Both the AFA and the FPA have recommended changes to the financial adviser education standards proposal in their submissions to Government and neither organisation supports the proposed 10 years of experience in the past 12 years pathway as is currently proposed.

The FPA’s CEO, Sarah Abood, says in a statement outlining its submission that the proposal made in relation to streamlining the education requirements for financial advisers, “…risks the professionalism journey that financial planners have been undertaking over the past decade.”

She says that while experience is an important factor in competence to provide a professional service to a consumer, “…education is also universally identified as a key component of professional competence.”

…all advisers should be able to say that they are tertiary qualified…

Meanwhile the AFA’s CEO Phil Anderson says in an update to members discussing his organisation’s submission, that the AFA has “…argued that all advisers should be able to say that they are tertiary qualified, and this could be based upon a four subject Graduate Certificate.”

He says the AFA has sought to balance its views “…on the need for greater recognition of prior learning and experience with a range of other factors including a determination to see financial advice recognised as a profession.”

Anderson says it has “…long argued for greater recognition of prior learning and experience” and that it has put forward a proposal that substantially increases the recognition of prior learning.

The AFA explains that the proposal from the Government comprised two pathways. The Experience pathway, with a threshold of 10 years’ experience as at 1 January 2026, which will impact the bulk of existing advisers and the Qualification pathway which will significantly impact the new entrants into financial advice, which is critical for the future of the profession.

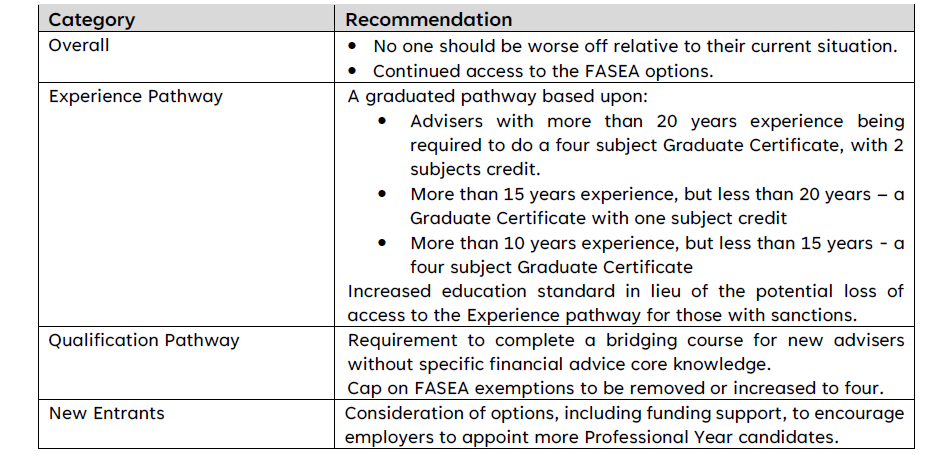

Anderson says the AFA has “…argued that all advisers should be able to say that they are tertiary qualified, and this could be based upon a four subject Graduate Certificate. We have also argued for a graduated approach to the recognition of experience.”

It’s key recommendations are: Abood says in the FPA statement that it’s important to maintain the gains the profession has won and keep the trust of consumers.

Abood says in the FPA statement that it’s important to maintain the gains the profession has won and keep the trust of consumers.

“We cannot return to the days when a planner could technically be qualified with only a two-day course, with no timeframe for that to change. For this reason, the FPA does not support the proposed 10 years of experience in the past 12 years pathway as proposed.”

Abood says the association believes this is an insufficient foundation to meet the objectives of raising the minimum education requirements for the financial planning profession, while also continuing to build consumer confidence in the profession.

…an experience pathway … should only be available for those … aged over 55, with at least 15 years’ experience gained in the past 20 years, and be sunset in 10 years’ time…

“If, however, Treasury plans to move forward with an experience pathway, it should only be available for those professionals aged over 55, with at least 15 years’ experience gained in the past 20 years, and be sunset in 10 years’ time.”

She says this approach would “…reduce the potential for discriminatory impact of the current proposal, recognise the experience of longstanding members, and still allow for a profession with all practitioners being tertiary qualified within a reasonable period.”

However, she adds that in order to make tangible changes to education standards that will benefit the profession, “…the existing framework should broadly be retained, however with added flexibility for more experienced financial planners.

“This will help alleviate pressure being felt by experienced, skilled professional financial planners, but maintain the intent of the framework which requires financial planners to be tertiary qualified.

“It also recognises that many practitioners have already invested substantially in education under the current pathways, and that should be recognised and supported.”

Abood says the FPA believes there is also room for a conversation to be had about specialisation and competency frameworks, as part of the upcoming Quality of Advice review.

Member Surveys

As part of preparing a response to the consultation, the FPA again surveyed members to better understand their views on the proposed modifications.

Abood says that importantly, 83 percent of FPA members have already met, or are on track to meet, the existing education standards “…and a majority of members oppose the proposal made by Treasury in this consultation.

“For the most part, our membership supports an education framework which includes more recognition of prior learning and experience, which we believe FASEA failed to take into consideration sufficiently as part of their legislated framework.

“FASEA got it wrong with its one size fits all framework. Financial planners have entered with a variety of degrees and prior career experience, and they shouldn’t have to restudy what they already know,” she concluded.

Click here for a copy of the FPA submission and here for the AFA’s submission.

The AFA submission also included its recent member survey on the education standards. It’s update to members highlighted:

- 75.5% of respondents do not believe that FASEA provided sufficient recognition for prior learning and experience

- 74.7% of respondents support the provision of an increased level of recognition of prior learning and experience

- The level of support for increased recognition of prior learning and experience varies between 47.8% from those who are already FASEA education standard compliant and 96.4% for those who do not intend to do any further study

- 53.6% of respondents support the Experience pathway as proposed by the Government, however 25% of respondents believe that the Government has gone too far

- The level of support for the Government’s proposed Experience pathway varies between 21.4% from those who are already FASEA education standard compliant to 84.3% for those who are yet to start the education journey, however intended to meet the FASEA Standard

- 22% of respondents believe that the Experience pathway will undermine community recognition of financial advice as a profession

Where do I start?

There will always be a UTOPIAN vision where all is wonderful and the world will sing to the same song sheet, in harmony.

Then there is the REAL WORLD, where the vast majority live.

It is all very well to talk about a grand vision, when that very vision and implementation has caused absolute financial devastation that affects nearly every Australian, where now, after being dragged through the FASEA fiasco and an unworkable maze of complexity that has caused ten thousand Advisers to exit the Industry, the costs to get advice rising dramatically and Life / Disability renewal premium increases of 50% and higher in the last few years, causing anger from loyal customers, there is more argument on how to stymie Advisers again?

Those Advisers who have sacrificed the last few years studying while trying to survive and keep their family intact which has been the biggest juggling act with no applause, are justified in feeling resentment.

However, WE MUST think of what is the best overall solution for all Australians.

In the Life Insurance Advice space, it makes ZERO sense to make it financially impractical to provide advice, which is where the Utopian direction took us.

Investment advice is a different world to Insurance Advice, yet Insurance specialists are subjected to Education mandates that in the vast majority of times, have ZERO bearing on the work they do.

If Australia wants to have a viable Life Insurance Industry, where Australians can get Insurance advice and have appropriate Insurance to meet their needs, then we need to make it viable for Advisers to provide that service.

The current path is a disaster and WILL NOT get better and only get worse, unless it becomes attractive for Holistic Financial Planners to easily bring on Insurance Advice as part of their service.

Most Advisers are finding Life Insurance advice, a minefield and are loathe to get back into it unless a client threatens to leave.

The FPA are once again showing their ignorance around Life Insurance advice and the AFA are more attuned to what risk advisers need.

Though unless risk advice is separated from Investment advice and it is made attractive for Advisers to specialise in Insurance, then the current path of virtually NIL new advisers coming into Insurance Advice and thousands exited and continuing to exit, will make it worse for all Australians.

The Government has made a step in the right direction and I agree with their 10 year experience and clean record to enable experienced Advisers to stay on.

Just as clients should be given the right to choose how they pay for their advice with regards to Life Insurance, they should also be able to choose or retain their Adviser.

The way to administer the Education protocols and allow Australians to decide which Adviser they wish to work with, is to clearly show all the tertiary qualifications advisers have attained, in conjunction with their years experience and ongoing training register and only allow Advisers to provide advice in the areas they are capable.

Life Insurance Advice does not need University degree qualifications, though the current new Adviser entrance regime is causing Adviser numbers to collapse in the Insurance space, so what benefit is this providing to anyone? ZERO.

IF WE DO NOT STOP THE OUTFLOW OF RISK ADVISERS AND DO NOT SOLVE THE CURRENT ISSUE OF NIL NEW RISK ADVISERS ENTERING THE INDUSTRY, THEN ALL THE UTOPIAN VIEWS AND OPINIONS COUNT FOR NOTHING, AS THE RETAIL ADVICE LIFE INSURANCE INDUSTRY WILL COLLAPSE.

SPOT ON as usual Jeremy. What you’ve said above, especially about risk advisers, you and I and the other venerable advisers on these pages have trumpeted for years. I’m only just starting to see that anyone who is anybody capable of fixing it has left the building and not coming back. No entities like life companies (go figure!) or investment companies, govt plebs or special interest groups want to hear the truth (as you’ve beautifully laid out above). I’ve left the ‘game’ now but my heart and spirit will probably always hurt for what ‘could’ have been in our once-magnificent industry. Sadly, I’m convinced it will never happen, that’s why I left.

Comments are closed.