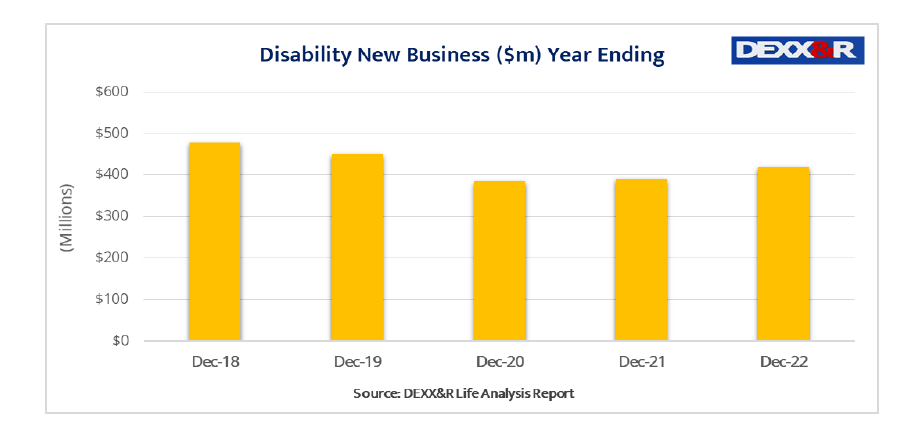

Total individual risk sales were down 1.1% in the 12 months to December 2022, while disability income new business rose 7.6%, putting an end to an 11-year low for disability new business, according to DEXX&R.

The research firm’s latest Life Analysis Report found that total individual risk new premiums decreased by 1.1% to $1.4 billion in the year to December 2022, while disability income new business increased by 7.6% to $420 million, up from the $391 million recorded in the 12 months to December 2021.

DEXX&R says this increase “…puts an end to an 11-year low for disability new business recorded over the year to September 2022” (see: IP New Business Hits 11-Year Low).

Meanwhile, total risk in-force premium increased by 3.0% to reach $16.4 billion, up from the $15.9 billion recorded at December 2021.

Meanwhile, total risk in-force premium increased by 3.0% to reach $16.4 billion, up from the $15.9 billion recorded at December 2021.

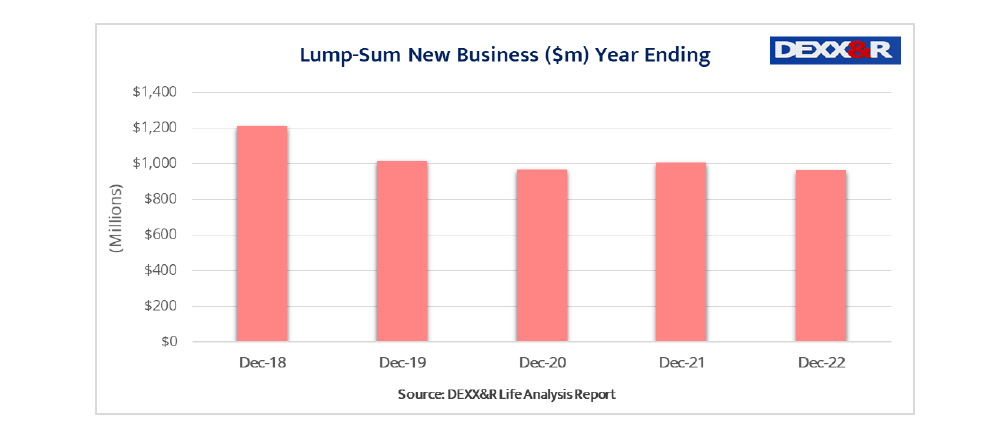

DEXX&R says that in the December 2022 year individual risk lump sum new business was down 4.4% to $962.3 million from the $1.01 billion recorded in the year to December 2021.

During the December quarter individual lump sum new premium decreased by 2.6% to $245 million, $7 million less than the $252 million recorded in the September 2022 quarter.

December quarter sales of $245 million were 4.0% higher than the $236 million recorded in the December 2021 quarter.

Looking at individual lump sum discontinuances, the DEXX&R Attrition Rate, which calculates discontinuances as a percentage of in-force premiums, was slightly higher at 9.3% in December 2022 when compared to the 9.2% attrition rate at December 2021.

Looking at individual lump sum discontinuances, the DEXX&R Attrition Rate, which calculates discontinuances as a percentage of in-force premiums, was slightly higher at 9.3% in December 2022 when compared to the 9.2% attrition rate at December 2021.

Quarterly Disability Income

In the December 2022 quarter, disability income new business of $111 million was down 1.0% from the $112 million recorded in the September 2022 quarter.

However December 2022 quarter sales were 18.1% higher than the $97 million recorded in the December 2021 quarter.

…the attrition rate for disability income business increased for the second year..

The firm also notes that the attrition rate for disability income business increased for the second year, up from the 9.2% recorded in December 2021 to 9.8% in December 2022.

DEXX&R says that discontinuances remain at historically low levels “…indicating that not withstanding the small increase during the year to December 2022 retention levels remain at a higher level than that applicable over the past 10 years.”

It says this trend is expected to continue “…as the terms and conditions offered by existing products are significantly more favourable than those offered by current onsale products.”

The report includes data on all risk business issued by life companies from their statutory funds.

The report includes data on all risk business issued by life companies from their statutory funds.

A few points:

1) These statistics are so delayed that they are irrelevant – especially given that premium increases are the higher of 5% or inflation

2) Even after adjusting for inflation, age increases are a few magnitudes larger

3) The current economic climate and the ageing median policy holder age demands a far more relevant metric than “premium”. How about the number of lives insured?

4) Why has the long term stable cash cow death started… well, dying?

5) Adviser numbers are destined for a retirement collapse in the next 5 years, policy holders not long after and Gen Y and Z are not interested or have nothing to protect.

What is the industry’s next move? More nepotism?

Silver lining: nominal numbers!

Comments are closed.