- Yes (72%)

- No (20%)

- Not sure (8%)

Our latest poll asks you to consider whether new data now publicly available on life company claims comparisons may impact your future choice of product solution for your clients.

This conversation stems from the release of APRA’s 2018 Life Insurance Claims and Disputes statistics which provides a comprehensive, dispassionate analysis of how each of the retail insurers, among others, is tracking on key claims metrics (see: APRA Releases ‘World-Leading’ …Claims Data).

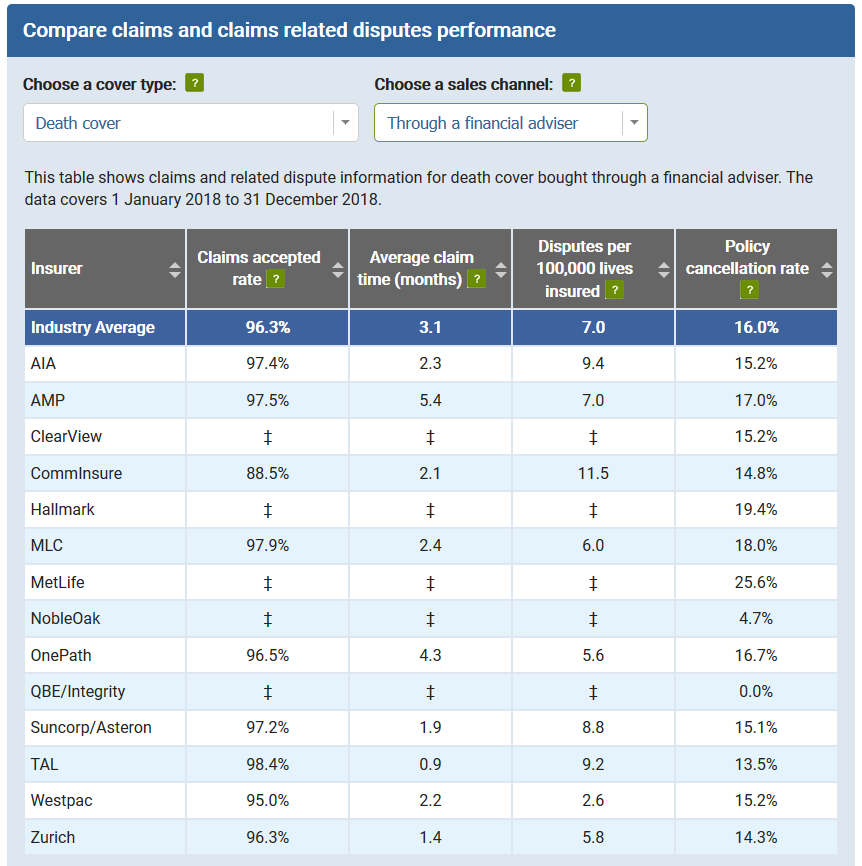

Available on ASIC’s MoneySmart website (click here), life insurers are compared across cover types and distribution channels, including the advised channel, on key metrics including:

- Percentage of claims accepted

- Length of time taken to pay claims

- Number of disputes

- Policy cancellation rates

Here’s an example of the information available on the MoneySmart website, where the comparison tool only reports data where there are enough insurers and finalised claims to provide a reliable comparison:

To what extent might this information, promoted by APRA and ASIC as ‘world-leading’, impact your decision-making on product selection for your clients?

Tell us what you think and we’ll report back next week…

I really don’t see how current claim payment rates, time frames or disputes is relevant to clients and the advice provided today. Life insurance is a long term product. Decades long.

I’m not making long term protection recommendations based on a company’s fluctuating operational performance today. The insurers are all bound by the life code and the staff turnover and M&A within the industry is such that staff and management responsible for today’s good or bad experience at insurer A will likely be at insurer B or C next year or in several years time.

In my view, the information really is not relevant to the majority of clients who thankfully will never need to claim, or to those who may need to claim in several years time.

Comments are closed.