There was strong reader interest this week in our report on new insights highlighting the role that all financial advisers should play in serving their clients when it comes to life insurance advice, regardless of their expertise in this area…

New data and insights shared at this week’s inaugural FAAA Congress have highlighted the role that all financial advisers can and should play in serving their clients when it comes to life insurance advice, regardless of their expertise in this area.

This message was eloquently argued by Zurich Risk Strategy Specialist, Adam Crabbe, in his presentation titled ‘Life Interrupted: post-pandemic claims insights amplifying the adviser’s role in risk advice‘.

Crabbe presented the case to advisers that in a post-pandemic world, there has emerged a heightened case for all advisers to be sensitive to the protection and well-being needs of all their clients, irrespective of their confidence level in delivering life insurance-related advice.

He articulated his argument by sharing a number of different scenarios across which advisers could harness new claims data and other updated statistics related to areas such as key life events and growing personal debt levels. Crabbe was effectively presenting all advisers with an armoury of new information which they can utilise in their client conversations.

The following selection of slides taken from Crabbe’s presentation highlight a number of these scenarios – no product knowledge required:

Post pandemic financial reserves

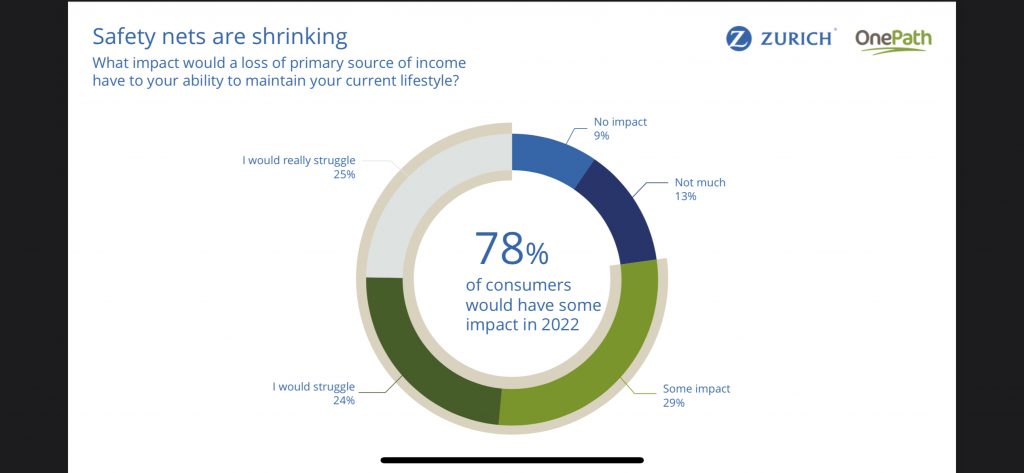

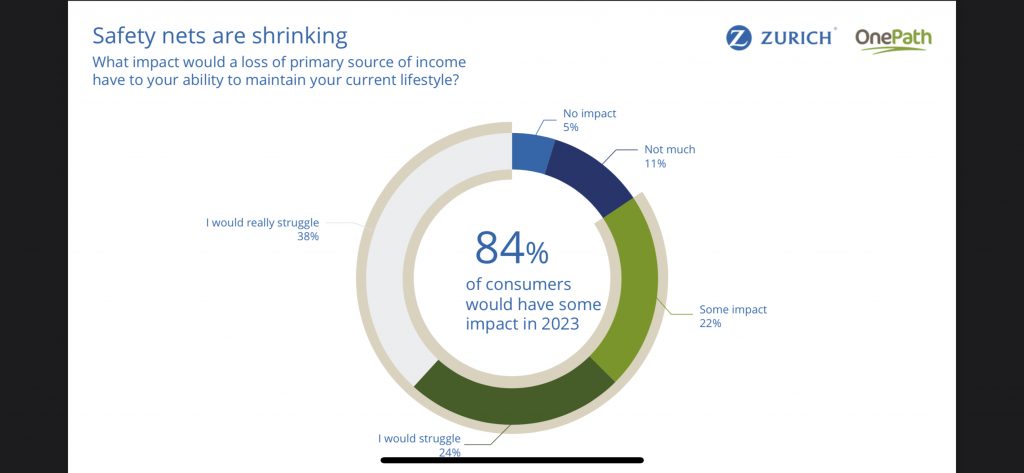

Crabbe shared new data that demonstrates the financial safety net for Australian consumers is shrinking, as evidenced by the following two charts. We note in particular the significant increase in Australian consumers who think they will ‘really struggle’ if something interrupted their income stream (click inside slides to magnify):

Key life event triggers

Latest Zurich data reveals the life event that most triggers thoughts about life insurance is when Aussies start a family (nine in ten), closely followed by the number of consumers who identify entering a significant financial commitment as a crucial trigger:

Rising personal mortgage debt levels

Rising personal mortgage debt levels

Crabbe revealed up-to-date data with regard to personal debt levels per state. He emphasised these average mortgage levels apply only to the personal or family dwelling, and preclude any investment property loan debt. He highlighted the staggering average personal mortgage held by New South Wales residents:

Zurich research reveals many Australians would consider life insurance if they or a loved one developed a serious health issue. But the issue here is whether this insight would arrive too late:

Reducing personal health risks

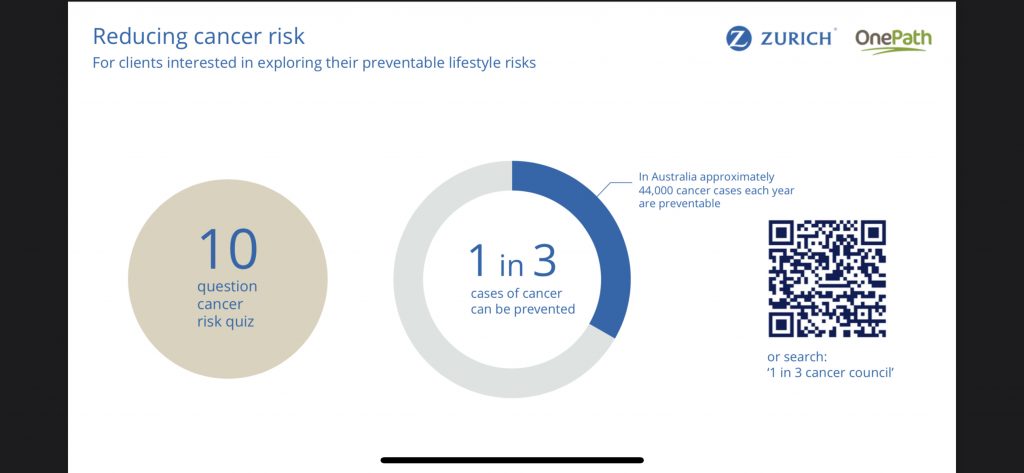

Crabbe shared statistics around a number of common health issues experienced by Australians, including the incidence of musculoskeletal accidents and events, the growing area of mental health-related claims and their impact on Australian lives. He also outlined the prevalence of various common cancer conditions, including cervical, breast and bowel cancer, and how screening for these conditions can save your clients’ lives:

In concluding his message, Crabbe reiterated the critical value of education and financial awareness needed by all Australians – as important or more important today than it has ever been:

Crabbe urges all financial advisers – ALL advisers – to have these conversations with their clients in order to serve their best interests and to ensure they are made aware of the options available to them when it comes to protecting their lives and the lifestyle they are seeking to build for themselves and those close to them.

Crabbe urges all financial advisers – ALL advisers – to have these conversations with their clients in order to serve their best interests and to ensure they are made aware of the options available to them when it comes to protecting their lives and the lifestyle they are seeking to build for themselves and those close to them.

The startling thing about the research, is that 51% of the respondents said if their primary source of income was lost, it would have no impact, to some impact.

This figure highlights just how unaware people are when it comes to money management and future risks / expenses that will financially cripple them if their income ceases.

The Government has done very little to encourage Advisers to have these conversations around Wealth Protection, as the roadblocks are still there.

Streams one, two and three of the Quality of Advice Review have turned into trickles and the Government needs to be told the truth about the REAL issues with Risk Advice.

What we are seeing is the same old talkfest and as far as wealth protection is concerned, the path is still strewn with tumbleweeds and incorrect signposts that ALL STILL lead everyone to the same maze of confusion, red tape and warnings of hell and damnation if you do not comply with untenable demands.

The FAAA and the AIOFP need to cut to the chase when talking to Treasury, the Government and Opposition, by articulating in plain English what the problem is and the simple solution.

All we are seeing are a blending of words that do not separate the issues and unless this changes, there will be the same old arguments and the same results, which is the true definition of insanity, where thinking that doing the same incorrect things over and over, is going to change things for the better to get a different result.

Jeremy, the reason many respondents are complacent about the future is because many think a Go Fund Me page is a way out of any financial emergency they might face.

Comments are closed.