.

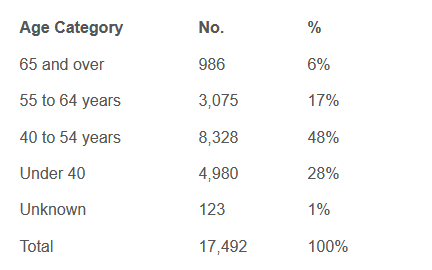

The AFA also notes that amongst the answers to Senator McDonald’s questions, ASIC provided a split of advisers by age demographic as of 24 February 2022, “…which shows a good spread of ages, inclusive of nearly 1,000 advisers over the age of 65.”

The breakdown of advisers’ ages shows that the largest cohort, 8,328 or 48 percent, are in the 40-to-54 year age group with the next biggest group being those under 40, totalling 4,980 or 28 percent of advisers.

The AFA update included the following table:

“ASIC has also stated they are currently undertaking a review of the Financial Adviser Register to ensure that all advisers who had not passed the exam by 31 December 2021 and did not qualify for the extension until 30 September 2022, have been updated to reflect a “ceased” status,” says AFA.

“ASIC has also stated they are currently undertaking a review of the Financial Adviser Register to ensure that all advisers who had not passed the exam by 31 December 2021 and did not qualify for the extension until 30 September 2022, have been updated to reflect a “ceased” status,” says AFA.

“ASIC has suggested that this review might lead to a further reduction in adviser numbers on the FAR,” it notes.

Hmmm, isn’t this interesting! So, the 900 will give it one more go to make sure they can see it through to 2026 and then they’re out at -0 or before – that time. I suspect the majority of risk writers that did the so-called ‘exam’ prior 31st Dec’21 will make the same call prior 2026. How can they do otherwise, honestly? 60/20 commission that doesn’t even meet the cost of doing business, 2 (TWO!) year responsibility period for remuneration honestly and fairly hard-earned and spent on the business and can be whipped back AFTER being spent. Last but NOT least the ridiculous compliance time/sanity wasting regime all advisers and clients must endure ONLY to keep taxpayer funded politicians happy and electable. Truly, if anybody believes Liberal OR Labor will sprinkle fairy dust and make all right in the world of our industry after the election they are dangerously and sadly mistaken. Liberals would have done it by now if they meant it and was important to them and Labor, well . . . Labor, I shouldn’t have to tell you about duplicity, should I?

The sad reality is that risk specialists have declined dramatically and most holistic advisers who dabble in Insurance, have cut back and are in client preservation mode, as a disgruntled Insurance client who is also an Investment client, will question the fees and service across the board if the Adviser does not help them with their massive premium increases, by coming up with a solution.

There has been a temporary reprieve for Life Companies who have used the premium increase strategy to bolster their revenues, which will fail in the long term as more and more people cancel their policies and with less Advisers to educate them about the reasons why they should maintain cover and with around 50% of the Insurers revenue coming from clients aged 50 and older, this also is a ticking time bomb as the older clients stop paying their Insurance premiums.

With an Insurable population of 12 million that needs Life Insurance advice, plus over 1 million Business owners, 50,000 Life risk Advisers would be needed to service their needs with 260 clients per Adviser.

What we have today, is a rapidly declining Adviser pool and no incentives for new Advisers to specialise in risk.

If Australia wants a viable and thriving Life Insurance Industry that can provide good quality policies at reasonable prices, then making it attractive with less road blocks to enter, is the only way forward.

Separating risk advice from Investment advice is the most important first step.

Comments are closed.