Insignia Financial intends to reset its financial advice operating model through a new partnership ownership model for its self-employed licensees comprising RI Advice Group, Consultum Financial Advisers and TenFifty.

As part of a quarterly Business Update announcement to the ASX, the firm says its ambition is to create Australia’s largest adviser-owned licensee group.

While the new brand name and identity has yet to be established, this new business is being developed under the working name of Advice Services Co or ASC.

…ASC represents the ambition to create Australia’s largest adviser-owned licensee group…

The company says that “…ASC represents the ambition to create Australia’s largest adviser-owned licensee group, positioning it to capitalise on the dynamic self-employed advice market with the support of Insignia Financial.”

It notes the new business will operate with “…independent management, oversight and governance, with input from both Insignia Financial as well as key advice practice representatives.”

Initially, Insignia Financial will hold a majority stake in ASC, but notes this stake will reduce over time as advisers are invited to receive equity in ASC.

“Insignia Financials’ continued shareholding will ensure alignment and commitment to the self-employed advice model through an ongoing partnership. ASC will have a strong mandate to grow the number of advice practices and advisers operating under its licences,” the statement says.

Insignia Financial CEO, Renato Mota says this is “…a transformational initiative for our Advice offering and will accelerate the return to profitability of our Advice business, while ensuring our Advice Services model is positioned for growth as the financial advice industry continues to evolve.”

ASC will be “…owned and run for advisers

He adds that ASC will be “…owned and run for advisers, with the backing and support of Insignia Financial. The formation of ASC creates an adviser-focussed licensee that can innovate in support of an emerging high quality, self-employed profession.”

It also provides the company “…with greater opportunity to focus on the growth of its Professional Services Advice businesses, Shadforth Financial Group and Bridges Financial Services, expanding the scope of advice through superannuation, and the development of new technology-enabled advice delivery to leverage future opportunities presented by the Government’s response to the QoA Review.”

Mota says the greater focus and specialisation of both organisations “…will lead to better outcomes for clients, making advice more accessible to more Australians.”

Insignia Financial will contribute staff, resources and working capital to ASC and will continue to support the new business under a transitional services agreement for 12 months from completion, which is expected to occur in the coming months.

The new business will be led by an experienced management team, headed by CEO Darren Whereat. Key management personnel will also participate in equity.

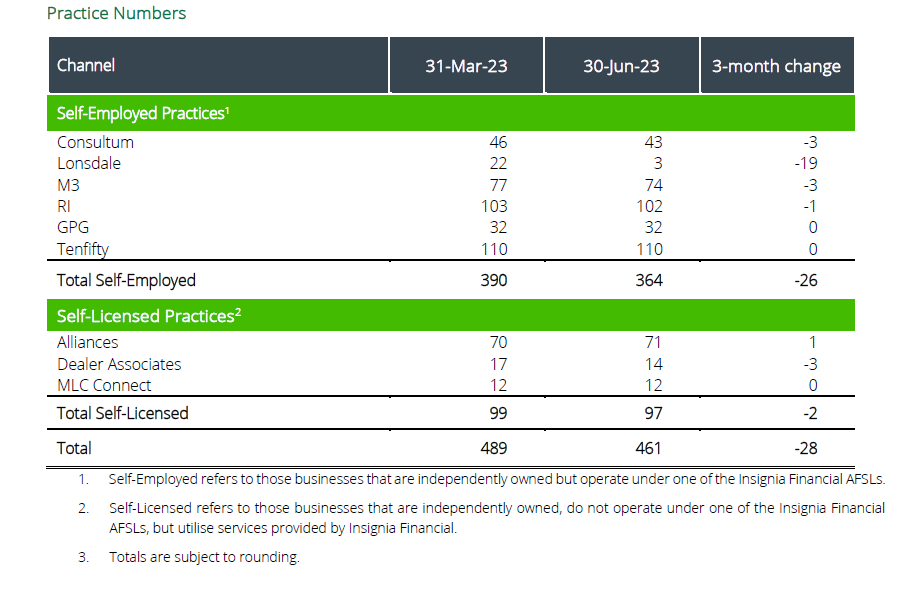

Riskinfo understands the life insurance advice-focussed Millennium3 business is not seen by Insignia as a good ‘fit’ for the ASC advice group proposition and its statement includes confirmation it is in discussions with interested parties regarding the potential sale of the M3 licence.

The company also notes that separate to the establishment of ASC, ownership of Godfrey Pembroke Group is expected to be returned to Godfrey Pembroke advisers with Insignia Financial retaining a minority stake.

It adds that the closure of the Lonsdale licence is almost complete “…with a number of advisers transitioning to Consultum or moving to self-licensing through Insignia Financial’s Alliances offer.”

Insignia notes it supports 1,413 financial advisers as at 30 June 2023, comprising 1,171 self employed/self licensed advisers in its Adviser Services channel and 242 salaried advisers in its Professional Services channel.