New premiums for Individual Death, TPD and Trauma Business have continued to fall marginally in the past 12 months according to Dexx&r, which has reported a drop of 0.7% in sales in these areas for the year to December 2016.

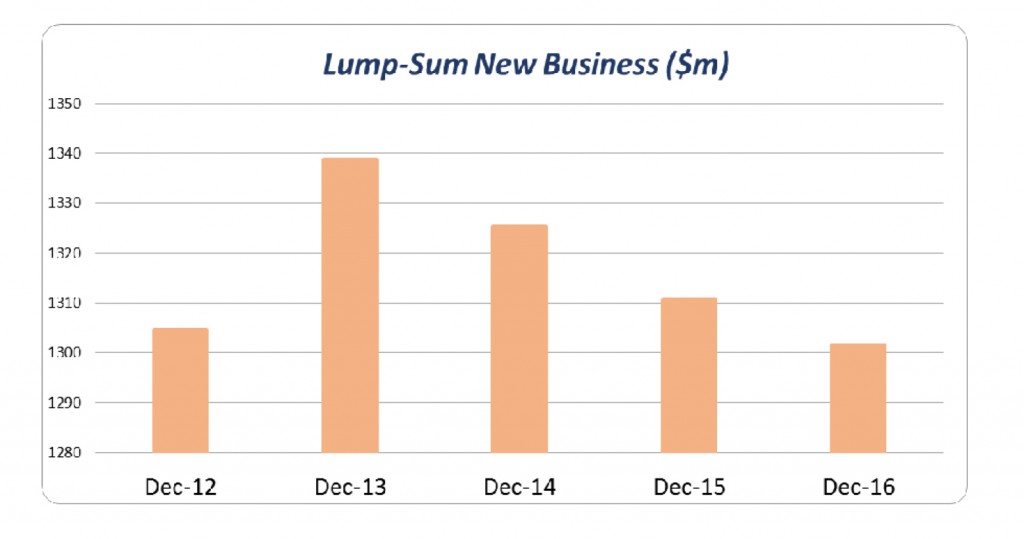

The drop is the third consecutive annual decline from a high of $1.325 billion in 2013 with the total of lump sum new business equaling $1.3 billion for 2016, down from $1.31 billion for the year to December 2015 (see table below).

Dexx&r released the numbers as part of its quarterly Life Analysis Report stating that only two life insurers – MLC and Zurich – have recorded an increase in sales in each of the past three years.

The researcher stated that lump sum new business also fell during the December 2016 quarter, after two consecutive quarters of growth, with a decrease of 10% to $336 million, which was 8% higher than the December 2015 quarter which recorded sales of $310 million.

Individual Lump Sum Discontinuances continued to fall from their December 2012 peak of 15.8% settling at 13.3% at December 2016, placing the rate on par with the December 2009 quarter, with Dexx&r stating this decline would offset the stagnant growth in sales and have a positive impact on life

company profitability.

“The continued fall in Lump Sum and Disability discontinuance…indicates that the industry is improving retention…”

Disability Income sales were much stronger than Individual Lump Sum with a recorded increase of 8.7% to $521 million, up from $479 million in December 2015, and with six of the top ten insurers posting an increase in Disability Income new business over the twelve months to December 2016.

Sales for the December 2016 quarter were also up compared to the previous two quarters with a 2.1% increase to $137 million from the September 2016 quarter, which was a 16% increase when compared to the December 2015 quarter.

Disability Income Discontinuances, however, fell only slightly from 14% at December 2015 to 13.8% at December 2016.

“The continued fall in Lump Sum and Disability discontinuance rates during both periods of growth and flat or falling sales indicates that the industry is improving retention with a commensurate improvement in profitability,” Dexx&r stated.