There was strong reader interest this week in news that the body monitoring Australia’s Life Insurance Code of Practice had reviewed well over 200 possible breaches of the Code in 2022-23, and detailed the resulting number of confirmed and significant breaches…

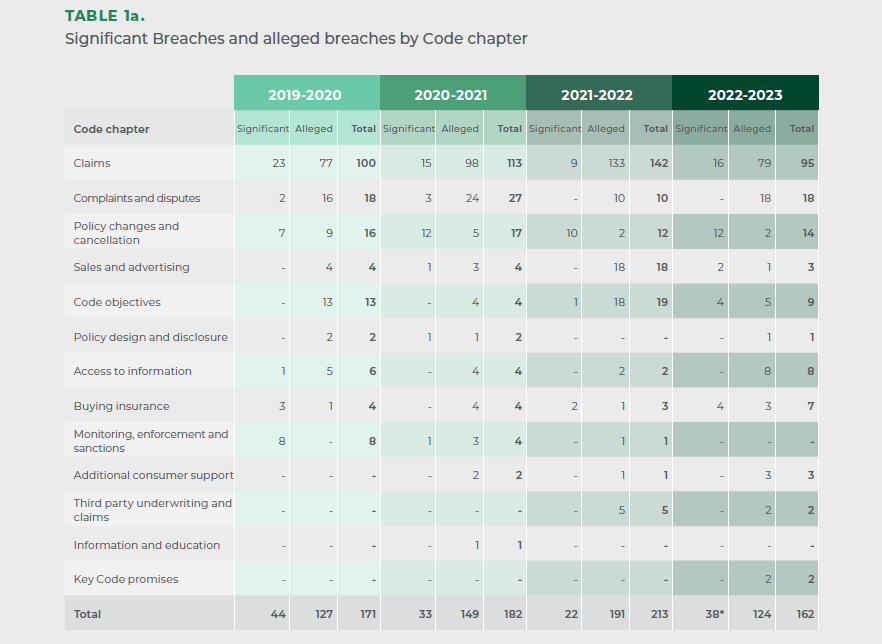

The Life Code Compliance Committee reviewed 236 possible breaches of the Life Insurance Code of Practice by insurers and confirmed 79 breaches, including 35 significant breaches in 2022-23.

The committee, which monitors adherence to the Code of Practice to help insurers deliver high quality service standards to consumers, has released its Annual Report for the 2022-23 year.

The report also highlights the committee’s success in encouraging better reporting practices among life insurers.

…more insurers reported significant breaches in 2022-23…

It notes that following the Life CCC’s efforts “…more insurers reported significant breaches in 2022-23, reflecting a commitment to transparent reporting as an essential aspect of genuine compliance with the Code of Practice.”

While the Life CCC does not celebrate breaches, it acknowledges the importance of insurers identifying and reporting them promptly.

Jan McClelland AM, Chair of the Life CCC emphasised this point and expressed an ongoing desire to see accurate reporting of genuine compliance with the Code.

“It is pleasing to see that our message about proper accurate reporting is getting through. More subscribers reporting breaches suggests that the code and reporting obligations are being taken seriously,” she says in a statement.

“We encourage a genuine reduction in breaches based on improvements to processes, systems and procedures. And this begins with accurate and transparent reporting of breaches.”

Breach Reporting

The report itself notes that outside of the annual reporting cycle, the insurers reported an additional 50 breaches of the Code, up from 22 in 2021-22. Out of the 50 breaches reported, 38 were reported as Significant Breaches.

It says that in addition to the breaches reported by insurers, the Life CCC received 52 concerns, alleging 124 Code breaches, from non-subscribers, including customers or their representatives.

“Claims-related breaches made up the majority of all alleged breaches, a finding consistent with data from previous reporting periods,” the report notes.

“With claims-related issues remaining key, subscribers must continue to invest in and improve their processes and procedures to assess claims more efficiently and effectively,” it states.

The report also notes that off the 35 confirmed Significant Breaches, 16 related to the requirement to provide an annual notice in writing prior to the anniversary of the policy.

It says this has “…continued to be an issue for subscribers, as we identified in our report on an OMI [Own Motion Inquiry] into subscribers’ compliance with section 6.3 of the Code, published in January 2022. After initiating the OMI into subscriber compliance with section 6.3 in 2021, we received multiple Significant Breach reports…”

“ It is significant and disappointing that subscribers identified these breaches only after we initiated our inquiry,” the report says.

It adds that ensuring that customers receive their annual notices prior to the anniversary of their life insurance policy “…is critical to ensuring that customers are armed with all the information that they need to evaluate the suitability of their life insurance policy.”

“We have therefore initiated a follow-up OMI on subscribers’ compliance with their obligations, with a report due to be published in the first half of 2023-24.”

Click here to see the full report.