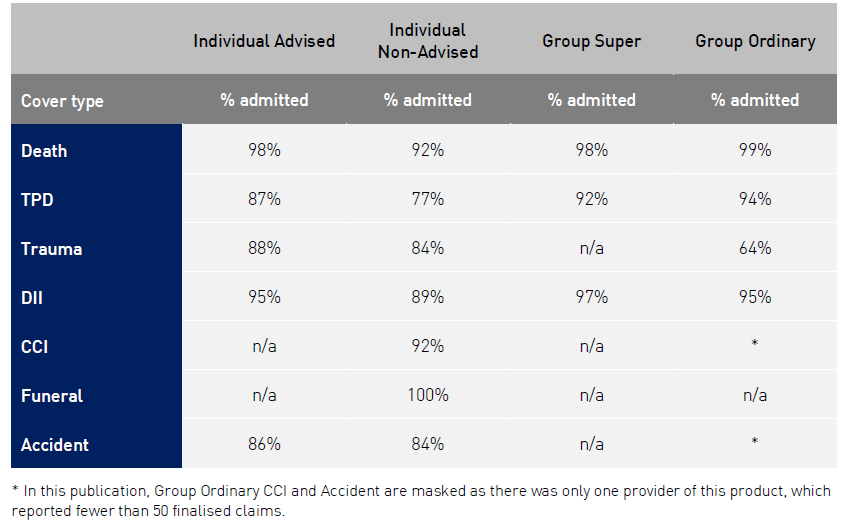

Latest data confirms life insurance policy holders who have financial advisers are more likely to have their claims accepted than unadvised claimants.

This affirmation is contained within APRA’s Life Insurance Claims and Disputes Statistics for the year ending 31 December 2022, in which data reveals the percentage of individual advised claims for Death, TPD, Trauma, and DII all delivered a higher admitted percentage rate than that of individual non-advised claims.

The report notes the reason for higher successful claim rates for advised claimants could be due to the policyholder “…having clearer expectations up front of what is covered by the product, or the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.”

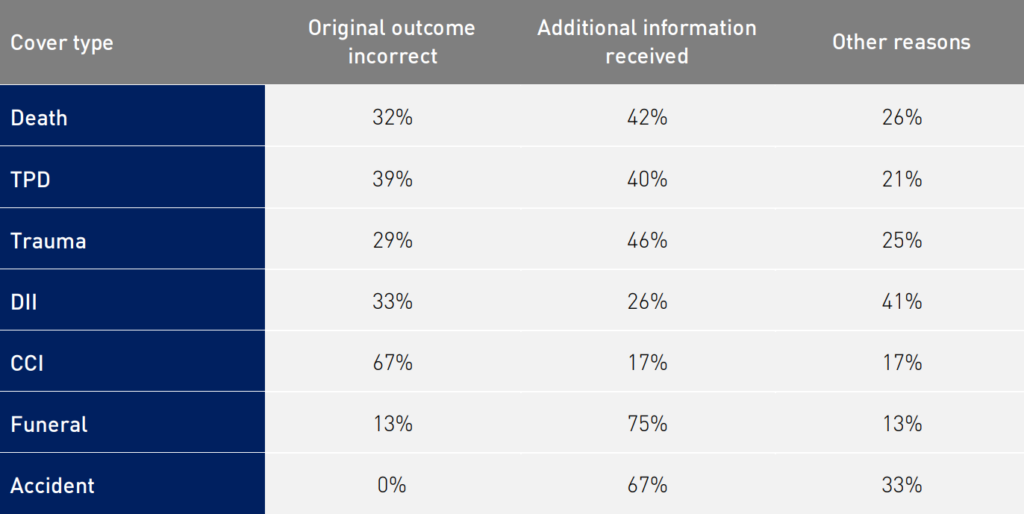

Altogether, more than 15,000 disputes were resolved during the reporting period, with TPD and DII making up the vast majority – 27% and 56% of the total respectively. Three products showed a small number of disputes resolved, namely CCI (199), funeral (665) and accident (218).

Data shows that admittance rates across all distribution channels have remained stable while claims paid ratios for death and trauma have declined. In contrast, the ratios for TPD and DII peaked in December 2020 – before returning to a lower level by December.

Table 6 of the report shows that when it came to death cover claims, 32% of the insurer’s first decisions were incorrect, TPD 39%, DII 33%, and trauma 29%.

For individual products, APRA’s data reveals a sharp increase in the dispute lodgement ratios across all distribution channels since June 2021. It states this has been driven by DII, due to the “…various repricing activities undertaken to address the product’s sustainability issues”.

The report states a ‘dispute’ can refer to:

- A dispute managed within the insurer’s internal dispute resolution system

- A dispute registered with an external dispute resolution scheme or tribunal

- Legal proceedings initiated by the claimant

APRA notes that disputes generally relate to old claims, and even older claim events “…any insurer that has rapidly grown or shrunk its business since then may report dispute lodgement ratios that significantly differ from the ‘true’ underlying experience”.

“This is particularly likely for insurers in run-off, and for the Group Super channel, where the trustees have the option to change their insurance providers every 2-3 years.”

APRA says ASIC’s MoneySmart Life insurance claims comparison tool has been updated with the latest data.