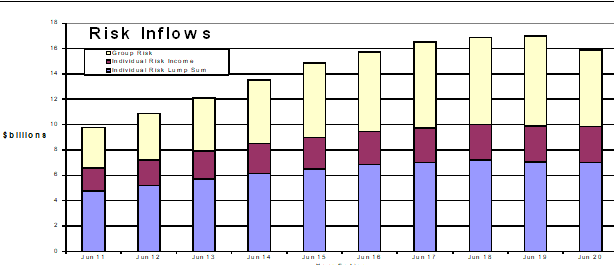

Life insurance risk market inflows were down in the 12 months to June 2020, as were individual risk income and lump sum sales, albeit at a lesser rate than in the March 2020 and December 2019 years.

Plan for Life’s latest Overview of Life Insurance Risk Market Inflows & Sales report found that overall risk inflows fell 6.4 percent in 2019/20 from $17 billion to $15.9 billion.

The company says that most companies reported decreases but market leader TAL (13.2 percent) and ClearView (7.2 percent) posted increases.

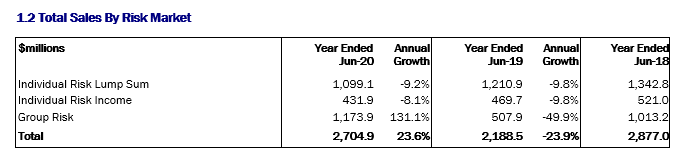

It says that total reported Premium Sales jumped by 23.6 percent, due to a more than doubling of Group Risk sales, “…completely reversing a similarly sized drop that was experienced in the previous year”.

Meanwhile, individual risk income total sales fell 8.1 percent in the 12 months to June 2020, while individual risk lump sum sales fell 9.2 percent.

Meanwhile, individual risk income total sales fell 8.1 percent in the 12 months to June 2020, while individual risk lump sum sales fell 9.2 percent.

However, this compares with a fall in the March 2020 year of 9.2 percent for individual risk income sales and a drop of 10.4 percent for individual risk lump sum sales.

Sales declined even more for individual risk income sales in the December 2019 year, down 14.6 percent, while individual risk lump sum sales were down 20.2 percent for that year.

Plan for Life says that in the latest June 2020 year, new sales in the individual risk income market saw both MLC (9.0 percent) and BT / Westpac (3.9 percent) report higher sales.

For the individual risk lump sum sales, however, all company sales were lower.

i guess no one is really surprised at this. It will continue until the adviser makes that list of A preferences that FASEA and others keep talking about

Comments are closed.