While accountants feel confident in their understanding of the financial implications of critical illnesses and other health issues, new research has found that not all accountants are equipped with sufficient insurance coverage.

PPS Mutual’s inaugural 2023 State of Health and Wellbeing in Accounting report, polling Australian accountants on their physical, mental and financial wellbeing found that three out of four accountants say they understand the potential costs they may incur if they required treatment for a serious physical or mental health condition.

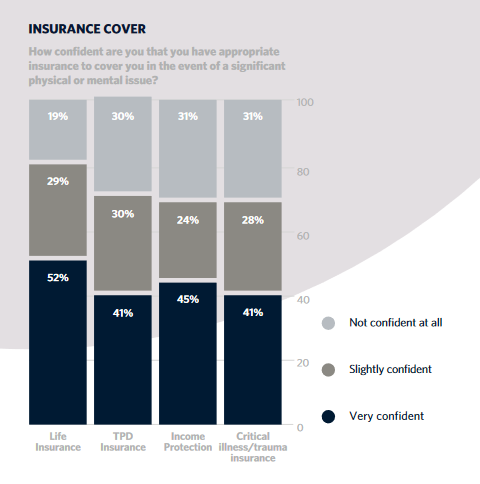

“However, fewer than half, or 41% of accountants, are ‘highly confident’ they already have the appropriate risk insurance coverage for a critical illness,” PPS Mutual says.

In addition, most respondents did not have access to a group insurance policy.

PPS Mutual’s CEO Michael Pillemer says this means the majority “..or 59%, are not confident that they are appropriately covered, which can create further stress. Without group insurance, many are also vulnerable to financial risk.”

Pillemer says there is “…a clear opportunity for greater education around the income protection, Total Permanent Disability and life insurance options available that can provide a ‘safety net’ for accountants and their families in the event of illness, injury, disability or death.”

The survey was conducted by independent researchers Investment Trends and PPS Mutual says it is the first of its kind to examine the mindsets of Australian accountants in practice and across the workplace.

“It seeks to qualify how Australian accountants think about their professional wellbeing, their working lives, any impacts on their physical health, and the safety nets created to protect against losing their income or ability to work.”

Other findings around accountants views on insurance were:

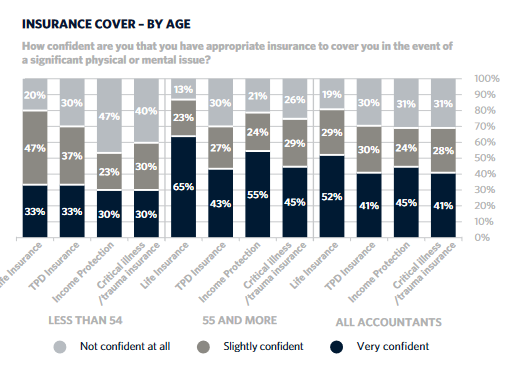

- Older accountants (aged 55 and over) were also much more confident than younger accountants in their understanding of the potential costs, with 48% saying they were ‘very confident’ compared with just 13% in the younger cohort. As would be expected, older accountants were also twice as confident in their life insurance cover (65%) as compared to their younger counterparts (33%).

- When comparing the data by gender, men were twice as sure as women that they understood the costs, with 40% saying they were ‘highly confident’ compared to 22% of women.

- Overall, life insurance was by far the type of insurance that accountants felt most sure of, with 81% saying they were ‘very confident’ or ‘slightly confident’ that they already had the appropriate amount of cover in the event of a significant physical or mental issue.

- Women were also far more confident than their male counterparts in this regard. Just 6% of female respondents said they felt ‘not confident at all’, compared with 22% of men.

- Accountants were also assured of their TPD coverage, with 70% saying they felt confident, followed by income protection and critical illness or trauma insurance, both at 69%.

Referrals to a financial adviser

One in six (17%) accountants in public practice ascribe the highest level of importance to having insurance conversations as part of their service proposition, the PPS Mutual report states.

It says 51% of accountants in public practice said they had discussed life insurance with their clients, and the accountants tended to be the main instigators of these conversations.

The report says that “…48% of accountants who had discussions about life insurance with clients then referred these clients to a financial adviser with whom they had an existing referral agreement.”

PPS Mutual says that when asked about the barriers preventing them from discussing insurance with clients “…a small group of respondents cited not being a registered financial adviser, not working in a firm providing insurance cover, or otherwise not being in an appropriate role to discuss the topic as key reasons. Other factors were having a busy schedule or the client not asking for the service.”