- Yes - but I don't support the remuneration proposals (41%)

- No (35%)

- Yes - and I support the remuneration proposals (12%)

- Not sure (12%)

Our latest poll results indicate adviser attitudes have changed little in the fourteen months since the release of the new Life Insurance Framework reform proposals.

Responding to our question on the commercial realities implied in the remuneration component of the proposed Life Insurance Framework reforms, 41% of those taking our poll have said that, despite disagreeing with the proposed reforms, their advice business could successfully operate under the new 60/20 remuneration structure. An additional 11% support the reforms and have indicated they could also operate under these new reduced commission arrangements.

More than one in three advisers (36%) say their advice business could not operate under the LIF remuneration reforms, while 12% remain undecided.

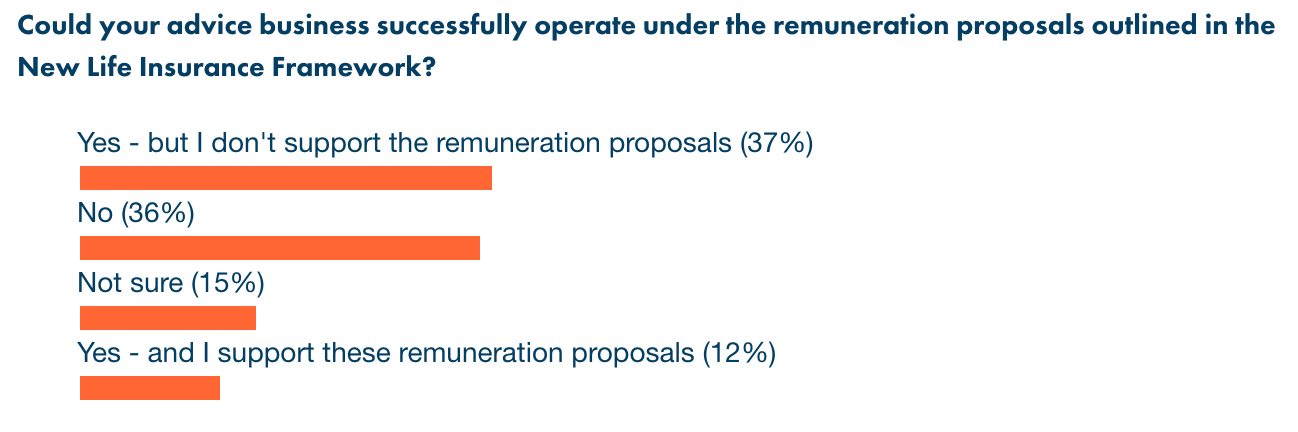

These results almost mirror the outcome of the same poll question we put to you in the first two weeks of July 2015. Here’s a snapshot of the poll results then:

Comparing the results from July 2015 with today’s poll at the top of this page, the only movement has been a small reduction in those who are unsure as to whether their business will be able to make the transition, and a small corresponding increase in the proportion of advisers who believe their business will remain viable.

Comparing the results from July 2015 with today’s poll at the top of this page, the only movement has been a small reduction in those who are unsure as to whether their business will be able to make the transition, and a small corresponding increase in the proportion of advisers who believe their business will remain viable.

Feedback from one adviser has questioned the validity of the poll, or at least the relevance of its findings, due to what he sees as a skewed participation:

“There is a major flaw with this poll, in that it has been open to Financial Planning practices that offer a broad spectrum of Financial Services…This does not allow life insurance only advice practices ( who will be the most severely affected, ) to gain a proper voice and dilutes the poll to a set of percentages, with little analytical study from risk specialists, who are the only ones who fully understand the real impact.”

The same adviser, Jeremy Wright, also offers a neat summary of what he sees as a government policy (the LIF reform proposals) intended to serve the life insurance interests of consumers, but which ultimately has an opposite effect:

“It is a self fulfilling prophesy when on the one hand, everyone screams under-insurance, then makes it harder for advisers to provide quality advice to remedy the problem.”

Note to Advisers:

We welcome your comments and in the interest of fairness, request that you properly identify yourself either in your post ID or at the end of each comment.

Jeremy Wright makes an excellent point. The poll could have been expanded to ask for the status of the person responding (risk only, mixed, no risk).

Comments are closed.