In unpacking the Quality of Advice Review, the AFA wants to start with a blue-sky perspective and look at how the industry can make a quantum leap in improving the regime in front of it, particularly in relation to re-engineering/improving the financial advice process and the servicing process.

At a member briefing AFA CEO Phil Anderson says one of the association’s key drivers is to look at this as an exercise in process re-engineering the financial advice process.

He says this calls for a detailed analysis of all the activities that need to take place and then an assessment as to whether each of those steps are adding value for the consumer outcome, or if they are simply non value-adding, unnecessary bureaucratic processes.

Also, he asked, what’s the opportunity for improvement?

He says the factfind part of the process is essential “…but how much can we do to improve that, how can we fundamentally change that? We want this review to be looking at this from a blue sky perspective.”

He asked, what if it was possible for a client to come into an office and press a button, with the client’s consent, and the adviser has all their factfind information in front of them.

“What if you had all of the facts to start with?” What if the adviser could then work through all the different scenarios with the client.

Anderson said advisers may ask how is this possible, technologically and from a regulatory sense, “…but that is why this exercise needs to look at how we can make a quantum leap in improving the regime that we have in front of us.”

Anderson told the briefing that AFA’s primary objectives from the review were to:

- Reduce complexity

- Reduce the cost of financial advice and the cost of running financial advice businesses

- Improve the client centricity in the advice and service processes

- Ensure that financial advice is a sustainable profession

He said the association appreciated that there is no single silver bullet and real change will only come with a comprehensive package of measures.

“We also need to appreciate that politicians will be reluctant, in the absence of clear evidence, to reduce consumer protections. Our goal is to get as many of the high priority initiatives across the line as possible.”

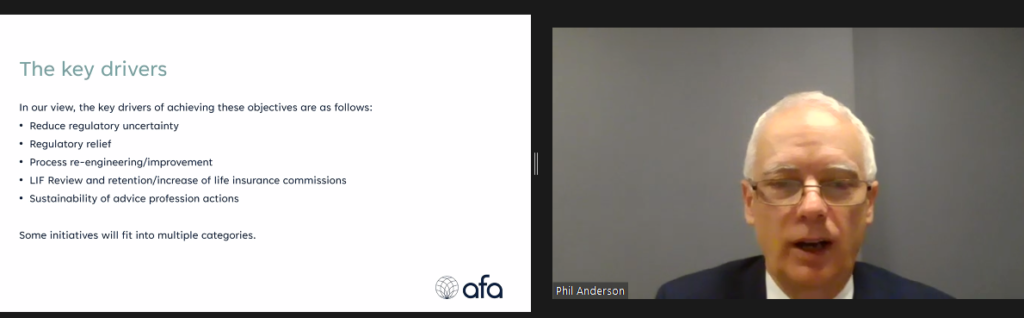

Anderson said in the AFA’s view the key drivers of achieving these objectives are:

- Reduce regulatory uncertainty

- Regulatory relief

- Process re-engineering/improvement

- LIF Review and retention/increase of life insurance commissions

- Sustainability of advice profession actions

He says some initiatives will fit into multiple categories.

Bearing in mind that the client is the driver and the vehicle is the way for the driver to get to their destination, then the question should be, “Do we ask the driver if they need or want to know how the engine works?”

The answer has always been right in front of us every time we start getting technical.

I actually had a client fall asleep when I started discussing the technical aspects of how Insurances work, which pretty much told me that what I thought was riveting, actually held little interest for my snoring client.

How much information a new client is prepared to give and how much they want to share at any point in time, depending on their circumstances and beliefs, will always be the unknown entity.

What the Regulators and the Government need to understand is that people have a limit to what they can or will do, what they are interested in and prepared to pay for and what their capacity is for change.

If a client wants a simple request for some Income Protection and enough Life Insurance to pay off all their debt, then telling them it is not that simple and that even though that is what you want, you cannot have it unless you pay thousands of dollars in fees and then be given multi page SOA’s that they do not understand, so everyone else is happy, this can leave a bad taste in the clients mouth, with the end result either the client walking away, or the Adviser saying we cannot help you.

Either way, the end result is totally negative for everyone and for Australia.

We need to ask the client and let them decide what they want to do, based on some alternative strategies, not the other way round.

Comments are closed.