The Life Code Compliance Committee’s 2023 Follow-Up Inquiry into compliance with obligations for annual notices says life insurers could do more to reduce breaches and states that for on-going non-compliance it will consider imposing sanctions.

In her introduction to the report Obligations for annual notices – a follow-up inquiry, the LCCC’s chair, Jan McClelland says that over the next 12 months, the committee will “…examine the significant non-compliance of several subscribers and monitor their progress in rectifying their systems, processes and procedures to ensure compliance with the annual notice obligations under the Code.”

She says that where it identifies “…on-going non-compliance, we will seriously consider imposing appropriate sanctions.”

McClelland notes that the follow-up inquiry, saw some insurers reduce breaches of obligations to send annual notices “…many having embraced the opportunity to review systems and processes following our 2021 Inquiry. However, we also saw some increases in breaches.”

She says that encouragingly, the content of annual notices improved for many subscribers “…which is a step in the right direction. But we would like to see improvements extend to all aspects of all annual notices, including for off-sale products as well as on-sale products.”

…While it was clear that many subscribers did seriously consider the recommendations, it appears that some elected not to…

She notes too that the initial Inquiry of 2021 made several recommendations “…and we expected, at a minimum, that all insurers would consider them seriously. Ideally, they would implement the recommendations in full. While it was clear that many subscribers did seriously consider the recommendations, it appears that some elected not to.”

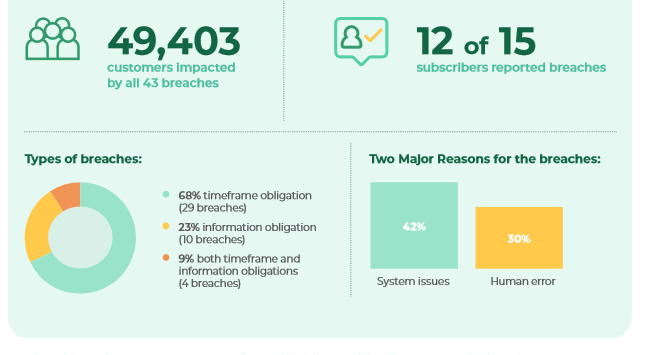

The report says that over the follow-up inquiry period (1 July 2022 to 28 February 2023) there were 43 breaches of annual notice obligations and 17 of these were significant breaches.

The report also highlights that nearly 49,500 customers were impacted by the 43 breaches and that 12 of 15 life insurers reported breaches.

The committee says that with mixed results across the industry, the 2023 Follow-Up Inquiry revealed that breaches of obligations for annual notices remain an issue and subscribers could do more to improve their compliance.

The LCCC was concerned that seven life insurers appeared to not consider the recommendations in the initial 2021 Inquiry.

…One of these subscribers was responsible for 62% of the customers impacted by the breaches identified…

“One of these subscribers was responsible for 62% (30,557) of the customers impacted by the breaches identified in the 2023 Follow-Up Inquiry, and we have commenced a formal investigation into its practices.”

Looking at further monitoring, the report notes that two other subscribers were jointly responsible for 25% (12,620) of the total impacted customers.

“These two subscribers are currently working on agreed remediation plans, and we expect them to adhere to the plans and improve compliance with obligations in the Code.”

It notes it will consider looking into the compliance frameworks of insurers “…that reported breaches despite claiming their processes were sufficient and did not require a review. This may involve the subscribers demonstrating how they considered the recommendations of our initial 2021 Inquiry.”

The committee expects that the insurers that failed to examine their practices in line with the recommendations in the initial 2021 Inquiry, as well as those that continue to report breaches will review their systems, processes and compliance frameworks to improve compliance.

“For persistent inaction and continued non-compliance, we will consider taking further action such as formal investigations and sanctions.

Under ‘Key Observations’ the LCCC says insurers continue to breach the obligations for annual notices set out in section 6.3 of the 2016 Code of Practice, despite the findings and recommendations of its 2021 Inquiry and report.

…most subscribers reported breaches…

“While the majority of breaches can be attributed to three subscribers, most subscribers reported breaches. Our 2023 Follow-Up Inquiry found that too many subscribers failed to:

- Adequately review their processes

- Embed comprehensive regular checks as routine

- Meet both the information and time-frame elements of the obligations.

The report notes that the 2023 Follow-Up Inquiry came about because the committee wanted to examine subscribers’ responses to the recommendations and findings of the 2021 Inquiry and see what improvements had taken place.

It states too that the annual notice is often the main source of information for a customer on their life insurance policy.

Click here to read the full report.

Until we are provided with details of the nature of these “breaches” this report from the

LCCC is a total waste of space. Who are these people anyway?

Name and shame please!

Comments are closed.