Small licensee numbers are surging as Australia’s financial services scene continues its evolution, according to the latest research from Adviser Ratings.

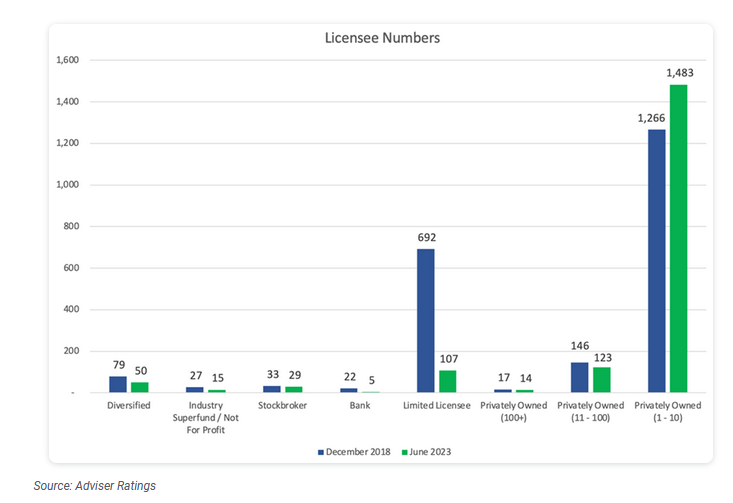

In laying out two scenarios for advisers, the research firm points to a 17% increase in small licensees (1-10 advisers) since 2018.

It says this rise is reshaping advisory services “…leading to diversified, specialised offerings and posing essential inquiries into implications for advisers’ choices and the transformation of the financial advisory framework.”

Adviser Ratings also notes the surge of small licensees means this as the only AFSL segment that has grown as AFSLs numbers have declined from a high of 2,282 at the end of 2018 to 1,826 today.

In asking what the implications are for advisers and the financial advisory landscape, the research firms poses two scenarios, firstly pointing to one adviser who, in 2021, decided to close his AFSL and join a larger group.

In asking what the implications are for advisers and the financial advisory landscape, the research firms poses two scenarios, firstly pointing to one adviser who, in 2021, decided to close his AFSL and join a larger group.

It notes that conversely however, hundreds of advisers were opening their own AFSLs and going self-licensed “…with advisers preferencing self-licensing to mid-tier licensees and dealer groups as banks have exited and AMP and Insignia have cut their numbers.”

Adviser Ratings says that the adviser who joined a larger group pointed to five reasons:

- Focus: He had two jobs – compliance and adviser; he argued that it ‘was hard to be your own police officer’

- Time: Doing it right takes longer that you think

- Knowledge: He questioned whether he really had the knowledge, expertise and experience

- Risk: As Responsible Manager and shareholder of his practice, was he being compensated for the risk

- Cost: He argued that running his AFSL was not the cheaper option

Adviser Ratings says that there is also the argument that smaller licensees have higher financial and operational risks for any new advisers looking to join them.

…The onus is on the adviser to ensure that they’re partnering with a reliable and reputable licensee…

“Not all licensees will offer the same quality of products, services, or support. The onus is on the adviser to ensure that they’re partnering with a reliable and reputable licensee.”

The company says that as seen time and again “…if a small licensee faces negative publicity or regulatory actions, it can have a cascading effect on the reputation of the advisers associated with them.”

“Countering this do many mid-tier and larger licensee groups really offer that financial stability or appropriate level of PI cover.”

Adviser Ratings says self-licensed and small licensees will contend that the opportunities and benefits are there particularly in terms of choice via:

- More diverse offerings: The proliferation of small licensees can lead to a wider range of offerings. With each licensee potentially specialising or having a unique value proposition they can mould, which can better suit the needs of their clientele

- Niche market specialisation: Smaller licensees or self-licensed advisers might focus on niche markets or specific client segments that larger licensees might overlook. This provides advisers the opportunity to cater to these specific segments with specialised products, such as MDAs, and other services

- Flexible business models: Smaller entities might offer more flexible business arrangements, access to technology, fee structures, or service models. This could be appealing to advisers who are looking for bespoke arrangements or are dissatisfied with the constraints of larger licensees

- Personalised relationships: Many self-licensed advisers argue they have more direct and personalised relationships and are not beholden to bureaucratic layers or inefficiencies that may exist in larger organisations, leading to quicker decision-making processes and lower costs

The firm notes that on a pure numbers basis, many advisers currently side in the self-licensed camp.

To accommodate and in part alleviate concerns within the first scenario, Adviser Ratings notes that “…many larger licensees are turning themselves into licensee support services.”

It concludes that with adviser numbers bottoming out “…will fragmentation continue to grow? Or will we see more consolidation in the mid-tier group and the rise of mega-licensees on the back of Count-Diverger merger?”