Most engagement this week was in our report on the ‘staggering’ number of Australians who don’t have and don’t want life insurance – and we take note of the comments at the end of this article…

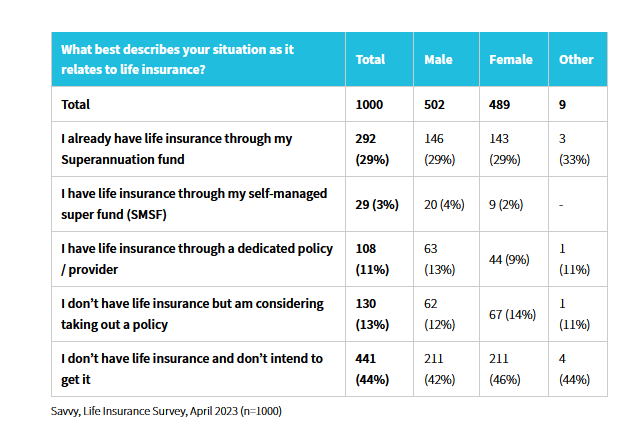

A “staggering” 44% of Australians don’t have any life insurance – and have no plans to take out a policy in the future, a recent national representative survey into cost-of-living pressures has found.

Conducted by online financial broking firm Savvy, its Life Insurance Survey 2023 found 46% of women and 42% of men say they don’t have – and don’t want – a life insurance policy.

“That leaves a little under a third with basic life insurance provided through their superannuation fund (33%) and only 11% who have taken out a life insurance policy through a dedicated provider,” the company states.

It also notes that 13% of those surveyed said that they don’t have life insurance as of yet but are considering buying a policy.

Savvy also points to the Financial Services Council’s Life Underinsurance Gap: Research Report, which says there are an estimated one million Australians underinsured for Death and TPD and about 3.4 million underinsured for income protection insurance.

What people value with life insurance

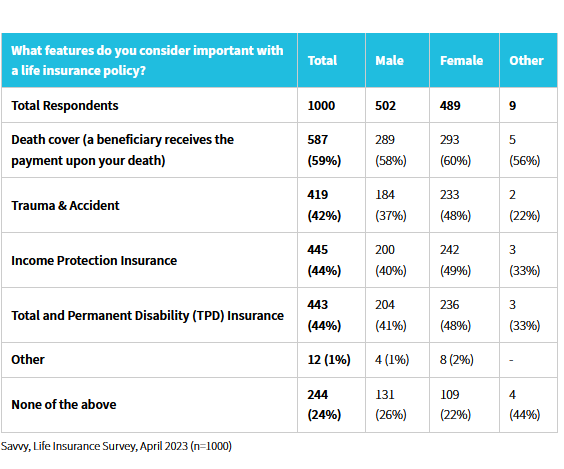

As far as what life insurance policies should cover, Savvy states that 59% of Australians agree that it should cover death with 67% of 35-44 year-olds citing it as the most important component of a life insurance policy.

However it notes 42% said that trauma and accident cover is important “…with 44% of respondents agreeing that income protection insurance and TPD insurance are important features. 48% of women said that trauma and accident insurance is important, compared with 37% of men.”

Adrian Edlington, spokesperson for Savvy, says the fact that so many Australians seem to understand the value of life insurance yet don’t have a policy is alarming: “Life insurance in all its forms, be it death cover, income protection, or total and permanent disability is not only about protecting yourself but protecting your family and community for the worst.”

…even a temporary shortfall in income could prove disastrous for many families

He adds that with costs of living rising and inflation still biting “…even a temporary shortfall in income could prove disastrous for many families. Though communities would love to help someone when they’re able to, the fact is that few communities can afford to at the moment. That’s why people should find a good life insurance premium that covers them adequately without spending too much.”

But, he adds, “…the ultimate benefit is this – peace of mind.”

The Government has not helped when they cancelled Life and disability Insurances for so many Australians who needed the cover under the guise of Protect your Super.

I tried to help a young lady who was not a client, though had $400,000 Life /TPD cover under a Super policy, she had over $50,000 in her account, though because no contributions had been made for 16 months, the Government forced the Life Insurer to cancel her covers, only for her to find out later, she had terminal cancer.

She was in her thirties, had a two year old, was pregnant with her second child, she was told the baby might not survive and if it did, could have major health issues, she was feeling very unwell the whole pregnancy and had to take a lot of time off work, not knowing she already had the cancer.

She was notified by the Insurer, though with a huge mortgage, her husbands job being made redundant and all the other things going on with her life, her priority was on everything else, not on Government laws and Regulations, so the policies cancelled and we could not reinstate them at the time as she had since found out she had cancer.

She and her husband and 2 kids lost their home and she passed away last month.

This was the result of “Government improvements” that know nothing about how important Life and disability Insurance is to all Australians, though pass through insane regulations that should NEVER have been allowed.

Change is always important to make improvements, though ill thought out change, has ramifications like what has destroyed this young family.

Most Australians understand that Life / disability Insurance is important.

Where it all falls down, is they do not understand HOW important it is.

Apathy and the perception of, “It’s all too hard,” is what stops so many from taking the next step.

That is where the Life Insurance Adviser steps in.

In actual fact we need 20,000 Life Insurance Advisers, though due to the “OTHER” Government improvements, we are now down to hundreds of risk Advisers who specialise in this field.

One devastating effect of poorly thought out legislation over the last 10 – 15 years.

Sad beyond words Jeremy. This is exactly the sort of case study we need to rub into the noses of so-called consumer groups and govt responsible for this tragic situation. When I say rub their noses in it sometimes I feel in a literal sense as it makes me so mad. Where the hell is the mainstream media on this? What happened to the days when the likes of Mike Willesee and Mike Munroe would grab the ball and run with it right to the end to hold these creatures accountable? Govt operates in an elitist bubble world, reacting only to the opportunity for a soundbite and camera flash here and there to ensure re-election. Putrid and disgusting the way these frauds operate and are ALLOWED to operate.

Hi Squeaky, you’re right about taking this to Canberra, however I have a terrible feeling that somehow the Pollies and media would twist this story to again lay blame at the feet of Advisers, like somehow their madness is our fault. Tell me I’m wrong but the blame game is what we’ve seen unfold since the GFC. Unfortunately no Adviser is prepared (I’m certainly not) to talk to most people (particularly the younger cohort where commission revenue hardly compensates for your time and is at risk for 2 years) about insurance because we’re not totally sure how the courts and ASIC will apply Standards 1-12. We know the Corps Act is very clear about scaled/limited Àdvice, however the Standards gazumps the Corps Act. Mr Jones has been quoted in the AFR describing the industry as a HOT MESS, yet the law makers think tinkering around the edges (QAR) is the magic solution…NOT. Until insurance can again be SOLD with relative confidence of not being tripped up by ludicrous standards, then the under insurance gap will continue to widen. Insurance is SOLD people never bought. Yes there will be viewers who think my archaic attitude is the problem and I should disappear, and they can think that, but going down this “professionalism” road is a mistake for insurance and if the current state of play doesn’t convince you then maybe it will take the collapse of a big recognised insurer before things change. RANT done!

Thanks for your rant BKY, appreciate it . You’re 100% spot on in all you say. Hot mess, LOL!! Hot steaming mess more like it 😉 I once, not too long ago, had a real passion for helping clients with risk advice – it is all I did and all I wanted to do. Therefore I did it well and helped many clients, saved many from bankruptcy and many families from ruin. I had maximum job satisfaction.

When that passion disappeared I cannot say accurately – I had it fully for a good 25- 30 years though so probably started to dissipate somewhere in the past 5 years or so. 100% due to this political idiocy, incompetence and compliance nonsense which simply stopped us being able to deliver easy to understand risk solutions at a reasonable price.

Since I left in late 2021 I’ve felt the weight off my shoulders incredibly but still stressed for those who remain (and newbies if any!) and my old clients. All consumers and advisers actually who are being reamed by this and the past government and actions of consumer groups and life companies. Just stinks, the whole lot. Our once-great profession won’t ever be the same I fear. I just hope, somehow, other older riskies manage to exit gracefully and equitably as I did. This steaming hot mess is not likely to improve at all – how could it possibly(?) – politicians are calling the shots and they always get the last word!

Scary. But totally predictable. Personal risk Insurance is a basket case thanks to legislation which talks about recognising the lack of access to insurance advisory services but has done practically nothing to address it. It’s a disaster which distresses myself and many of you reading this, especially when added to the conversation we are having almost every day with policy holders who are facing massive premium increases as the shape of the market becomes more and more distorted.

Yes Tim, those massive premium increases are a sore point that govt will neatly sidestep in every conversation. Fascinating, on one hand, how the govt is happy to force lower commissions on advisers to a point that puts many risk specialists out of business (or at least kills profitability) which is in fact running contrary to corporations law(!). Then, on the other hand, govt will do nothing to reign in the outrageous premium increases which are heavily to the detriment of consumers and a big part of the reason for the under-insurance crisis. Which group does it look like the ELECTED government is supporting . . . consumers OR life companies (big end of town)?? Where’s the REAL media when we need them to be trumpeting this obscene situation most?

Comments are closed.