ASIC has published its draft Cost Recovery Implementation Statement for 2021-22 which confirms the lower cost recovery levy put in place by the previous Government will remain for the current year.

A statement from ASIC says the draft CRIS outlines its estimated regulatory costs for 2021-22 and how it is proposed these will be recovered as levies under the industry funding model.

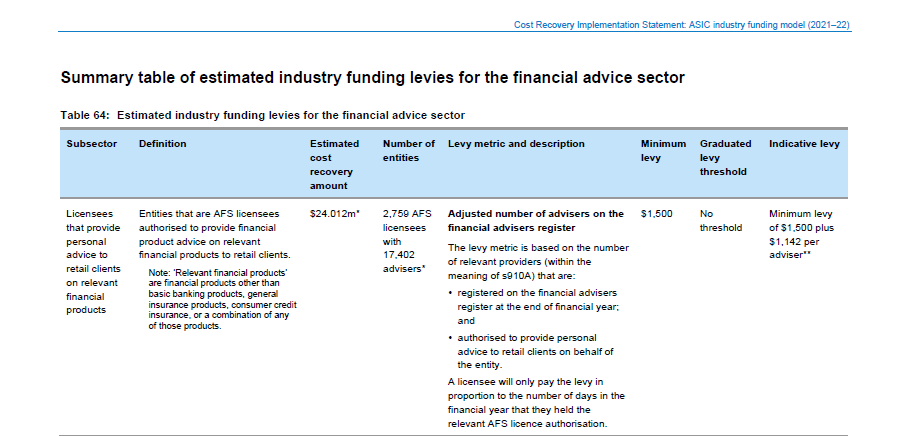

The summary table of estimated industry funding levies for the financial advice sector shows that the indicative levy for licensees that provide personal advice to retail clients on relevant financial products remains at a minimum levy of $1,500 plus $1,142 per adviser.

ASIC’s CRIS explains that in August 2021, the Government announced temporary relief for AFS licensees that provide personal advice to retail clients on relevant financial products (financial adviser levy relief).

“The relief restored the graduated component of the levy charged for this subsector to its 2018–19 level for two years (2020–21 and 2021–22).” (See: Win for Advisers on ASIC Levies.)

The summary table puts the estimated cost recovery amount from the financial advice sector at $24.012 million noting that there were 2,759 AFS licensees with 17,402 advisers (the number of advisers on the financial advisers register as at 17 March 2022).

The statement from ASIC notes that the indicative levies are based on its planned regulatory work and associated costs for the 2021–22 financial year.

The statement from ASIC notes that the indicative levies are based on its planned regulatory work and associated costs for the 2021–22 financial year.

Feedback on the draft CRIS can be submitted until 28 June 2022. Click here to download a copy of the CRIS.