The level of life insurance purchased online from insurers has increased by more than 100 per cent in the last five years with around 350,000 policies sold via this channel in 2017, according to research released by Roy Morgan.

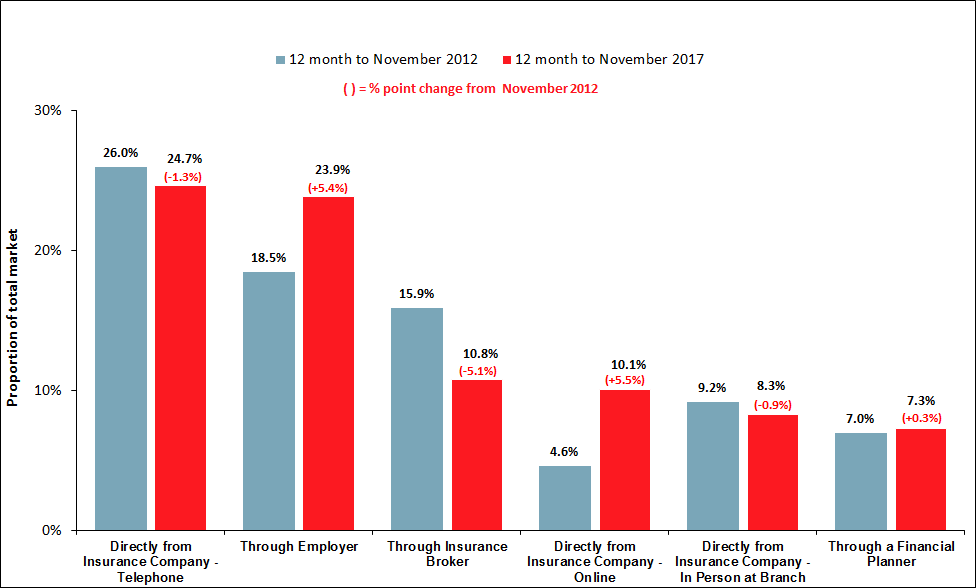

The research compared the 12 months to November 2017 with the same period in 2012 and found that online sales now accounted for 10.1 per cent of purchases, or 349,000 policies, compared to 4.6 per cent, or 168,000 policies, in 2012.

Direct contact with a life insurer via the telephone has remained the dominant method by which life insurance is purchased with around of quarter of polices (24.7 per cent) purchased over the phone, a figure which has dropped marginally from 26 per cent in 2012.

Insurance purchased via an employer, that is within a superannuation or group life arrangement, is the next most common way of purchasing life insurance, according to Roy Morgan, accounting for 23.9 per cent of policies sold, up from 18.5 per cent in 2012.

Areas where the level of purchases declined over the past five years include via an insurance broker, which decreased from 15.9 per cent in 2012 to 10.8 per cent in 2017, and directly from an insurer’s branch office, which fell from 9.2 per cent to 8.3 per cent.

Financial advisers gained a small measure of territory accounting for 7.3 per cent of policy sales…

Financial advisers gained a small measure of territory accounting for 7.3 per cent of policy sales, up from 7 per cent in 2012.

Roy Morgan, Industry Communications Director, Norman Morris said the acquisition of life insurance by consumers was “facing a major transformation or disruption, moving away from the more traditional insurance broker (or life insurance salesman) towards purchasing online as well as moving more to the employer, where it is generally combined with superannuation.”

“However, the shift to online is even greater than these numbers suggest. Among those who have taken out a new policy or changed their policy or insurer the incidence of online is much greater,” he said.

Roy Morgan said demographic based purchasing patterns emerged from the research and that higher income groups showed a greater preference than lower income groups for using financial planners, insurance brokers and online when purchasing life insurance. Lower income groups preferred to purchase insurance in person or via telephone.

Men were found to have a greater preference for purchasing life insurance online, in person and through insurance brokers compared to women who preferred to use financial planners or purchase via the telephone.

The findings were drawn from Roy Morgan’s Single Source survey of over 50,000 consumers per annum, with around 9,500 people responding to questions related to life insurance (see table).

Source: Roy Morgan Single Source Survey. 12 months to November 2012, n= 9,562; 12 months to November 2017, n= 7,632 Base: Australians 18+ with Life Insurance.

If you have a budget big enough to keep putting this “crap” in front of Mr and Mrs “joe average “ eventually some of its going to stick

Sweet young actors and actresses portraying life and it’s numerous situations and how a simple phone call can fix everything !! Really no Medical’s no blood test no care full stop

If these adds are not misleading than show me one that is?

And when the “fine tooth comb” comes out at claim time and some obscure previous issue is deemed to be pre existing and the claim is denied who is responsible ? Not the salesman ( they are not even close to advisers) because it was pushed onto the client under the disguise of general advice

Don’t see any best interest duty here accept to the shareholders

What amess this has become and getting worse

Comments are closed.