The continuing decline in advised life insurance new business sales attracted much reader interest this week…

Retail advised lump sum and IP new business sales volumes continued their journey south in the year to June 2023.

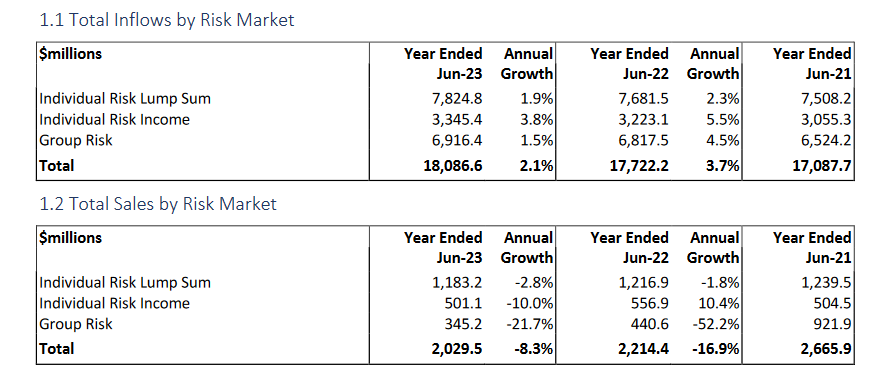

Plan for Life’s latest data reveals individual risk lump sum sales fell by 2.8% in the year to June 2023, while individual IP new business declined by a significant 10.0%.

This latest data continues the trend in declining retail advised new business sales as reported in by Riskinfo in previous quarters (see: Risk New Business Sales Fall Again).

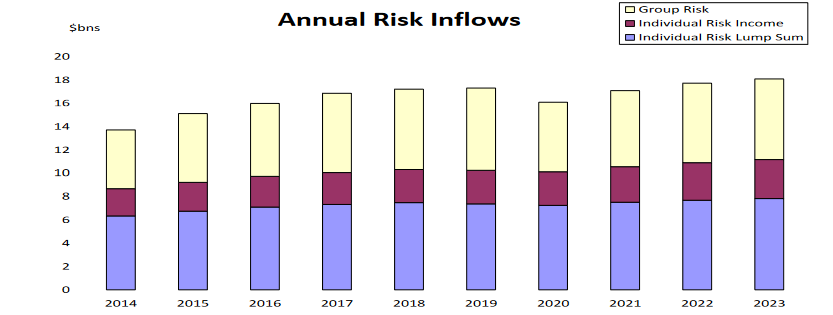

The research firm’s latest data for the June 2023 year reports, however, that total risk inflows (which include annual CPI and age-based increases applying to inforce business) rose 2.1% from $17.7bn to $18.1bn, with individual risk income inflows lifting 3.8%.

Inflows for individual risk lump sum were 1.9% higher, while individual IP premium inflows rose 3.8% during the period.

Anyone really surprised? Low quality, compliance nightmarish IP policies to recommend to clients. I’m surprised sales haven’t stopped completely!

Would be interesting to see policy numbers for new sales in addition to premium value. With all the lump sum upfront selection discounting (averaging around 25% year 1) being offered by insurers (some insurers show the customer and adviser the discount while others hide it in the ‘rates’) how much of the reduction is due to this discounting.

For IP there is a trend to longer waiting periods and shorter benefit periods which also means potentially each policies average premium is lower than past average premiums.

Fascinating isn’t it. It’s like watching a slow train wreck or one of those long series of formulaic superhero movies that my grandson likes. It’s an entirely predictable script.

I guess while the CEOs of the insurance companies can gouge the premiums of existing policyholders, the fact that new businesses at such low levels really won’t effect shareholder value and their bonuses. Not for a while – yet.

Advisers are constantly telling the captain of this particular ship that the ship will very shortly hit that iceberg dead ahead. The captain keeps reassuring us that all is well in the industry is unsinkable.

I guess the question is – will there be enough lifeboats

The one certainty in Business, is that change is inevitable.

The factors that can inhibit or strengthen a Business and an Industry are Regulations, Competition, Economic circumstances out of our control, like Interest rate rises and consumer sentiment.

The biggest factor for everyone, including the Advised Life Insurance sector, is about risk versus reward.

The Advised Life Insurance sector has been put through a decade of torture and uncertainty, which still exists today, with it being a maze just to get to the starting point and the Industry is still being hamstrung by ridiculous, unworkable restrictions of trade that was the cause of most risk specialists to leave the Industry in disgust.

The one bright light, is that there are still sufficient holistic Advisers in Australia who can help turn things around and are waiting in the wings to see where the Regulatory wind blows and are also looking for improvements in Technology to allow them to increase efficiencies in their Businesses to the point where they can eagerly reopen the doors to providing profitable and satisfying Wealth Protection advice.

Ask anyone who has spent years fighting the bureaucracy, struggling to survive never ending red tape, then upon finally getting to the finish line, asking them if they would jump straight back in and do it again and the vast majority would answer “NO.”

Though, the one thing about human nature, is that as time passes, so does the memory of all the pain and before you can rehash with total clarity, you make the best decision subconsciously, which is to come to the realization that the fact you survived, also enabled you to build up a treasure trove of experience that can be used to make the next journey much more enjoyable with less booby traps to catch you out as you step over or around them.

Life is a continual journey, full of up’s and downs. The secret to making the journey a better one, is to enjoy the good times, reroute around the potholes and learn from other journeymen and women who have been there before you and can articulate a better path to follow.

I know that there is a great future ahead for Advisers in the risk space, if we all move together in the right direction.

Today, it is still raw of what we have all been put through, though as my wife told me, having one baby is sufficient reason NOT to have another, though with the passage of time and a good wine, it is amazing how the “Never Again,” can turn to, “Okay let’s try this again.

The return on investment will far outweigh any pain.

Rebuilding the risk books of all our Businesses will reap long term financial rewards for all of us and Australia will be much better off, with sustainable policies and people being able to sleep well knowing they have great cover to meet their needs.

Jeremy, the word you are looking for is relevance. The industry is no longer relevant. The industry took a nice chunk of money off people that were well off enough to not be “middle class” but not rich enough to self-insure. Income inequality now means that market segment is dying and inheritance won’t fill the gap (it divides by the number of children).

Repeat after me: life insurance is no longer RELEVANT.

So wait… total inflows are 2.1%

Inflation is 5-6%.. never thought that 5% policy term would kick in, am I right actuaries?

So already down at least 3% in real terms.

Age increases are in the vicinity of 5-10% on average. How many young lives with no capital to protect are you insuring to cover the gap? Yay for neo-liberalism and boomer millionaires that didn’t even graduate high school.

Teh top heavy capital economy is about come down hard on the jobs for mates program.

About time the industry reported on lives insured but likely too afraid of reality. Better bump them premiums up.

Does anyone think that millennials or younger are going to buy this stuff without a winning-the-lottery type property boom to make them feel “rich”?

This is popcorn material.

Comments are closed.