Satisfaction with risk and life insurance continues to fall, according to new research from Roy Morgan.

The findings from Roy Morgan’s Single Source Survey (Australia) show that satisfaction with risk and life insurance has fallen to 64.6 per cent in July 2019, down from 65.6 per cent in 2018 and 68.4 per cent in 2016.

These levels place risk and life insurance as having the lowest satisfaction of all major household and personal insurance types, including general and health insurance.

The research found how Australians obtain risk and life insurance is becoming increasingly fragmented – with insurance companies, insurance brokers or agents, financial planners – either independent or working for a financial institution, accountants or employer via superannuation all provide insurance to Australians.

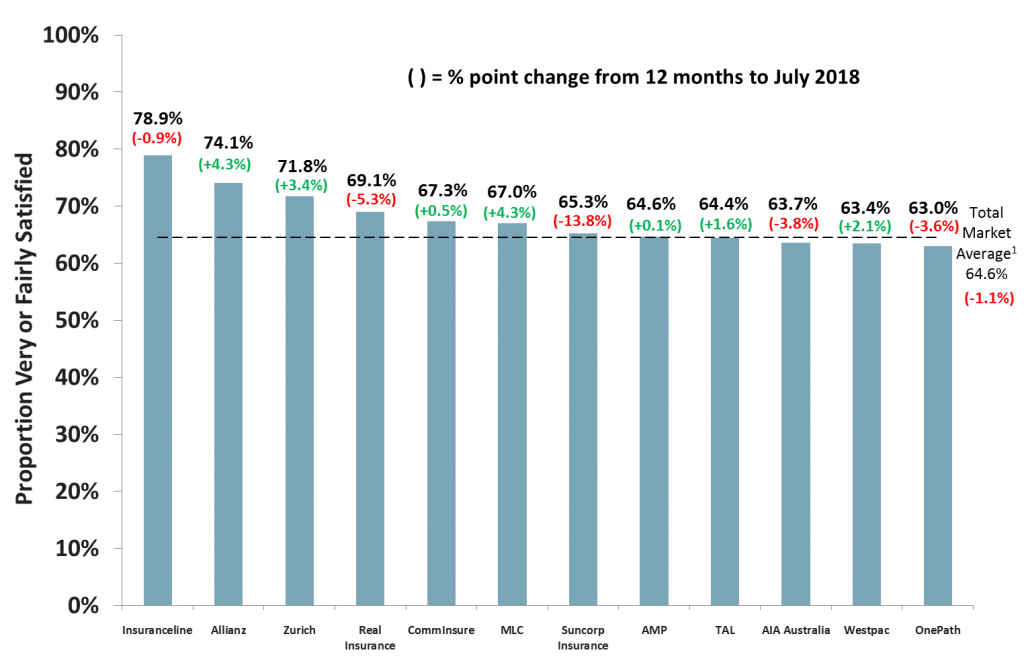

Among satisfaction ratings in the year to July 2019, Insuranceline topped the ranks with a satisfaction rating of 78.9 per cent ahead of second placed Allianz (74.1 per cent) and Zurich (71.8 per cent).

Although overall satisfaction with risk and life insurance declined over the year, some companies showed improvement, with Allianz and MLC increasing the most (up 4.3 percentage points) followed by Zurich (up 3.4 percentage points) and Westpac (up 2.1 percentage points).

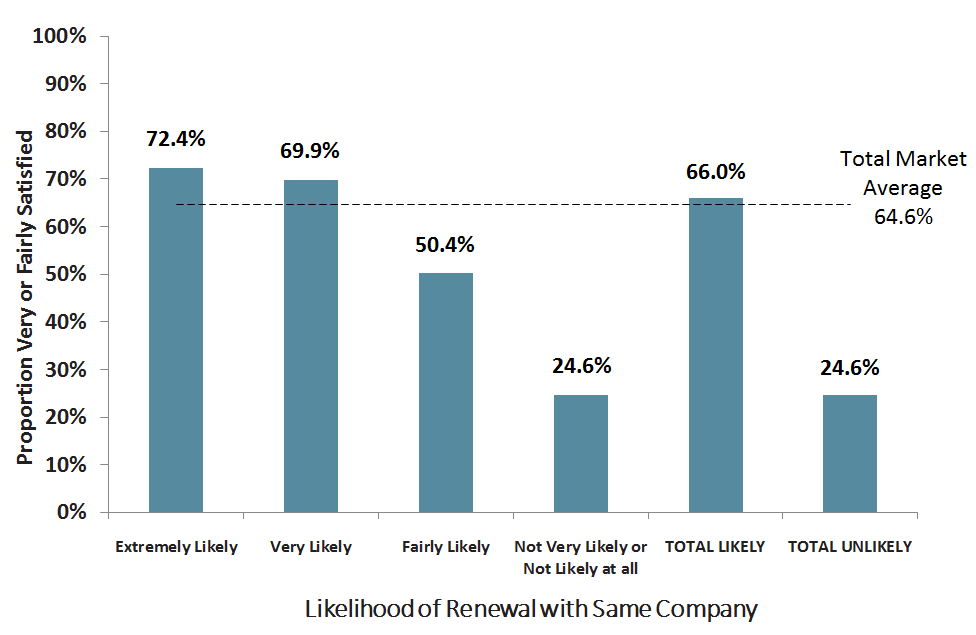

The research also indicated that satisfaction improves likelihood of customer retention. Policy holders that say that they are ‘extremely likely’ to renew their insurance with the same company have a satisfaction rating of 72.4 per cent, well above the market average of 64.6 per cent.

Roy Morgan CEO, Michele Levine, says, “…the use of insurance brokers and financial planners remains an important channel to purchase risk and life insurance which now accounts for around 17 per cent of the market, but thi s is down from 21.3 per cent three years ago.

“The use of these third parties to purchase risk and life insurance has the potential to take the customer relationship away from insurance companies and as a result they are likely to have less control over satisfaction and retention levels.”

Levine added: “These results also indicate that fewer Australians are taking out risk and life insurance, 199,000 in the past year down from 236,000 three years ago. This is likely to lead to a smaller market over time if this trend continues.”

The Roy Morgan Single Source Survey is based on in-depth personal interviews conducted face-to-face with over 50,000 Australians per annum in their homes, including around 10,000 with risk and life insurance policies.

‘Satisfaction’ you say? Insuranceline? Insuranceline doesn’t face the compliance behemoth that we do! Their website says ‘Simple Claims Process. Flexible Payment Plans. Apply in Minutes’. It’s easy to deny claims first up with minimal application info, so that’s simple. Apply in minutes, ask few questions, issue the policy and then deny the claim. Again, as our furry little friend says – ‘simples’.

“The use of third parties to purchase risk and life insurance has the potential to take away customer relationships with the companies???” Are you serious ?? Without advisers there would be no companies !! We chase up claims settle clients down and find alternative options when the insurance companies decide its time for a 20% hike in premiums and more than once recently ( with the usual excuse its claims experience) review their covers explain definitions assist accountants and solicitors with providing tax information or structures to fit into buy sell or key man products etc etc etc and usually at no additional cost to the client . And then wear a 60% claw back if the client decides it’s too dear or the partnership has folded and the cover is no longer required

Who wins at this certainly not the adviser

Isn’t it time some of you idealistic information studiers formatted some realistic information into your reports

Who on earth are you asking about these issues???

Anything simple always gets the tick of approval ( insurance line Real insurance etc with minimal or no investigative questions) and then there is suddenly a claim and guess what We are not paying as that’s a pre existing condition ?? Forgot to tell you about that ! Oh I remember we don’t have too !!! We are not subject to the same rules as advisers!

One last thing on this !! Sorry I

But when was the last time a client or should I say perspective client walked into a bank with a horrified looks saying that last night I dreamt I had no life cover my family was at risk ? Thank god you we’re open early for me to come in get advice and take out the cover I needed !!??

Don’t kid yourselves insurance is sold its not bought and always will be but hopefully by people like us advisers we can opening their eyes up to the real financial dramas they may face without cover.

Without sales people in this industry how does the government support pensions sickness benefits total and permanent disability partial pension and access for similar support pensions and payments sit !!!??? If there are no alternative personalised structures like clients insuring themselves Not in a good space I would think ! and who pays the excess on this? the so called consumers they are trying to allegedly support having to come up with more premium increases to bail them out

I cannot believe the actions of not only this government but the stupid options the other sides put forward

Is there anyone one out there that is not thinking of themselves or their parties objectives?

Till next time

Good night

Comments are closed.