If all current members of the FPA and the AFA transition to the new merged association, the FAAA will secure, in theory, a potential 56% of all current advisers on the FAR or 8,835 advisers, according to Wealth Data.

Writing in his latest weekly report Wealth Data’s Colin Williams says the vast majority of the potential FAAA advisers, at 6,988, sit in its Financial Planning business model, at 66% of all those advisers.

Williams notes that the new entity will start formally enlisting new members as existing members of the FPA and AFA renew their membership into the merged FAAA entity. Most of this will occur by 30 June 2023 (see Associations Officially Merge).

He states that the ‘potential’ number is based on the assumption that all current AFA and FPA renew their membership into the new FAAA, adding that the data is extracted from the ASIC FAR and is reliant upon each licensee entering the correct membership details for their advisers.

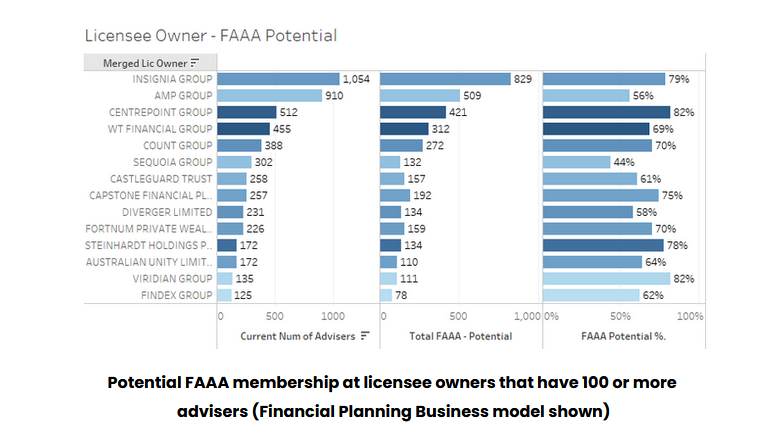

Williams has also looked at the membership rates across the advice models and licensee groups.

He says when Wealth Data looks only at the Financial Planning business model and splits it between advisers who commenced before 2013 “…it is at 75% and only 46% for those advisers who commenced post 2013.”

…This indicates that the FAAA has some work to do with newer advisers…

“This indicates that the FAAA has some work to do with newer advisers,” Williams states.

When he digs deeper in this business model “…the FAAA potential is at 60% for licensee owners that have between 20-49 advisers, up to a high of 71% for the three licensee owners that have 500+.”

Looking at the licensee-owner level, Williams says the results are more wide ranging. “Insignia at 79% and Centrepoint at 82% have a high potential membership, whereas AMP Group is much lower at 56%. Sequoia is the lowest at 44%.”

Williams says the analysis indicates that the new FAAA “…may have a big opportunity but not without risks.”

He adds that “…no doubt other associations will be hoping that this is a good time to extend their reach.”

Williams notes that the industry is seeing “…a greater number of advisers seeking to start their own AFSL, with another four starting this week. Any association must be able to deliver a proposition that is flexible enough to appeal to all types of advisers working in very different licensees.”