TAL has provided a record amount of benefits to customers in a half year, paying $2 billion in claims during the six months from 1 April 2023, with 23% of all claims relating to mental health conditions.

The insurer says that of the 32,456 individuals and their beneficiaries who received payments in the period, 75% were living benefits – sums paid to customers living with, or recovering from, an injury or illness – up from 72% in the 2022/23 financial year.

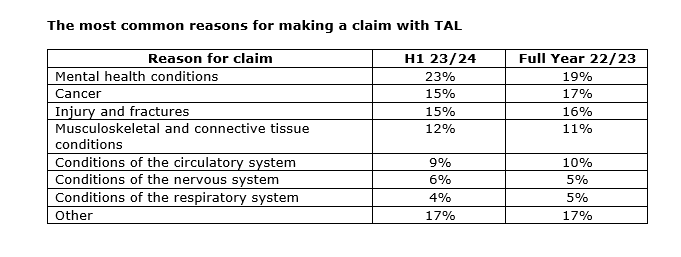

It notes that living benefit payments were driven by an increase in Income Protection and Total and Permanent Disability claims related to mental health conditions including post-traumatic stress disorder and depression (23% of all claims), followed by injuries and fractures and cancer (each 15% of all claims).

TAL says claims for mental health-related conditions have grown steadily over recent years, with mental health conditions surpassing cancer as the leading cause of claims in 2021/22.

TAL Chief Claims Officer, Jenny Oliver says this was the highest value in claims ever paid by the life insurer in a half-year period.

She says that paying claims “…is the most important thing we do. Life insurance provides our customers with peace of mind when making important decisions like buying a home or starting a family, and provides important financial protection during life’s biggest challenges.”

…the large majority of claims are paid to help TAL customers as they recover from an illness or injury…

Oliver notes that people often think that life insurance provides payments to families when a loved one passes away “…but in reality, the large majority of claims are paid to help TAL customers as they recover from an illness or injury.”

She says TAL strives to continually improve the claims process and experience for its customers, super fund partners and their members.

“This includes investing in digitising the right services to increase the speed and efficiency of the claims process, and increasing the integration between super fund partners, administrators and insurers, so claims can be paid faster.”

…customers need the right tools to help them engage with their insurance cover or make a claim…

She adds that customers need the right tools to help them engage with their insurance cover or make a claim. “That is why we have developed Claims Assist where customers and super fund members can easily lodge and manage their claim, and Cover Assist which allows them to check and change their cover.”

She also notes that TAL takes a holistic view of health and recovery, and understood the importance of assessing the balance of physical, mental and financial health – proactively and after the unexpected happens.

“Beyond a claim payment, TAL provides a wide range of support services to help our customers prevent illness or injury as well as to recover when things go wrong, including pain management, occupational rehabilitation services and cancer support to customers to help meet their health goals.”