A new book launched by life industry senior statesman, Russell Collins, has been welcomed by industry stakeholders as a ‘must have’ for any risk-focused financial adviser.

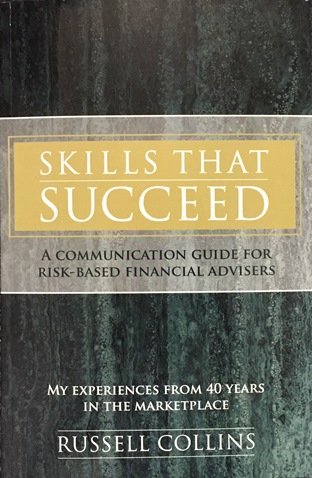

Formally launched in Sydney last week, Mr Collins’ book, called Skills that Succeed: A Communication Guide for Risk-based Financial Advisers, delivers the wisdom gained by Mr Collins during his 40 years as a risk-specialist financial adviser.

In an advice era dominated in many ways by regulation and compliance, Mr Collins’ message to his peers reminds them that, to succeed in the mission to help protect every-day Australians with life insurance, modern advisers need outstanding communication skills.

Speaking to his fellow advisers at the book launch, another long-standing life industry colleague, Godfrey Phillips, suggested this book should become an almost compulsory text for any advisers seeking to provide quality life insurance advice to their clients. This endorsement was supported by AFA President, Deborah Kent, who said the practical information the book provides around communication will help advisers succeed in the changing advice landscape. “Every new adviser should read it and every existing adviser should read it. It provides a legacy of knowledge for the future of the life industry in this country.”

The content of the book deals with two inter-related elements, namely communication and process, and how these two elements are inextricably linked. For example, Mr Collins shares with his peers how the simple file note process can act as a critically-important communication tool, and how this can be used to set the adviser and client on a path to a long-standing and mutually beneficial relationship.

The content of the book deals with two inter-related elements, namely communication and process, and how these two elements are inextricably linked. For example, Mr Collins shares with his peers how the simple file note process can act as a critically-important communication tool, and how this can be used to set the adviser and client on a path to a long-standing and mutually beneficial relationship.

I do not believe that selling and professionalism are mutually exclusive

In supporting the industry’s move away from product-based to advice-based financial solutions, Mr Collins noted, “People buy advice first and product last and there is daylight inbetween.” But he added it was ironic that, in an effort to meet compliance obligations, advisers are being taught more and more technical skills and developing greater product knowledge at the expense of relationship and communication skills: “This approach appears to stem from an unnatural fear that communication skills are about selling and that selling is not professional. I do not believe that selling and professionalism are mutually exclusive and unless advisers improve their communication, relationship building and selling skills, our underinsurance problem will only worsen.”

Riskinfo has previously released two articles based on extracts from Mr Collins’ book:

Click here to order a copy of the book or to learn more…