Researcher DEXX&R reports discontinuance rates for both individual lump sum and disability income products are continuing their downward trend.

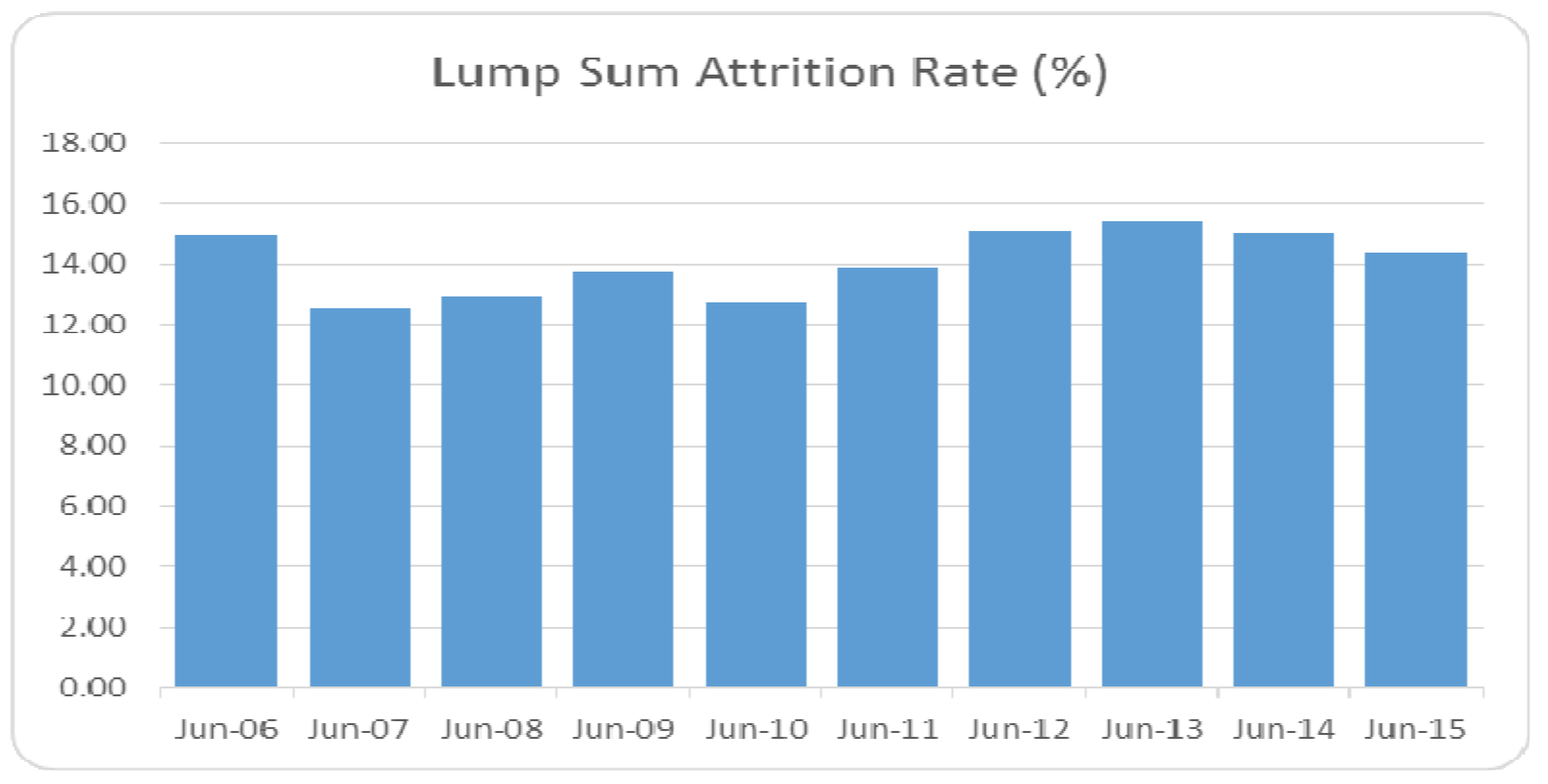

The firm says analysis of its database on discontinuance rates, which dates back to 1985, indicates that policy discontinuances move through a four or five year cycle. In its June Quarter 2015 release, it reports individual lump sum discontinuances have increased each year since 2010, peaking in June 2013 at 15.4 per cent. However, the researcher reports that in the 12 months to June 2015 the discontinuance attrition rate fell to 14.4 per cent:

“While individual company experience varies, the industry attrition rate for Lump Sum Individual Death, TPD and Trauma business has been falling for 8 consecutive quarters,” says the report.

…this downward trend will continue for another two to three years

DEXX&R reports similar trends for income protection products, where the rate for disability income business decreased from 14.9 per cent at June 2014 to 14.0 per cent as at June 2015: “As with lump sum business there is now a clear trend of decreasing discontinuances in the Disability Income market,” says the researcher, which added that, based on previous cycles in the thirty years it has maintained its database, it expects this downward trend will continue for another two to three years.

![[INSERT LUMP SUM DISCONTINUANCE (Attrition Rate) CHART]](https://riskinfo.com.au/news/files/2015/09/Screenshot-2015-09-22-09.22.20.png)