The advice sector continues to debate the future of risk commissions on two fronts. Firstly, will risk commissions be given a reprieve following the outcome of the 2022 Quality of Advice Review? And if commissions are retained, will it all be for nothing if the current 60/20 cap means many or most risk specialist businesses will prove to be unsustainable…

- Disagree (70%)

- Agree (23%)

- Not sure (7%)

A 60/20 commission model remains a bridge too far for most advisers when it comes to sustaining a viable business proposition – but it seems some advisers are reconsidering this question.

As we go to print with the results of our latest poll, around two in three advisers (65%) say the current 60/20 commission model isn’t enough to sustain a viable risk-focussed advice business, while 27% say the 60/20 model will work, and 8% are undecided.

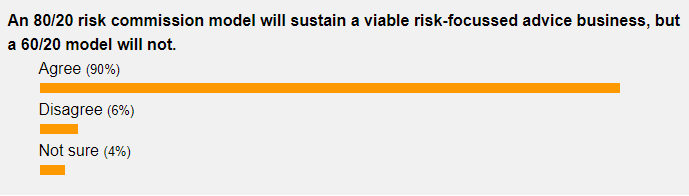

While the majority opinion rests in those who say the 60/20 model isn’t commercial, we note the 27% who say it is, especially when compared with only 6% of advisers when responding to a very similar question in early 2021:

While we appreciate this February 2021 poll asks a slightly different question, the result so far in our latest poll tends to support the possibility that more risk-focussed advisers may be finding a way to streamline and structure their business proposition under the present 60/20 commission caps brought in with the Life Insurance Framework reforms.

While we appreciate this February 2021 poll asks a slightly different question, the result so far in our latest poll tends to support the possibility that more risk-focussed advisers may be finding a way to streamline and structure their business proposition under the present 60/20 commission caps brought in with the Life Insurance Framework reforms.

That said, the prevailing view is articulated well by regular contributor, Jeremy Wright, who comments that the question of what is a reasonable commission to make it feasible for advice practices to provide best interest duty advice, comes down to two simple points, namely cost and risk. He says that in the current climate:

…60/20 is not enough and if 80/20 becomes the new benchmark, that will help alleviate the COST part of the equation

“…60/20 is not enough and if 80/20 becomes the new benchmark, that will help alleviate the COST part of the equation, though does not help with the RISKS, whether real or perceived.”

The risks to which Wright refers relate to regulatory risks for advisers being the big ‘unknown’, but he seems to still represent the majority view of the adviser community in advocating that 80/20 works in a commercial sense, whereas 60/20 does not.

Where do you stand on this question? And has your view changed at all over time? Tell us what you think as our poll remains open for another week…

One issue is whether this point is getting through to the Life companies. Brett Clark from TAL, and more recently, Simon Swanson from Clearview, are pushing forward with the idea that 60/20 is enough and/or we need to give it a chance. I would ask that anyone from those insurers reading this, please make it clear to both CEO’s that they are indeed wrong! Provide them with the results of this survey. The insurers must get the message – commissions must be increased to at least 80/20. if not, it’s just another nail in the coffin for the specialist life adviser.

Given that nobody in this industry gets paid until a premium is paid, I wonder if Bret Clark and Simon Swanson would be willing to have a 2 year responsibility period on their weekly pay packets? Then, when any business comes off the books, EVERYONE who received payment from that would have it charged back – NOT JUST the advisers! Why is this not so?! Of course, this goes for everybody in a life company. NOBODY gets paid until an adviser brings in a premium paying client. Did Bret and Simon get a pay cut when commissions went down to 60/20?!

I broadly agree with the statement made by Jeremy Wright. He’s correct in saying, too, that it is only one part of the whole fix. I wonder, though, how the new IP contracts and their assumedly ‘lower’ premiums will impact commissions. Sure, client best interest dictates that the lower premiums should be the priority along with value for money but commissions are based on premium. perhaps, IF the new style policies have lower premiums then perhaps a jump abck up to 80/20 may simply see us stay where we are now, commission-wise in real terms. I don’t know – what do others think on this particular point? One thing I DO know for sure is that IF commissions stay at 60/20 with the new lower premiums then the risk industry advisers – pure riskies – will sadly cease to exist by 2026. Even with higher current premiums, at 60/20 it is a struggle that most will relinquish soon.

Comments are closed.