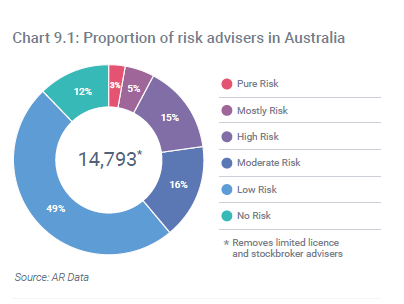

There are now only approximately 1,200 risk specialist advisers in Australia, according to the Adviser Ratings’ Landscape Report.

The comprehensive, 230 page report says the 2021 year closed a with further 609 specialist risk advisers (pure risk or mostly risk) leaving, and at a rate of almost 2.5 times greater than their non-risk counterparts, leaving a high proportion of orphaned clients.

“To further complicate the exits, some holistic advisers are choosing to remove risk advice altogether due to the cost, complexity, and compliance,” it says.

The Adviser Ratings’ Landscape Report, which illustrates how the changing nature of wealth management has impacted financial advice, funds management and consumers, is based on six research projects undertaken across five months and involving more than 40,000 surveys of financial advisers and consumers.

The Adviser Ratings’ Landscape Report, which illustrates how the changing nature of wealth management has impacted financial advice, funds management and consumers, is based on six research projects undertaken across five months and involving more than 40,000 surveys of financial advisers and consumers.

A statement from the firm says other key findings include:

- 100,000 either ceased receiving advice or were orphaned by their adviser, as advice affordability became more of a concern

- There are 5.6m unadvised Australians looking for professional advice, with five percent of consumers indicating they get all their advice from social media

- The average median cost of advice has increased a further eight percent to $3,256

- 234 licences were discontinued in 2021 – the largest number since tracking began in 2015

- There has been a 50 percent increase in the past four years of advisers partnering with super funds, as super funds become the next frontier for consumers looking for affordable advice.

The firm says that with it predicting the departure of a further 2,387 advisers from the industry in 2022, the cost of advice and the number of orphaned clients look set to grow.

Adviser Ratings CEO, Angus Woods says the advice industry has been in a state of flux for a number of years, “…and we continue to see that change today.”

“Through our research we go deep inside the evolution of advice and funds management. We look at how it is responding to consumer needs and analyse the penetration and sentiment towards the technology that underpins the industry.”

There are 100,000 fewer customers of financial advice today and 3,323 fewer advisers compared to 12 months ago, with the median cost for advice increasing another eight per cent, to $3,256.

“This has coincided with a general improvement on the standard advice, with the Adviser Ratings Adviser Quality Score (AQS) increasing from 678 at the end of 2018 to 707 at the end of March 2022, based on a score out of 1,200.”

Adviser Ratings says that to service clients more effectively and efficiently, research indicates that financial advisers intend on using investment platforms more in 2022.

Woods says the advice and wealth management industries continue to evolve and the impacts across the board, from product providers through to consumers, is significant.

“Our research asks many questions on how Australians will receive advice in the future, and who will advise them. There is more change to come,” he says.

So the Clients of Low Risk and No Risk, where do they go for advice? Seems like a lot of Financial Planners are not acting in “The Best Interests of their Clients”

I don’t know where they go Damian – but as one of the handful of ‘Pure Risk’ advisers left, I’m happy to help them out!

One of the biggest FP Firms here in Mackay sold their Risk Book to another Firm in Brisbane, go figure

The absolute tragedy about the mass exodus of specialist risk Advisers, is it was totally avoidable.

Based on 12 million Adults and 1 million Businesses that would need Life and Disability cover in Australia today, we would need 25,000 specialist risk advisers to look after 40 Business clients and 480 personal clients each.

1,200 Advisers would need to look after 833 Business clients and 10,000 personal clients each.

Houston, we have a problem.

It is blindingly obvious that there is a huge market, yet the Regulators and Government have killed off any incentive for Advisers to stay, let alone grow.

The solution is so simple and has been given many times and yet we still see a lack of support and we all still have to wait till the end of 2022 for a Quality of Advice report that well could be flawed, just like all the other reports we have been subjected to that failed the What, Why, How test.

Further to Jeremy Wright’s assertion, “Houston, we have a problem”, I concur strongly. I often wonder when the media, bless it’s little cotton socks, is going to expose precisely how much danger the life companies are in regarding their failure. By failure, I don’t only mean how they’ve failed to support clients and advisers (shafted advisers; 60/20, 2yr clawback) but I mean the bankruptcy and collapse of their business!

Can you imagine the sh*tstorm when the first life company goes under in 2028 due to lack of inflows with others following close behind? I wonder if the stupid self absorbed politicians responsible will be around to take the blame or in some way held to account. Not to mention the ‘quarterly profit-possessed’ life company CEOs who sat and did nothing, and still are, as advisers leave due to 60/20 and 2yr C/back. These two aspects have singularly brought about the death of so many small businesses, made then unsustainable to the point of collapse. Small businesses whose sole purpose was to protect Austrlians who couldn’t protect themselves in time of financial disadvantage or catastrophe.

How tone deaf are these creatures – the pollies and CEOs?! When is the media going to address this ‘baked into the cake’ scenario which is looming for 2026+? Will they wait until the 11th hour as it is about to happen after 2026 or will they get on the front foot NOW and investigate this like George Negus and Mike Munroe with a proper good ol’ journalistic ‘foot-in-the-door’ attitude to ‘ask a few pointed questions’? Life companies WILL collapse and clients WILL be at detriment. Any business follows this path without new income through the front door from the distribution channel.

It would be SO good to see our media chaps blazing an independent trail on this before it is too late. I can’t think of a more important story – the imminent collapse of Australian life companies. Show me how I’m wrong on this, please – I’m waiting for your call . . . 🙂

Comments are closed.