A warning to insurers that the regulators will monitor their progress in meeting expectations of their life insurance pricing decisions drew much reader interest this week…

Life companies have been warned that over the next 12 months APRA and ASIC will monitor their progress in meeting regulatory, consumer and community expectations of pricing decisions.

The regulators will also monitor marketing and disclosure, as well as product design “…to deliver better consumer outcomes.”

A detailed letter to all life insurers outlines the findings from the regulators’ joint review of life companies’ practices in relation to premium increases, including subsequent corrective action taken by some life companies. It also makes clear ASIC and APRA’s regulatory expectations of life companies going forward.

…we will consider appropriate regulatory action if our expectations are not met…

It states that “… we will consider appropriate regulatory action if our expectations are not met.”

The regulators’ expectations are that life companies:

- Have sound risk management and compliance assurance around re-rating practices and ensure any contract terms allowing for premium increases are transparent and not unfair

- Clearly explain how premiums are calculated and may change over the life of the policy

- Design and price life insurance products factoring in consumers’ need for premium stability

APRA and ASIC also say that as next steps, life companies should “…examine their contracts to ensure that the terms about how and when premiums may change are transparent and not unfair.”

…Life companies should ensure their disclosure and marketing materials … are fit for purpose and help consumers to properly understand how their premiums may change…

They say when making re-rate decisions “…due consideration should be given to the consumer impact as part of the risk management framework. Life companies should ensure their disclosure and marketing materials and any other relevant communications are fit for purpose and help consumers to properly understand how their premiums may change.”

The two bodies say that to do this effectively “…life companies themselves need to better understand the rate and drivers of future premium increases.”

“More rigorous product governance practices, which will be aided by deeper engagement with the design and distribution obligations, will help life companies to better meet consumer needs and deliver responsible market practices.”

Addressing Concerns Raised in 2022

The letter also notes that life companies have started taking action to address concerns raised by APRA and ASIC in an earlier letter dated 8 December 2022:

- Three life companies found instances where premium increases were applied to consumers without a clear right to increase premium rates in the underlying policy. The life companies have all indicated that they have started, or will start, remediating consumers

- Three life companies found possible problems with disclosure and marketing materials. Seven identified areas for improvement in PDSs, quotations, insurance schedules, annual renewal notices, consumer flyers, educational content on their websites, as well as adviser communication and guidance. Some improvements have already been made, while others are in progress

But, they say, more needs to be done by life companies.

Frequent Re-ratings

Amongst the observations regarding premium increases APRA and ASIC say life companies conduct an annual experience investigation and then decide whether premiums are set at the right level to cover estimated future claims costs.

“This frequently leads to increases in base premium rates that are charged to consumers. This process is known as re-rating premiums.”

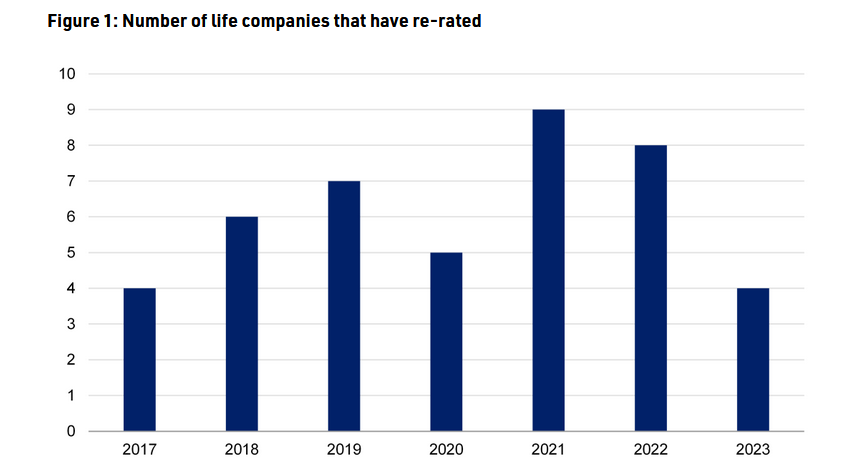

The letter points to frequent re-ratings. “Of the 16 life companies that have provided retail life policies, 13 have re-rated at least once and seven have re-rated at least four times since 2017.

The observations on premium increases in the letter also note:

- Re-rating rationales: Most life companies said re-rating decisions were triggered by worsening claims experience and were made to restore target profitability levels following changes in assumptions on lapses, claims and economic conditions and/or reinsurance arrangements

- Smoothing and capping re-rates for acceptable consumer impact: Some life companies greatly increased premiums in a single year, hoping to restore profitability and prevent increases in future years. They reported that this resulted in a spike in lapses and had a negative impact on consumers. Other life companies were more mindful of how such increases could affect consumers and affordability. They made smaller but more frequent increases or capped the maximum annual increase at a set level to avoid selective lapses

- Re-rating level premiums more than stepped premiums: Increases of base premium rates for consumers on level premiums were generally larger than those for consumers on stepped premiums. Despite consumer expectations that level premiums are more stable than stepped, only one life company made the conscious decision to keep increases for level premiums at a lower rate than for stepped premiums

Click here to view the full letter to life companies.

Too late! Asleep at the wheel as usual. Policyholders are voting with their wallets!

Advisers have been screaming about these gouging practices for almost 2 years and in particular after the sale of a very large book of business that attracted national headlines.

A regulator-driven review that starts today may not find anything at all happening in 2024. The insurers could take the hint and cease-and-desist, just for now.

And for those who love bureaucratic language, there is now a new term for that pernicious practice of 25% UNSISCLOSED UP FRONT DISCOUNTS where the client gets a kick in the guts in year two onwards

APRA now refers to large upfront discounts as DURATION BASED PRICING.

Why doesn’t the communication requirement contained in Standard 5 apply to regulators? Only a nerd would understand the meaning of that insider phrase but everyone knows what it does to their pocket.

The 25% upfront discount is clearly being utilised by some advisers to the long-term detriment of their clients. It wouldn’t be offered if it wasn’t successful!. So here’s a question: how efficient are compliance auditors when they review an SOA that clearly is using a product with a 25% upfront discount but the auditor can find no disclosure and warnings in the SOA of the impending financial doom in year two and three.

The elephant in the room, and NOT mentioned by the regulators, is that IF life risk commission rates were restored back to their pre-LIF levels, insurers would not need to dangle carrots to advisers, and their uninformed clients, to increase new business and take pressure off the Statutory Number 1 Funds.

Maybe we should organise a protest at Mr Jones’s electoral office where some of his voters, who been the victims of premium gouging, turn up and demonstrate. Hello FAAA !

Publicly reported demonstrations work – just ask the Victorian police who been painting anti-government signs on the sides of paddy wagons for months, and have just been awarded with pay rises and shift reductions.

At least some insurers disclose the discount and it’s tapering while others ‘build it into their rates’. Wonder what APRA thinks about 125% increases over 2 years.

Comments are closed.