The life insurance industry needs to move away from the ‘insurance is sold not bought’ approach if it is to succeed in the new world of the consumer, Swiss Re has advised.

The global reinsurer recently released the findings of its latest ‘Sigma’ study, which revealed that clients do not want to be sold to. Instead, the research found that empowering consumers to make informed decisions will be the key to success for the life insurance industry in the future.

The modern customer prefers to research options and make proactive buying decisions

According to the report, today’s tech-savvy consumers are empowered by easy access to information, which makes them more proactive and independent in their buying decisions. The modern customer prefers to research options and make proactive buying decisions, based on objective information from unbiased sources and trusted peers.

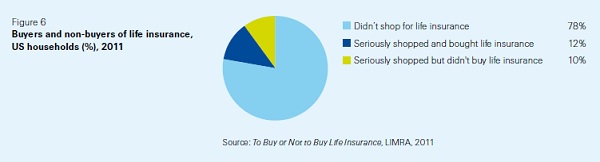

However, the issue for insurers and insurance advisers, said the report, is that the majority of consumers without cover have simply never actively ‘shopped’ for a life insurance policy.

Swiss Re offered the following chart, representing the results of a 2011 US study, as an example of the extent of the lack of consumer engagement with insurance:

In order to boost customer engagement and encourage buying behaviour, Swiss Re gave a number of recommendations to the insurance industry:

Simplify and innovate product design

Product simplicity and transparency are key desirables for consumers, said Swiss Re. The reinsurer suggested insurers consider offering simple, transparent products, tailored for every stage of the consumer lifecycle.

One of the other issues facing the Australian market is the proliferation of add-on features and options, which Swiss Re said have sometimes been created without the insurer first having ascertained whether customers are willing to bear the associated costs, or even that they see any value in the different options. The reinsurer recommended further analysis of product design to determine the appropriateness of the benefits available and consumers’ willingness to pay.

Product simplicity and transparency are key desirables for consumers

To overcome one of the obstacles in the buying process – a drawn-out application timeline – Swiss Re advocated for a greater use of electronic underwriting and sophisticated behind-the-scenes, predictive technology.

Improve communication and customer education

A regularly cited barrier to the take up of insurance is a lack of education or understanding of the products available. Swiss Re suggested using simpler language within contracts, and promoting the value of insurance through claims case studies to improve consumers’ ability to self-educate.

The reinsurer also recommended collective, coordinated communication and education programs to inform people about the role and importance of financial planning, life insurance, and risk mitigation. ‘Education in schools and at the workplace could improve financial literacy and thereby empower individuals in their decision making with respect to life events’ Swiss Re said in its report.

Innovation with distribution platforms

Swiss Re argued that with the growth of the internet and mobile technology, the buying process will become increasingly two-staged: ‘First consumers will gather information about products, prices and brands from online comparison websites and their peers. Then they will make the purchase face-to-face with a sales representative of an insurance company, a broker or adviser, or a bank.’

‘Moreover,’ the reinsurer said, ‘life companies will be benchmarked against their competitors in social media and on comparison sites. This will increase competition and put companies with large sales divisions or expensive remuneration agreements with brokers under pressure. As a result, sales staff will increasingly be challenged to justify their value added. At the same time, the multichannel distribution model will gain in importance.’

Improve long-term relationships

According to Swiss Re, social media will likely play an important role in improving long-term relationships between insurers and their customers. ‘Good ratings and many “likes” not only help to attract new consumers, they also help to retain clients,’ the reinsurer said.

…life companies will be benchmarked against their competitors in social media

Insurers would also benefit from engaging customers more regularly, for example, at particular trigger points in the consumer lifecycle.

In addition, Swiss Re argued that there was plenty of room for product innovation that fostered loyalty, including value-adds which go beyond the traditional premium payment in return for a policy approach.

Close the consumer knowledge gap

Finally, Swiss Re said that there was a significant opportunity globally for insurers to become more in touch with their customers. This could be achieved by utilising existing data to identify life stage triggers and patterns in insurance buying.

More research is also required to determine why consumers do, or don’t consider buying life insurance. Swiss Re used behavioural economics to analyse trends for its report, and recommended this approach to insurers as a way to identify and eliminate key obstacles in the buying process.

To view a copy of the full report, click here.

agree, the opportunity presents to improve the understanding that consumers have about life insurance – to decrease the complexity – to simplify the product and the process involved in getting insurance – and tailor the message and communication of all of this so that it actually means something – that there is a tie in to enabling customers to see how getting the right insurance cover actually contributes to the clients life ……everyday….not just when things go wrong

Great research and long over due.

Insurance is sold not bought has been the mantra of the industry for way too long, in our modern society if people are sold to, they get buyers remorse and end up with a bad experience and lapse their policies.

The new mantra should be “People don’t like to be sold too, but people love to BUY!”

And they do, people love to buy. Look at all these online stores doing a fantastic trade.

An advisers role to to help people buy, show them the way to the right decision about insurance. This way there will be no buyers remorse, and lapse rates will eventually come down.

Too often we put the marketing of tangible and intangible products in the same boat. They are not. The key to client engagement is for the insurance companies to create “tangible” value for the buyers.

We are talking about issues such as “no vision of mortality therefore no need” for the younger buyers and misalignment between levels of insurance actually required and what the buyer thinks is needed.

The stats are very interesting . In a nation like USA with very high internet usage the people who have never shopped for insurance is significant. What does it tell us? Don’t throw the sales force or adviser force out quite yet . We have a long way to go to convert this intangible into a tangible.

For many people they see insurance as a necessary evil: a bit like a prostate exam . Some would argue with similar characteristics. This will be an interesting journey.

Paraphrasing Rumsfeld, ‘there are things we know, there are things we don’t know and there are things we don’t know we don’t know’. The average punter falls into the 3rd category when it comes to understanding insurance. They still think that a policy that covered death is enough, and before doctors began extending our lives after being diagnosed with a life threatening condition that was about all you needed. At the other end of spectrum we have the words of Dr Marius Barnard, ‘we should insure because we are going to live, not suddenly die’. I think the stats for those with mortgage debt having trauma insurance is around 14%. Compare this to my clients with debt; it’s close to 100% who have trauma insurance. Do you think the same group would all have trauma insurance by just doing their online research? I might add I just don’t do a fact find and throw a product at them. With my input they are just as concerned about losing their homes because of cancer as they are because of fire. So in my opinion I believe that insurance is sold and before it is bought. Go and ask a guru like Russell Collins if you find that an unpalatable comment.

Great input Mark. Spot on.

Great contribution Mark.

However, I think that your clients are still not being “sold” insurance.

You are undertaking a risk management exercise with them. You identify and quantify their risks and suggest a solution for managing those risks. They then buy the solution.

Having got to know the virtual Mark T, I am quite confident that you wouldn’t sell a client a policy that they didn’t need.

Hi Mark,

Well said. I also think that there is too much emphasis put on the term sold in this old saying. Realistically, the theory behind this saying, in my opinion, is that the average punter doesn’t wake up in the morning and think to themselves, I think I will go out a research all of the personal insurance options I have. It takes a professional to educate and advise them of their options and help them discover their needs. The decision is then in their hands.

If this article was not so serious, I really would have to laugh. I find it quite incredible and ironic that a Reinsurance company of all institutions is now telling us that life insurance should be “bought and not sold!” Reinsurance companies have effectively dictated terms and conditions of insurance acceptance for decades without “getting their hands dirty at the coal face” and here is one now telling us to change our thinking in the way those are at the coal face should go about acquiring new business. All the research in the world will never convince me that life insurance is or should be “bought” and not “sold” by consumers…….and in nearly 30 years as an advisor, I for one have never had anyone walk in off the street and want to “buy” life insurance. Borrowing a catch phrase form Grahame Evans, I see reinsurance companies as a necessary evil and if Swiss Re is really serious about their beliefs from this research, let us see them expand their licence so they can put them into practice.

Dont we have an under-insurance problem in this country ?.

Hands up those advisers who meet clients with a $500k mortgage, 2 kids at school, a part time spouse, and $350k D/TPD in an ISN fund

These people are constantly exposed to the ISN marketing mailouts, listen to David Koch , use on-line calculators and are sick to death of Paul Mercurio direct insurance ads

They have the info, they still need assistance to buy

The advisory skill needed is, as it always has been, to convince the client that they are making the correct decision

Thats called salesmanship ! And it will always be necessary

If we just take the clients order, after he has consulted an ” un-biased source ” ( no such animal ) how exactly are we acting in our clients best interests

The courts regard advisers as the ” professionals “. Letting the client set the agenda is not being professional

Now I understand why people are underinsured! The concept that people will buy when they are educated is a great theory but … it does’t seem to work.

In my experience online shoppers research ‘price’ but have little understanding of ‘need’.

The above comments are all good. As is the research from Swiss Re. That said, it’s very likely that the researchers have never sold a single thing in their lives, much less life-risk insurance.

Yes, we need to move with the times and innovate accordingly. Even so, balance is appropriate. We still need the communication skills to engage with clients and a long way farther up the road communication skills to engage with prospective ones.

With such skills we can BRIEFLY and succinctly detail what a life-risk policy will do for a client. They really don’t need to know from A to Z about it. So in that respect nothing has changed – we still sell benefits, not features.

I agree with a lot of the comments here, I’ve never had a client rock into my office begging me to help them to buy a big bunch of insurance. Life insurance is not a tangible product; you can’t pick it up and take a bite to taste if it suits your palate. However, by the time the client knows they need it, it’s almost impossible to get it for them and worse, if their apple was full of worms, it’s probably also too late to fix.

Ultimately Life Insurance is the by-product of an affluent society, in that if we weren’t so affluent and had little to lose, it’s completely unnecessary. This in itself makes the product confusing simply because we’re not all identically affluent. We all have different needs and different goals.

The research is great and does offer some quality insights, however I feel that it’s addressing the wrong end of the issue. We as an industry need to change the way we’re approaching and presenting Life Insurance altogether. Do you judge a Doctor by the pills that he prescribes you or the outcome of his advice? Do you even accept or follow all of the advice that your Doctor gives you? Importantly though, do you care how much he or she charged you if they get it right or is the cost only a concern when they get it wrong? This is a value proposition, not a price comparison. How many people refuse to buy a generic medication “just in case” it’s not as effective? I would hazard a guess that it’s about the same number who complains about the cost of their treatment after they’ve been saved or cured rather than before.

You don’t know what you don’t know so an “online comparison” site can only compare the tangible items which are price or benefits. This dangerous at best simply because price is not directly related to value or quality and no two benefits are identical. The rise in Direct Insurance take-up is a quality example of this problem. Does “Joe Public” know that he isn’t covered for an existing condition and that in a lot of cases it doesn’t even matter if he didn’t know that it was pre-existing? Not at all; and how is Joe going to find this out by comparing prices online in between arguing with his 2.4 kids and watching the telly? How will Joe find out that he needs to insure himself to live rather than to die or that he is more likely to have a heart attack than have his house burn down around him. How is he to understand that the heart attack will actually be more costly and more devastating for his family?

Promotions such as “if we can’t beat your current quote” we’ll give you $50 seem to proliferate the concept that “cheap is good” and “cheapest is best.” We shouldn’t even compare life insurances with general insurances because it’s too important, but does Joe Public know this? If I get my car insurance wrong to save me $50 then at worst it costs me a few bucks to fix and I won’t do it next time. There is no next time with Life Insurance.

Ultimately quality advice is the answer, but we’re now so regulated that what is already a difficult and complex subject which is met, in a lot of cases, from the viewpoint of an Ostrich has become unbearably cumbersome and painful to the people it’s supposed to protect and help. No wonder Joe Public is keen to pick “a quick and easy solution” with a direct product. The issue here is that the regulators appear to be equally naive and ill-educated as they appear more focussed on churning and excessive commissions rather than quality advice or education. Don’t get me wrong, there are some serious issues here that need addressing but I believe that a semi-informed customer “self-buying” is significantly worse and current regulations appear to be encouraging this outcome rather than addressing it.

So yes, modern day buying trends and growth of social media should lead us to a conclusion that clients will buy rather than being sold, but that doesn’t make it a good solution or direction. They buy jewellery and clothes and research cars and houses but these things are all tangible. They don’t research 100+ page PDS’s to decide that this is a better structured Heart Attack definition or better partial disability definition. What is the definition of “simple, transparent products, tailored for every stage of the consumer lifecycle?” Tailored automatically says “personal” not generic. However, no matter how “simple” the product becomes, simplicity will never convince a client of the need for protection or the need to investigate quality protection which is tailored to their specific needs and circumstances.

It means that we as an industry need to evolve our selling practices and professionalism to match client’s needs and we need to separate ourselves from products specifically. We need to become practitioners, not order takers providing the cheapest product available within the search specifications of an online search engine. We need desperately to increase customer education, product transparency, innovation and design in line with our evolving market and trends. We also need to significantly increase the profile, trust and perception of the industry above the current “read the fine print” and “insurers never pay” attitude.

Encourage social media to benchmark life companies against their competitors, but not on price, on claims and customer outcomes. Encourage Social Media to also bench mark the practitioners but separately because the product should only ever be the answer to the problem and it should be prescribed personally and carefully as every answer is as different as every client’s problems. And while a life insurance policy may be “bought” by a customer, life insurance advice will always be sold because we’re not selling a product; we’re selling an intangible concept that is different for every person we sell it to. This is why I believe that there is significant risk for our industry with Direct Insurance and in utilising Super to fund insurance premiums because we are already being; and will continue to be; judged as an industry group, both product and practitioner, on the outcomes of the advice that we give, not how cheap the pill was that we prescribed.

I am impressed with the feedback from every one and Rob, your input would have taken a long time to put together.

Well thought out input from Advisers can make a difference to our future and it always gives me hope when I see constructive criticism blended with strategies to fix problems.

Keep it up everyone and have a great 2014.

Comments are closed.